-

Trio wins chemistry Nobel for protein design, prediction

Trio wins chemistry Nobel for protein design, prediction

-

Braving war: Lebanon's 'badass' airline defies odds

-

US weighs Google breakup in landmark trial

US weighs Google breakup in landmark trial

-

Chinese stocks tumble on stimulus upset, Asia tracks Wall St higher

-

7-Eleven owner confirms new takeover offer from Couche-Tard

7-Eleven owner confirms new takeover offer from Couche-Tard

-

A US climate scientist sees hurricane Helene's devastation firsthand

-

Can carbon credits help close coal plants?

Can carbon credits help close coal plants?

-

Boeing suspends negotiations with striking workers

-

7-Eleven owner's shares spike on report of new buyout offer

7-Eleven owner's shares spike on report of new buyout offer

-

Your 'local everything': what 7-Eleven buyout battle means for Japan

-

AI-aided research, new materials eyed for Nobel Chemistry Prize

AI-aided research, new materials eyed for Nobel Chemistry Prize

-

The US economy is solid: Why are voters gloomy?

-

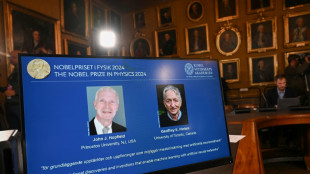

Scientists sound AI alarm after winning physics Nobel

Scientists sound AI alarm after winning physics Nobel

-

Nobel-winning physicist 'unnerved' by AI technology he helped create

-

Trump secretly sent Covid tests to Putin: Bob Woodward book

Trump secretly sent Covid tests to Putin: Bob Woodward book

-

Neural networks, machine learning? Nobel-winning AI science explained

-

Boeing delivers 27 MAX jets in September despite strike

Boeing delivers 27 MAX jets in September despite strike

-

Stock markets diverge as Hong Kong sinks, oil prices fall

-

US trade gap narrowest in five months as imports slip

US trade gap narrowest in five months as imports slip

-

Stay and 'you are going to die': Florida braces for next hurricane

-

Geoffrey Hinton, soft-spoken godfather of AI

Geoffrey Hinton, soft-spoken godfather of AI

-

Duo wins Physics Nobel for 'foundational' AI breakthroughs

-

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

-

China slaps provisional tariffs on EU brandy imports

-

Duo wins Physics Nobel for key breakthroughs in AI

Duo wins Physics Nobel for key breakthroughs in AI

-

German 'Maddie' suspect could be free soon after cleared of separate sex crimes

-

China says to take anti-dumping measures against EU brandy imports

China says to take anti-dumping measures against EU brandy imports

-

China stocks rally fizzles on stimulus worries amid Asia retreat

-

China stocks rally peters out on stimulus worries amid Asia retreat

China stocks rally peters out on stimulus worries amid Asia retreat

-

Taiwan's Foxconn says building world's largest 'superchip' plant

-

Nobel literature jury may go for non-Western writer

Nobel literature jury may go for non-Western writer

-

From Bolivia to Indonesia, deforestation continues apace

-

China holds off on fresh stimulus but 'confident' will hit growth target

China holds off on fresh stimulus but 'confident' will hit growth target

-

German suspect in 'Maddie' case faces verdict in sex crimes trial

-

Top economic official 'confident' China will hit 2024 growth target

Top economic official 'confident' China will hit 2024 growth target

-

COP29 fight looms over climate funds for developing world

-

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

-

Will Tesla's robotaxi reveal live up to hype?

-

'Invisibility' and quantum computing tipped for physics Nobel

'Invisibility' and quantum computing tipped for physics Nobel

-

Oil prices extend gains on Mideast tensions, Wall Street falls

-

'Dark day': Victims mourned around the globe on Oct. 7 anniversary

'Dark day': Victims mourned around the globe on Oct. 7 anniversary

-

Mission to probe smashed asteroid launches despite hurricane

-

Oil prices extend gains on Mideast tensions, Wall Street slips

Oil prices extend gains on Mideast tensions, Wall Street slips

-

Europe's asteroid mission Hera launches despite hurricane

-

Oil prices extend gains on Mideast tensions, Wall Street retreats

Oil prices extend gains on Mideast tensions, Wall Street retreats

-

What is microRNA? Nobel-winning discovery explained

-

Weather may delay launch of mission to study deflected asteroid

Weather may delay launch of mission to study deflected asteroid

-

China to flesh out economic stimulus plans after bumper rally

-

Asian markets track Wall St rally on US jobs data

Asian markets track Wall St rally on US jobs data

-

World marks anniversary of Oct. 7 attack on Israel

US job gains robust in December as wage growth slows

US job gains exceeded expectations in December while unemployment ticked down, a closely-watched government report said Friday -- in a sign the labor market remains hotter than hoped by policy-makers seeking to tamp down inflation.

While a strong labor market may fuel optimism that the world's biggest economy can stave off a major downturn despite an aggressive series of interest rate hikes, it is also an area of concern for the Federal Reserve since high wages can feed into inflation.

But in a more encouraging sign for the Fed -- also welcomed by market analysts -- the latest data did show a tempering of wage growth.

Last month, average hourly earnings rose less than anticipated by 0.3 percent to $32.82, while November's jump was revised lower, Labor Department data showed.

Overall, employers added 223,000 workers, down from the revised 256,000 figure in November as well though still higher than analysts expected.

While unemployment is typically expected to edge up as interest rates rise, the jobless rate dipped to 3.5 percent as participation moved higher.

President Joe Biden touted the continuing fall in unemployment -- which has been at a five-decade low since December -- while striking an optimistic note on the broader effort to combat inflation.

"This moderation in job growth is appropriate, and we should expect it to continue in the months ahead, even as we maintain resilience in our labor market recovery," Biden said in a statement.

"We still have work to do to bring down inflation... But we are moving in the right direction," he added.

Overall, average hourly earnings have risen 4.6 percent in the past 12 months, the Labor Department said, as many companies experiencing labor shortages after disruption from the pandemic have been keen to find and hold on to workers.

- Slowing wage growth -

"Notable job gains occurred in leisure and hospitality, health care, construction, and social assistance," the department said.

But it added that employment in the leisure and hospitality sector still "remains below its pre-pandemic February 2020 level."

Despite the robust figures, the data has also been signaling "positive momentum in job growth and moderating wages," economist Rubeela Farooqi of High Frequency Economics said in an analysis.

To combat inflation and cool demand, the Fed hiked interest rates seven times last year including a series of steep, back-to-back increases before slowing its pace in December.

"In terms of Fed policy, while job growth remains solid and the unemployment rate is low, a deceleration in wages in December and the downward revision to November will be welcome news," Farooqi said.

This could open doors to a slower pace of rate increases in the coming months, she added.

However, Nancy Vanden Houten of Oxford Economics cautioned that gains in jobs and annual earnings are still "above the pace the Fed sees as consistent with slowing inflation," meaning those looking for a cut in interest rates will likely be disappointed.

Interest-sensitive sectors like housing have slumped following the Fed's rate hikes, but other areas have proven more resilient.

While the Fed has eased its pace of rate increases, there remain questions over how much higher rates have to go to bring inflation under control.

Job growth in the past year has risen on the back of "catch-up hiring" in the Covid-19 recovery, said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

But this effect is fading across most of the economy, he said.

"We think substantially slower payroll growth is coming very soon," he added.

M.García--CPN