-

Creator's death no bar to new 'Dragon Ball' products

Creator's death no bar to new 'Dragon Ball' products

-

Chinese stocks tumble on lack of fresh stimulus

-

Trio wins chemistry Nobel for protein design, prediction

Trio wins chemistry Nobel for protein design, prediction

-

Braving war: Lebanon's 'badass' airline defies odds

-

US weighs Google breakup in landmark trial

US weighs Google breakup in landmark trial

-

Chinese stocks tumble on stimulus upset, Asia tracks Wall St higher

-

7-Eleven owner confirms new takeover offer from Couche-Tard

7-Eleven owner confirms new takeover offer from Couche-Tard

-

A US climate scientist sees hurricane Helene's devastation firsthand

-

Can carbon credits help close coal plants?

Can carbon credits help close coal plants?

-

Boeing suspends negotiations with striking workers

-

7-Eleven owner's shares spike on report of new buyout offer

7-Eleven owner's shares spike on report of new buyout offer

-

Your 'local everything': what 7-Eleven buyout battle means for Japan

-

AI-aided research, new materials eyed for Nobel Chemistry Prize

AI-aided research, new materials eyed for Nobel Chemistry Prize

-

The US economy is solid: Why are voters gloomy?

-

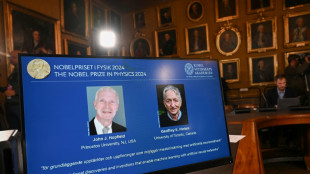

Scientists sound AI alarm after winning physics Nobel

Scientists sound AI alarm after winning physics Nobel

-

Nobel-winning physicist 'unnerved' by AI technology he helped create

-

Trump secretly sent Covid tests to Putin: Bob Woodward book

Trump secretly sent Covid tests to Putin: Bob Woodward book

-

Neural networks, machine learning? Nobel-winning AI science explained

-

Boeing delivers 27 MAX jets in September despite strike

Boeing delivers 27 MAX jets in September despite strike

-

Stock markets diverge as Hong Kong sinks, oil prices fall

-

US trade gap narrowest in five months as imports slip

US trade gap narrowest in five months as imports slip

-

Stay and 'you are going to die': Florida braces for next hurricane

-

Geoffrey Hinton, soft-spoken godfather of AI

Geoffrey Hinton, soft-spoken godfather of AI

-

Duo wins Physics Nobel for 'foundational' AI breakthroughs

-

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

-

China slaps provisional tariffs on EU brandy imports

-

Duo wins Physics Nobel for key breakthroughs in AI

Duo wins Physics Nobel for key breakthroughs in AI

-

German 'Maddie' suspect could be free soon after cleared of separate sex crimes

-

China says to take anti-dumping measures against EU brandy imports

China says to take anti-dumping measures against EU brandy imports

-

China stocks rally fizzles on stimulus worries amid Asia retreat

-

China stocks rally peters out on stimulus worries amid Asia retreat

China stocks rally peters out on stimulus worries amid Asia retreat

-

Taiwan's Foxconn says building world's largest 'superchip' plant

-

Nobel literature jury may go for non-Western writer

Nobel literature jury may go for non-Western writer

-

From Bolivia to Indonesia, deforestation continues apace

-

China holds off on fresh stimulus but 'confident' will hit growth target

China holds off on fresh stimulus but 'confident' will hit growth target

-

German suspect in 'Maddie' case faces verdict in sex crimes trial

-

Top economic official 'confident' China will hit 2024 growth target

Top economic official 'confident' China will hit 2024 growth target

-

COP29 fight looms over climate funds for developing world

-

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

-

Will Tesla's robotaxi reveal live up to hype?

-

'Invisibility' and quantum computing tipped for physics Nobel

'Invisibility' and quantum computing tipped for physics Nobel

-

Oil prices extend gains on Mideast tensions, Wall Street falls

-

'Dark day': Victims mourned around the globe on Oct. 7 anniversary

'Dark day': Victims mourned around the globe on Oct. 7 anniversary

-

Mission to probe smashed asteroid launches despite hurricane

-

Oil prices extend gains on Mideast tensions, Wall Street slips

Oil prices extend gains on Mideast tensions, Wall Street slips

-

Europe's asteroid mission Hera launches despite hurricane

-

Oil prices extend gains on Mideast tensions, Wall Street retreats

Oil prices extend gains on Mideast tensions, Wall Street retreats

-

What is microRNA? Nobel-winning discovery explained

-

Weather may delay launch of mission to study deflected asteroid

Weather may delay launch of mission to study deflected asteroid

-

China to flesh out economic stimulus plans after bumper rally

Stocks rise as horizon clears in China, US

Stock markets gained ground on Monday, building on hopes that China's economy will bounce with the easing of Covid rules, and that slowing inflation will stay the Federal Reserve's hand on interest rate hikes.

Gains began in Asia as traders took heart from the forecast-busting report on US job growth last week, which also signalled a slowdown in wage growth.

A separate report showed an unexpected contraction in the US services sector -- the first since spring 2020, at the height of the Covid pandemic.

The readings, while suggesting the world's largest economy was showing signs of weakness, indicated that easing inflation would allow the Fed to slow the pace of interest rate increases.

"Increasing evidence that the US may be able to achieve a soft landing coupled with the already billowing tailwinds of China's long-awaited reopening are fuelling an insatiable appetite for risk-taking," said Stephen Innes, managing partner at SPI Asset Management.

Investors are betting the US central bank will lift borrowing costs about 25 basis points at its next meeting, and are looking to December consumer inflation data later this week for confirmation prices are rising more slowly.

Policymakers have warned that rates will rise until decades-high inflation is brought under control, with some saying cuts might not be likely until 2024.

The eurozone will meanwhile experience "very strong" growth in wages in the coming months as salaries catch up with galloping inflation, the European Central Bank predicted Monday.

Oil prices rebounded more than two percent Monday after plunging last week on weaker demand concerns caused by the spike in Covid infections in China as containment measures are lifted.

Signs that a mild winter is helping European economies weather the shock of gas export cuts from Russia amid the Ukraine war also bolstered sentiment.

"Europe's energy shock is rapidly reversing and China's economy is quickly reopening," said George Saravelos, a London-based analyst at Deutsche Bank.

- Key figures around 1445 GMT -

London - FTSE 100: UP 0.2 percent at 7,714.62 points

Frankfurt - DAX: UP 1.1 percent at 14,770.72

Paris - CAC 40: UP 0.6 percent at 6,899.89

EURO STOXX 50: UP 1.1 percent at 4,059.82

Hong Kong - Hang Seng Index: UP 1.9 percent at 21,388.34 (close)

Shanghai - Composite: UP 0.6 percent at 3,176.08 (close)

Tokyo - Nikkei 225: Closed for a holiday

New York - Dow: UP 0.5 percent at 33,783.87

Brent North Sea crude: UP 2.2 percent at $80.28 a barrel

West Texas Intermediate: UP 2.6 percent at $75.46 a barrel

Dollar/yen: DOWN at 131.81 yen from 132.13 yen on Friday

Euro/dollar: UP at $1.0727 from $1.0647

Pound/dollar: UP at $1.2182 from $1.2095

Euro/pound: FLAT at 88.06

A.Zimmermann--CPN