-

Fed minutes highlight divisions over rate cut decision

Fed minutes highlight divisions over rate cut decision

-

Steve McQueen debuts new WWII film at London festival

-

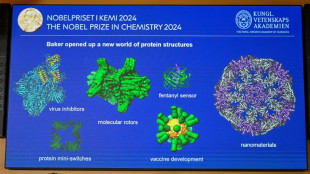

Nobel winners hope protein work will spur 'incredible' breakthroughs

Nobel winners hope protein work will spur 'incredible' breakthroughs

-

What are proteins again? Nobel-winning chemistry explained

-

AI steps into science limelight with Nobel wins

AI steps into science limelight with Nobel wins

-

Overshooting 1.5C risks 'irreversible' climate impact: study

-

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

-

Global stocks diverge as Chinese shares tumble

-

Time runs out in Florida to flee Hurricane Milton

Time runs out in Florida to flee Hurricane Milton

-

Chad issues warning ahead of more devastating floods

-

Creator's death no bar to new 'Dragon Ball' products

Creator's death no bar to new 'Dragon Ball' products

-

Chinese stocks tumble on lack of fresh stimulus

-

Trio wins chemistry Nobel for protein design, prediction

Trio wins chemistry Nobel for protein design, prediction

-

Braving war: Lebanon's 'badass' airline defies odds

-

US weighs Google breakup in landmark trial

US weighs Google breakup in landmark trial

-

Chinese stocks tumble on stimulus upset, Asia tracks Wall St higher

-

7-Eleven owner confirms new takeover offer from Couche-Tard

7-Eleven owner confirms new takeover offer from Couche-Tard

-

A US climate scientist sees hurricane Helene's devastation firsthand

-

Can carbon credits help close coal plants?

Can carbon credits help close coal plants?

-

Boeing suspends negotiations with striking workers

-

7-Eleven owner's shares spike on report of new buyout offer

7-Eleven owner's shares spike on report of new buyout offer

-

Your 'local everything': what 7-Eleven buyout battle means for Japan

-

AI-aided research, new materials eyed for Nobel Chemistry Prize

AI-aided research, new materials eyed for Nobel Chemistry Prize

-

The US economy is solid: Why are voters gloomy?

-

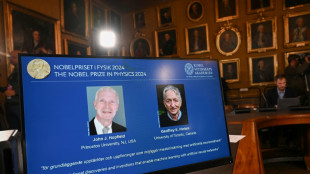

Scientists sound AI alarm after winning physics Nobel

Scientists sound AI alarm after winning physics Nobel

-

Nobel-winning physicist 'unnerved' by AI technology he helped create

-

Trump secretly sent Covid tests to Putin: Bob Woodward book

Trump secretly sent Covid tests to Putin: Bob Woodward book

-

Neural networks, machine learning? Nobel-winning AI science explained

-

Boeing delivers 27 MAX jets in September despite strike

Boeing delivers 27 MAX jets in September despite strike

-

Stock markets diverge as Hong Kong sinks, oil prices fall

-

US trade gap narrowest in five months as imports slip

US trade gap narrowest in five months as imports slip

-

Stay and 'you are going to die': Florida braces for next hurricane

-

Geoffrey Hinton, soft-spoken godfather of AI

Geoffrey Hinton, soft-spoken godfather of AI

-

Duo wins Physics Nobel for 'foundational' AI breakthroughs

-

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

-

China slaps provisional tariffs on EU brandy imports

-

Duo wins Physics Nobel for key breakthroughs in AI

Duo wins Physics Nobel for key breakthroughs in AI

-

German 'Maddie' suspect could be free soon after cleared of separate sex crimes

-

China says to take anti-dumping measures against EU brandy imports

China says to take anti-dumping measures against EU brandy imports

-

China stocks rally fizzles on stimulus worries amid Asia retreat

-

China stocks rally peters out on stimulus worries amid Asia retreat

China stocks rally peters out on stimulus worries amid Asia retreat

-

Taiwan's Foxconn says building world's largest 'superchip' plant

-

Nobel literature jury may go for non-Western writer

Nobel literature jury may go for non-Western writer

-

From Bolivia to Indonesia, deforestation continues apace

-

China holds off on fresh stimulus but 'confident' will hit growth target

China holds off on fresh stimulus but 'confident' will hit growth target

-

German suspect in 'Maddie' case faces verdict in sex crimes trial

-

Top economic official 'confident' China will hit 2024 growth target

Top economic official 'confident' China will hit 2024 growth target

-

COP29 fight looms over climate funds for developing world

-

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

-

Will Tesla's robotaxi reveal live up to hype?

| RBGPF | -2.48% | 59.33 | $ | |

| RYCEF | -1.01% | 6.9 | $ | |

| CMSD | -0.17% | 24.81 | $ | |

| RIO | -0.54% | 66.3 | $ | |

| CMSC | 0.04% | 24.65 | $ | |

| VOD | 0.77% | 9.735 | $ | |

| SCS | 1.92% | 13.03 | $ | |

| NGG | -0.33% | 65.685 | $ | |

| JRI | 0.34% | 13.205 | $ | |

| BCC | 0.45% | 142.66 | $ | |

| RELX | 0.28% | 46.77 | $ | |

| BCE | -0.52% | 33.337 | $ | |

| BTI | 0.71% | 35.472 | $ | |

| GSK | 5.82% | 40.37 | $ | |

| AZN | 0.82% | 77.505 | $ | |

| BP | 0.02% | 32.035 | $ |

Tokyo stocks surge, yen sinks as Bank of Japan holds policy

Tokyo's stock market surged, with exporters boosted by a tumbling yen after the Bank of Japan decided against further tweaking monetary policy.

Equities elsewhere largely steadied as traders showed caution in the face of growing talk that major economies may possibly dodge recession this year as inflation cools from sky-high levels.

Weak earnings Tuesday from bank titan Goldman Sachs, a jobs warning by Microsoft, and a plunge in US manufacturing data highlighted the bumpy road ahead for the world's biggest economy.

Still, hopes for China's recovery continued to provide much-needed support, with Vice Premier Liu He telling the Davos forum that growth would likely rebound this year as the country reopens after zero-Covid.

His comments came after data showed the Chinese economy expanded last year at its slowest pace since 1976 -- excluding pandemic-hit 2020 -- but beat forecasts.

The news added to hopes for a global recovery after last year's pain caused by rising prices, rate hikes, China's economic woes, a spike in energy costs and the war in Ukraine.

"Last fall, there was broad consensus that China was in the wrong place, Europe was slipping into a recession, and the Fed was ultimately caught 'wrong-footed' by very sticky inflation," said SPI Asset Management's Stephen Innes.

"But fast-forward to these early weeks of January, and China's reopening has put the country on a path to much better growth, investors are far more optimistic about Europe's recovery, and the bane of all ills US inflation is even starting to recede."

Oil prices continued to win support Wednesday on expectations of rising Chinese demand.

In foreign exchange, the yen slid one percent against the dollar.

Traders had been keenly anticipating the Bank of Japan decision after it last month shocked markets by announcing a tweak that allowed its tightly controlled bond yields to move in a wider bracket.

Clifford Bennett, chief economist at ACY Securities, said the decision indicated the BoJ was "acting appropriately in what is still an uncertain economic growth path, and still low inflation levels".

While other central banks have hiked rates, "Japan has long been a different story and remains so", he noted.

The move in December sent the yen soaring, and while the bank held firm Wednesday, there is a growing expectation that officials will eventually move away from the policy of buying up bonds to keep yields in check.

"Speculation will remain that it will eventually review its policy," Takahide Kiuchi, executive economist at Nomura Research Institute and a former BoJ policy board member, told AFP.

London's benchmark FTSE 100 index meanwhile flattened as data showed UK inflation slowed to 10.5 percent in December, remaining around four-decade highs.

- Key figures around 1200 GMT -

London - FTSE 100: FLAT at 7,853.89 points

Frankfurt - DAX: UP 0.1 percent at 15,198.86

Paris - CAC 40: UP 0.2 percent at 7,092.21

EURO STOXX 50: UP 0.2 percent at 4,182.27

Tokyo - Nikkei 225: UP 2.5 percent at 26,791.12 (close)

Hong Kong - Hang Seng Index: UP 0.5 percent at 21,678.00 (close)

Shanghai - Composite: FLAT at 3,224.41 (close)

New York - Dow: DOWN 1.1 percent at 33,910.85 (close)

Dollar/yen: UP at 128.93 yen from 128.13 yen on Tuesday

Euro/dollar: UP at $1.0830 from $1.0794

Pound/dollar: UP at $1.2384 from $1.2285

Euro/pound: DOWN at 87.45 pence from 87.85 pence

Brent North Sea crude: UP 1.7 percent at $87.39 a barrel

West Texas Intermediate: UP 1.9 percent at $81.71 a barrel

P.Schmidt--CPN