-

Fed minutes highlight divisions over rate cut decision

Fed minutes highlight divisions over rate cut decision

-

Steve McQueen debuts new WWII film at London festival

-

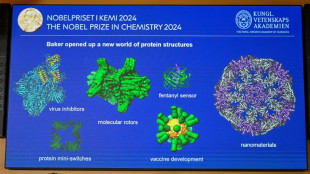

Nobel winners hope protein work will spur 'incredible' breakthroughs

Nobel winners hope protein work will spur 'incredible' breakthroughs

-

What are proteins again? Nobel-winning chemistry explained

-

AI steps into science limelight with Nobel wins

AI steps into science limelight with Nobel wins

-

Overshooting 1.5C risks 'irreversible' climate impact: study

-

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

-

Global stocks diverge as Chinese shares tumble

-

Time runs out in Florida to flee Hurricane Milton

Time runs out in Florida to flee Hurricane Milton

-

Chad issues warning ahead of more devastating floods

-

Creator's death no bar to new 'Dragon Ball' products

Creator's death no bar to new 'Dragon Ball' products

-

Chinese stocks tumble on lack of fresh stimulus

-

Trio wins chemistry Nobel for protein design, prediction

Trio wins chemistry Nobel for protein design, prediction

-

Braving war: Lebanon's 'badass' airline defies odds

-

US weighs Google breakup in landmark trial

US weighs Google breakup in landmark trial

-

Chinese stocks tumble on stimulus upset, Asia tracks Wall St higher

-

7-Eleven owner confirms new takeover offer from Couche-Tard

7-Eleven owner confirms new takeover offer from Couche-Tard

-

A US climate scientist sees hurricane Helene's devastation firsthand

-

Can carbon credits help close coal plants?

Can carbon credits help close coal plants?

-

Boeing suspends negotiations with striking workers

-

7-Eleven owner's shares spike on report of new buyout offer

7-Eleven owner's shares spike on report of new buyout offer

-

Your 'local everything': what 7-Eleven buyout battle means for Japan

-

AI-aided research, new materials eyed for Nobel Chemistry Prize

AI-aided research, new materials eyed for Nobel Chemistry Prize

-

The US economy is solid: Why are voters gloomy?

-

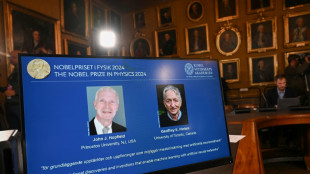

Scientists sound AI alarm after winning physics Nobel

Scientists sound AI alarm after winning physics Nobel

-

Nobel-winning physicist 'unnerved' by AI technology he helped create

-

Trump secretly sent Covid tests to Putin: Bob Woodward book

Trump secretly sent Covid tests to Putin: Bob Woodward book

-

Neural networks, machine learning? Nobel-winning AI science explained

-

Boeing delivers 27 MAX jets in September despite strike

Boeing delivers 27 MAX jets in September despite strike

-

Stock markets diverge as Hong Kong sinks, oil prices fall

-

US trade gap narrowest in five months as imports slip

US trade gap narrowest in five months as imports slip

-

Stay and 'you are going to die': Florida braces for next hurricane

-

Geoffrey Hinton, soft-spoken godfather of AI

Geoffrey Hinton, soft-spoken godfather of AI

-

Duo wins Physics Nobel for 'foundational' AI breakthroughs

-

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

German 'Maddie' suspect could be free in 2025 after cleared of separate sex crimes

-

China slaps provisional tariffs on EU brandy imports

-

Duo wins Physics Nobel for key breakthroughs in AI

Duo wins Physics Nobel for key breakthroughs in AI

-

German 'Maddie' suspect could be free soon after cleared of separate sex crimes

-

China says to take anti-dumping measures against EU brandy imports

China says to take anti-dumping measures against EU brandy imports

-

China stocks rally fizzles on stimulus worries amid Asia retreat

-

China stocks rally peters out on stimulus worries amid Asia retreat

China stocks rally peters out on stimulus worries amid Asia retreat

-

Taiwan's Foxconn says building world's largest 'superchip' plant

-

Nobel literature jury may go for non-Western writer

Nobel literature jury may go for non-Western writer

-

From Bolivia to Indonesia, deforestation continues apace

-

China holds off on fresh stimulus but 'confident' will hit growth target

China holds off on fresh stimulus but 'confident' will hit growth target

-

German suspect in 'Maddie' case faces verdict in sex crimes trial

-

Top economic official 'confident' China will hit 2024 growth target

Top economic official 'confident' China will hit 2024 growth target

-

COP29 fight looms over climate funds for developing world

-

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

Shanghai stocks soar to extend stimulus rally amid Asia-wide drop

-

Will Tesla's robotaxi reveal live up to hype?

| RBGPF | -2.48% | 59.33 | $ | |

| RYCEF | -1.01% | 6.9 | $ | |

| CMSD | -0.17% | 24.81 | $ | |

| RIO | -0.54% | 66.3 | $ | |

| CMSC | 0.04% | 24.65 | $ | |

| VOD | 0.77% | 9.735 | $ | |

| SCS | 1.92% | 13.03 | $ | |

| NGG | -0.33% | 65.685 | $ | |

| JRI | 0.34% | 13.205 | $ | |

| BCC | 0.45% | 142.66 | $ | |

| RELX | 0.28% | 46.77 | $ | |

| BCE | -0.52% | 33.337 | $ | |

| BTI | 0.71% | 35.472 | $ | |

| GSK | 5.82% | 40.37 | $ | |

| AZN | 0.82% | 77.505 | $ | |

| BP | 0.02% | 32.035 | $ |

US retail sales shrinks by most in a year as growth engine falters

US retail sales slumped for a second straight month in December, said government data on Wednesday, with its largest drop in a year signaling a key growth engine is faltering.

This comes as separate reports released Wednesday as well showed industrial output plunging last month, while producer prices made the biggest slump since early in the pandemic.

The US central bank has been raising interest rates steeply to cool the world's biggest economy as households found themselves squeezed by decades-high inflation -- and the effects are rippling across sectors including previously resilient consumer spending.

Retail sales contracted more than expected by 1.1 percent in December from a month prior, to $677.1 billion, said the latest Commerce Department figures. This was down from a revised one percent drop in November.

Falling sales at department stores and gasoline stations proved to be major drags, while the auto and furniture segments also saw declines.

Gas prices plunged last month, and analysts said bad weather across the country could have temporarily held back vehicle sales.

Spending at restaurants and bars took a hit as well, dropping 0.9 percent between November and December, despite remaining strong previously in the face of high inflation.

But retail sales remains 6.0 percent up from December 2021.

For all of last year, total sales jumped 9.2 percent, the Commerce Department said.

- Growth engine hit -

In a separate report, the Labor Department said US producer prices fell 0.5 percent in December from November, the biggest drop since early in the pandemic.

This signals further easing in inflationary pressures, as gauges for goods and energy costs both fell.

Meanwhile, Federal Reserve data showed industrial production plunging 0.7 percent from November to December, a much larger fall than anticipated on the back of energy price declines.

Lower energy costs, a stronger greenback and slowing global economy are taking a collective toll on US manufacturing, economists said.

But strikingly, "weaker consumer spending momentum at the end of 2022 is a sign the economy's main growth engine is beginning to sputter," said Oren Klachkin of Oxford Economics.

He added that the Fed is "unlikely to unwind its recent monetary policy tightening any time soon," stressing the central bank is comfortable with allowing a recession if consumer inflation returns to its two percent target.

Ian Shepherdson of Pantheon Macroeconomics noted that the steep drop in December retail sales continues a downward trend since last spring.

Food service sales "outperformed" for much of last year, partly due to a shift in consumption towards services and away from goods, but he said the segment is now struggling.

This comes as "consumers start to reduce discretionary spending in the face of an uncertain economic outlook and sharply higher borrowing costs," Shepherdson added.

L.K.Baumgartner--CPN