-

World can't 'waste time' trading climate change blame: COP29 hosts

World can't 'waste time' trading climate change blame: COP29 hosts

-

South Korean same-sex couples make push for marriage equality

-

Mumbai declares day of mourning for Indian industrialist Ratan Tata

Mumbai declares day of mourning for Indian industrialist Ratan Tata

-

7-Eleven owner restructures to fight takeover

-

Sri Lanka recovering faster than expected: World Bank

Sri Lanka recovering faster than expected: World Bank

-

Hong Kong, Shanghai rally as most markets track Wall St record

-

Uniqlo owner reports record annual earnings

Uniqlo owner reports record annual earnings

-

Hong Kong, Shanghai rally as markets track Wall St record

-

Indonesia biomass drive threatens key forests: report

Indonesia biomass drive threatens key forests: report

-

Mumbai mourns Indian industrialist Ratan Tata

-

China opens $71 bn 'swap facility' to boost markets

China opens $71 bn 'swap facility' to boost markets

-

Asian markets track Wall St record as Hong Kong, Shanghai stabilise

-

'Denying my potential': women at Japan's top university call out gender imbalance

'Denying my potential': women at Japan's top university call out gender imbalance

-

China's central bank says opens up $70.6 bn in liquidity to boost market

-

Youth facing unprecedented wave of violence, UN envoy warns

Youth facing unprecedented wave of violence, UN envoy warns

-

'A casino in every kitchen': Brazil's online gambling craze

-

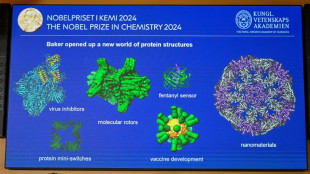

Nobel chemistry winner sees engineered proteins solving tough problems

Nobel chemistry winner sees engineered proteins solving tough problems

-

Discord seen as online home for renegades

-

US forecasts severe solar storm starting Thursday

US forecasts severe solar storm starting Thursday

-

Ratan Tata: Indian mogul who built a global powerhouse

-

One dead as storm Kirk tears through Spain, Portugal, France

One dead as storm Kirk tears through Spain, Portugal, France

-

Indian business titan Ratan Tata dead at 86

-

Fed minutes highlight divisions over rate cut decision

Fed minutes highlight divisions over rate cut decision

-

Steve McQueen debuts new WWII film at London festival

-

Nobel winners hope protein work will spur 'incredible' breakthroughs

Nobel winners hope protein work will spur 'incredible' breakthroughs

-

What are proteins again? Nobel-winning chemistry explained

-

AI steps into science limelight with Nobel wins

AI steps into science limelight with Nobel wins

-

Overshooting 1.5C risks 'irreversible' climate impact: study

-

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

-

Global stocks diverge as Chinese shares tumble

-

Time runs out in Florida to flee Hurricane Milton

Time runs out in Florida to flee Hurricane Milton

-

Chad issues warning ahead of more devastating floods

-

Creator's death no bar to new 'Dragon Ball' products

Creator's death no bar to new 'Dragon Ball' products

-

Chinese stocks tumble on lack of fresh stimulus

-

Trio wins chemistry Nobel for protein design, prediction

Trio wins chemistry Nobel for protein design, prediction

-

Braving war: Lebanon's 'badass' airline defies odds

-

US weighs Google breakup in landmark trial

US weighs Google breakup in landmark trial

-

Chinese stocks tumble on stimulus upset, Asia tracks Wall St higher

-

7-Eleven owner confirms new takeover offer from Couche-Tard

7-Eleven owner confirms new takeover offer from Couche-Tard

-

A US climate scientist sees hurricane Helene's devastation firsthand

-

Can carbon credits help close coal plants?

Can carbon credits help close coal plants?

-

Boeing suspends negotiations with striking workers

-

7-Eleven owner's shares spike on report of new buyout offer

7-Eleven owner's shares spike on report of new buyout offer

-

Your 'local everything': what 7-Eleven buyout battle means for Japan

-

AI-aided research, new materials eyed for Nobel Chemistry Prize

AI-aided research, new materials eyed for Nobel Chemistry Prize

-

The US economy is solid: Why are voters gloomy?

-

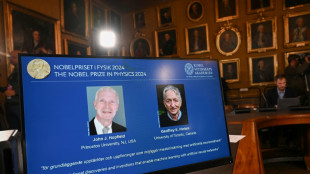

Scientists sound AI alarm after winning physics Nobel

Scientists sound AI alarm after winning physics Nobel

-

Nobel-winning physicist 'unnerved' by AI technology he helped create

-

Trump secretly sent Covid tests to Putin: Bob Woodward book

Trump secretly sent Covid tests to Putin: Bob Woodward book

-

Neural networks, machine learning? Nobel-winning AI science explained

Stock markets mostly slide on US rate-hike fears

Stock markets mostly slid and the dollar firmed Monday after a forecast-busting US jobs report fanned expectations of more Federal Reserve interest rate hikes to cool sky-high inflation.

Adding to the downbeat mood were geopolitical concerns after the United States shot down a suspected Chinese spy balloon that had floated across the country for days.

Equity market rallies enjoyed through January have largely stopped as investors contemplate an extended period of high borrowing costs aimed at bringing inflation down from multi-decade highs.

London's benchmark FTSE 100 index, however, struck an all-time high Friday, with analysts saying bad news, such as expectations of UK recession throughout this year, was priced in.

The British capital's top index has benefitted also from some strong company earnings, including record profits from energy giant Shell, and renewed investment from abroad amid pound weakness.

But it was down almost one percent near midday on Monday.

"Having hit a new all-time high..., the FTSE 100 opened the new trading week with a hangover," noted Russ Mould, investment director at AJ Bell.

"Throwing cold water over the party were stronger than expected jobs figures in the US, something closely monitored by the Federal Reserve when making interest rate decisions."

Eurozone stock markets fared worse, as did leading indices in Asia.

A softer tone from the Fed regarding its monetary tightening campaign had allowed market participants to entertain the possibility of a pause to rate hikes, or even a cut, later in the year.

But that optimism was dealt a heavy blow Friday by data showing more than half a million new jobs were created in the United States last month, nearly double the December figure and far more than the 188,000 expected.

Government figures also showed unemployment fell to the lowest level since 1969.

The reading showed the world's biggest economy remained strong despite almost a year of rate hikes and soaring prices, indicating the Fed still had plenty of work to do to rein in inflation.

"We are concerned that on the back of this kind of jobs report, it definitely holds the Fed to a higher-for-longer path," said Lisa Erickson at US Bank Wealth Management.

All three main indices sank Friday on Wall Street, with the Nasdaq down more than one percent as tech firms took a hit after disappointing earnings from giants Amazon, Apple and Google parent Alphabet.

In Asia on Monday, Mumbai stocks fell again with embattled tycoon Gautam Adani's troubled empire suffering more big losses.

Flagship Adani Enterprises gained more than 1,000 percent in five years before a rout begun last week on allegations of fraud at India's biggest conglomerate.

- Key figures around 1145 GMT -

London - FTSE 100: DOWN 0.9 percent at 7,832.80 points

Frankfurt - DAX: DOWN 1.1 percent at 15,301.70

Paris - CAC 40: DOWN 1.5 percent at 7,123.30

EURO STOXX 50: DOWN 1.5 percent at 4,194.91

Tokyo - Nikkei 225: UP 0.7 percent at 27,693.65 (close)

Hong Kong - Hang Seng Index: DOWN 2.0 percent at 21,222.16 (close)

Shanghai - Composite: DOWN 0.8 percent at 3,238.70 (close)

New York - Dow: DOWN 0.4 percent at 33,926.01 (close)

Euro/dollar: DOWN at $1.0762 from $1.0799 on Friday

Pound/dollar: DOWN at $1.2029 from $1.2052

Euro/pound: DOWN at 89.48 pence from 89.58 pence

Dollar/yen: UP at 132.23 yen from 132.00 yen

Brent North Sea crude: UP 0.5 percent at $80.32 per barrel

West Texas Intermediate: FLAT at $73.41 per barrel

A.Zimmermann--CPN