-

A very stiff breeze: BBC says sorry for 20,000 kph wind forecast

A very stiff breeze: BBC says sorry for 20,000 kph wind forecast

-

Musk finally unveiling his long-promised robotaxi

-

London's Frieze art fair goes potty for ceramics

London's Frieze art fair goes potty for ceramics

-

US, Europe stocks fall on US inflation data

-

US consumer inflation eases to 2.4% in September

US consumer inflation eases to 2.4% in September

-

Hurricane Milton tornadoes kill four in Florida amid rescue efforts

-

South Korea's Han Kang wins literature Nobel

South Korea's Han Kang wins literature Nobel

-

Ikea posts fall in annual sales after lowering prices

-

Stock markets diverge, oil gains after China rebounds

Stock markets diverge, oil gains after China rebounds

-

World can't 'waste time' trading climate change blame: COP29 hosts

-

South Korean same-sex couples make push for marriage equality

South Korean same-sex couples make push for marriage equality

-

Mumbai declares day of mourning for Indian industrialist Ratan Tata

-

7-Eleven owner restructures to fight takeover

7-Eleven owner restructures to fight takeover

-

Sri Lanka recovering faster than expected: World Bank

-

Hong Kong, Shanghai rally as most markets track Wall St record

Hong Kong, Shanghai rally as most markets track Wall St record

-

Uniqlo owner reports record annual earnings

-

Hong Kong, Shanghai rally as markets track Wall St record

Hong Kong, Shanghai rally as markets track Wall St record

-

Indonesia biomass drive threatens key forests: report

-

Mumbai mourns Indian industrialist Ratan Tata

Mumbai mourns Indian industrialist Ratan Tata

-

China opens $71 bn 'swap facility' to boost markets

-

Asian markets track Wall St record as Hong Kong, Shanghai stabilise

Asian markets track Wall St record as Hong Kong, Shanghai stabilise

-

'Denying my potential': women at Japan's top university call out gender imbalance

-

China's central bank says opens up $70.6 bn in liquidity to boost market

China's central bank says opens up $70.6 bn in liquidity to boost market

-

Youth facing unprecedented wave of violence, UN envoy warns

-

'A casino in every kitchen': Brazil's online gambling craze

'A casino in every kitchen': Brazil's online gambling craze

-

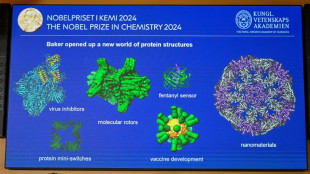

Nobel chemistry winner sees engineered proteins solving tough problems

-

Discord seen as online home for renegades

Discord seen as online home for renegades

-

US forecasts severe solar storm starting Thursday

-

Ratan Tata: Indian mogul who built a global powerhouse

Ratan Tata: Indian mogul who built a global powerhouse

-

One dead as storm Kirk tears through Spain, Portugal, France

-

Indian business titan Ratan Tata dead at 86

Indian business titan Ratan Tata dead at 86

-

Fed minutes highlight divisions over rate cut decision

-

Steve McQueen debuts new WWII film at London festival

Steve McQueen debuts new WWII film at London festival

-

Nobel winners hope protein work will spur 'incredible' breakthroughs

-

What are proteins again? Nobel-winning chemistry explained

What are proteins again? Nobel-winning chemistry explained

-

AI steps into science limelight with Nobel wins

-

Overshooting 1.5C risks 'irreversible' climate impact: study

Overshooting 1.5C risks 'irreversible' climate impact: study

-

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

-

Global stocks diverge as Chinese shares tumble

Global stocks diverge as Chinese shares tumble

-

Time runs out in Florida to flee Hurricane Milton

-

Chad issues warning ahead of more devastating floods

Chad issues warning ahead of more devastating floods

-

Creator's death no bar to new 'Dragon Ball' products

-

Chinese stocks tumble on lack of fresh stimulus

Chinese stocks tumble on lack of fresh stimulus

-

Trio wins chemistry Nobel for protein design, prediction

-

Braving war: Lebanon's 'badass' airline defies odds

Braving war: Lebanon's 'badass' airline defies odds

-

US weighs Google breakup in landmark trial

-

Chinese stocks tumble on stimulus upset, Asia tracks Wall St higher

Chinese stocks tumble on stimulus upset, Asia tracks Wall St higher

-

7-Eleven owner confirms new takeover offer from Couche-Tard

-

A US climate scientist sees hurricane Helene's devastation firsthand

A US climate scientist sees hurricane Helene's devastation firsthand

-

Can carbon credits help close coal plants?

European, US stocks rise on hopes of inflation slowdown

European and US stock markets rose Monday as investors set aside Asian losses and focused on expectations of slowing inflation in Britain and the United States, dealers said.

London and Frankfurt stocks were up 0.5 percent in afternoon trading, while Paris stocks advanced by 0.8 percent.

On Wall Street, the Dow edged up 0.1 percent as trading got underway.

"The expectation is inflation will have eased slightly when the US and UK report tomorrow and Wednesday respectively," said AJ Bell investment director Russ Mould.

Patrick O'Hare, analyst at at Briefing.com, said investors "are taking a somewhat guarded stance" before the data release.

The Bank of England, the European Central Bank and the US Federal Reserve ramped up interest rates last year in efforts to tame sky-high inflation.

While US inflation has been trending down for several months, data showing the jobs market remained very tight in January indicated the world's top economy was still robust.

The employment reading led a number of Federal Reserve officials to insist there was still plenty of work to do before they were happy they had prices under control.

"These comments were particularly noteworthy given that they explicitly pushed back against the narrative of rate cuts by year end, which markets had started to assume would be coming fairly soon," said Michael Hewson at CMC Markets.

In Asia on Monday, equities fell on growing expectations that US interest rates will go much higher and stay there for longer than previously thought.

Sentiment in Europe was also boosted by news that the eurozone economy was forecast to narrowly avoid recession this winter.

The 20-nation area's economy is now expected to expand by 0.9 percent instead of 0.3 percent, as "favourable developments" helped it weather fallout from Russia's invasion of Ukraine, the European Union's executive arm said.

Inflation in the eurozone is also expected to slow more than previously forecast after the war sent oil and gas prices soaring last year.

Oil prices retreated Monday, having jumped more than two percent Friday in reaction to Russia's decision to slash output by 500,000 barrels per day.

The move came after a Western price cap that was imposed on exports in retaliation for Moscow's war on Ukraine.

"Oil prices are falling as investors focus on near-term demand concerns, overshadowing news on Friday that Russia will cut oil production," said market analyst Fiona Cincotta at City Index.

Those concerns included Chinese inflation data last Friday coming in lower than expected, "suggesting that the ramping up of the country's economy after Covid could take some time," she added.

- Key figures around 1430 GMT -

London - FTSE 100: UP 0.5 percent at 7,921.05 points

Frankfurt - DAX: UP 0.5 percent at 15,377.39

Paris - CAC 40: UP 0.8 percent at 7,189.29

EURO STOXX 50: UP 0.7 percent at 4,229.05

New York - Dow: UP 0.1 percent at 33,906.45

Tokyo - Nikkei 225: DOWN 0.9 percent at 27,427.32 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 21,164.42 (close)

Shanghai - Composite: UP 0.7 percent at 3,284.16 (close)

Euro/dollar: UP at $1.0688 from $1.0684 on Friday

Pound/dollar: UP at $1.2089 from $1.2051

Euro/pound: DOWN at 88.43 pence from 88.56 pence

Dollar/yen: UP at 132.76 yen from 131.42 yen

Brent North Sea crude: DOWN 0.6 percent at $85.91 per barrel

West Texas Intermediate: DOWN 0.5 percent at $79.31 per barrel

burs-rl/lth

Y.Ponomarenko--CPN