-

Internet Archive reels from 'catastrophic' cyberattack, data breach

Internet Archive reels from 'catastrophic' cyberattack, data breach

-

Wall Street stocks retreat from records on US inflation data

-

Israel strikes central Beirut, killing 22

Israel strikes central Beirut, killing 22

-

Solar storm could impact US hurricane recovery efforts: agency

-

Delta eyes Election Day travel pullback as profits climb

Delta eyes Election Day travel pullback as profits climb

-

Florida battered by hurricane, floods but spared 'worst-case scenario'

-

UK's William and Kate in first joint public engagement since cancer treatment

UK's William and Kate in first joint public engagement since cancer treatment

-

Over 200 women in legal talks with Harrods over Fayed abuse claims

-

A very stiff breeze: BBC says sorry for 20,000 kph wind forecast

A very stiff breeze: BBC says sorry for 20,000 kph wind forecast

-

Musk finally unveiling his long-promised robotaxi

-

London's Frieze art fair goes potty for ceramics

London's Frieze art fair goes potty for ceramics

-

US, Europe stocks fall on US inflation data

-

US consumer inflation eases to 2.4% in September

US consumer inflation eases to 2.4% in September

-

Hurricane Milton tornadoes kill four in Florida amid rescue efforts

-

South Korea's Han Kang wins literature Nobel

South Korea's Han Kang wins literature Nobel

-

Ikea posts fall in annual sales after lowering prices

-

Stock markets diverge, oil gains after China rebounds

Stock markets diverge, oil gains after China rebounds

-

World can't 'waste time' trading climate change blame: COP29 hosts

-

South Korean same-sex couples make push for marriage equality

South Korean same-sex couples make push for marriage equality

-

Mumbai declares day of mourning for Indian industrialist Ratan Tata

-

7-Eleven owner restructures to fight takeover

7-Eleven owner restructures to fight takeover

-

Sri Lanka recovering faster than expected: World Bank

-

Hong Kong, Shanghai rally as most markets track Wall St record

Hong Kong, Shanghai rally as most markets track Wall St record

-

Uniqlo owner reports record annual earnings

-

Hong Kong, Shanghai rally as markets track Wall St record

Hong Kong, Shanghai rally as markets track Wall St record

-

Indonesia biomass drive threatens key forests: report

-

Mumbai mourns Indian industrialist Ratan Tata

Mumbai mourns Indian industrialist Ratan Tata

-

China opens $71 bn 'swap facility' to boost markets

-

Asian markets track Wall St record as Hong Kong, Shanghai stabilise

Asian markets track Wall St record as Hong Kong, Shanghai stabilise

-

'Denying my potential': women at Japan's top university call out gender imbalance

-

China's central bank says opens up $70.6 bn in liquidity to boost market

China's central bank says opens up $70.6 bn in liquidity to boost market

-

Youth facing unprecedented wave of violence, UN envoy warns

-

'A casino in every kitchen': Brazil's online gambling craze

'A casino in every kitchen': Brazil's online gambling craze

-

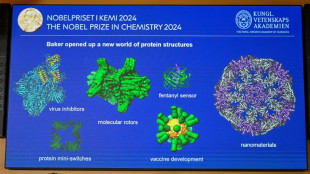

Nobel chemistry winner sees engineered proteins solving tough problems

-

Discord seen as online home for renegades

Discord seen as online home for renegades

-

US forecasts severe solar storm starting Thursday

-

Ratan Tata: Indian mogul who built a global powerhouse

Ratan Tata: Indian mogul who built a global powerhouse

-

One dead as storm Kirk tears through Spain, Portugal, France

-

Indian business titan Ratan Tata dead at 86

Indian business titan Ratan Tata dead at 86

-

Fed minutes highlight divisions over rate cut decision

-

Steve McQueen debuts new WWII film at London festival

Steve McQueen debuts new WWII film at London festival

-

Nobel winners hope protein work will spur 'incredible' breakthroughs

-

What are proteins again? Nobel-winning chemistry explained

What are proteins again? Nobel-winning chemistry explained

-

AI steps into science limelight with Nobel wins

-

Overshooting 1.5C risks 'irreversible' climate impact: study

Overshooting 1.5C risks 'irreversible' climate impact: study

-

Demis Hassabis, from chess prodigy to Nobel-winning AI pioneer

-

Global stocks diverge as Chinese shares tumble

Global stocks diverge as Chinese shares tumble

-

Time runs out in Florida to flee Hurricane Milton

-

Chad issues warning ahead of more devastating floods

Chad issues warning ahead of more devastating floods

-

Creator's death no bar to new 'Dragon Ball' products

Equities struggle but oil advances

US and European stocks turned in mixed performances on Thursday, while oil bounced higher on Chinese demand expectations.

Wall Street opened higher, with chip company Nvidia helping reassure investors about the outlook for the tech industry following a slew of poor earnings and forecasts.

While the company reported lower quarterly profits, its first-quarter revenue outlook topped estimates and executives expressed confidence about the growth of artificial intelligence technology.

Nvidia's shares jumped around 12 percent and the tech-heavy Nasdaq Composite index climbed more than one percent at the open of trading.

But US indices saw their gains evaporate and turn lower in late morning trading.

US stocks have been on the back foot since the middle of last week following inflation data that revived worries about additional interest rate hikes.

Minutes from a Federal Reserve policy meeting on Wednesday indicated US interest rates would keep rising for longer than investors had been expecting.

A blockbuster US jobs report and sticky inflation data this month have dealt a hammer blow to earlier expectations that the Fed could soon pause its monetary tightening campaign or even cut borrowing costs before year's end.

US unemployment claims came in lower than anticipated Thursday, which "will contribute to expectations for another strong gain in nonfarm payrolls and the Fed sticking to its tightening ways", according to Briefing.com analyst Patrick J. O'Hare.

Several Fed officials had lined up to warn traders they were too optimistic and that with the labour market still strong, rates would need to keep rising until it had weakened and prices were under control.

Expectations of higher for longer US rate hikes helped the dollar gain traction against major rivals.

In Europe, both Frankfurt and Paris stocks closed higher, but London's benchmark FTSE 100 index dipped as several stocks went past dividend dates.

London's loss came despite shares in Rolls-Royce soaring 23 percent after the maker of aircraft engines promised greater efficiency under its new chief executive Tufan Erginbilgic.

Oil prices bounced higher after several days of sliding.

"Crude oil prices have rebounded... as China demand expectations contrive to help keep a floor under prices," said CMC Markets analyst Michael Hewson.

- Key figures around 1630 GMT -

New York - Dow: DOWN 0.3 percent at 32,951.60 points

London - FTSE 100: DOWN 0.3 percent at 7,907.72 (close)

Frankfurt - DAX: UP 0.5 percent at 15,475.69 (close)

Paris - CAC 40: UP 0.3 percent at 7,317.43 (close)

EURO STOXX 50: UP 0.4 percent at 4,258.16 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 20,351.35 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,287.48 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.0595 from $1.0609 on Wednesday

Pound/dollar: DOWN at $1.2021 from $1.2046

Euro/pound: UP at 88.12 pence from 87.99 pence

Dollar/yen: UP at 134.79 yen from 134.71 yen

Brent North Sea crude: UP 1.7 percent at $81.99 per barrel

West Texas Intermediate: UP 1.8 percent at $75.26 per barrel

burs-lcm/rl

St.Ch.Baker--CPN