-

Musk unveils robotaxi, pledges it 'before 2027'

Musk unveils robotaxi, pledges it 'before 2027'

-

At least 11 dead in Florida but Hurricane Milton not as bad as feared

-

Asian markets mixed after Wall St drop, Shanghai dips before briefing

Asian markets mixed after Wall St drop, Shanghai dips before briefing

-

Automaker Stellantis says CEO will retire in 2026

-

Musk's promised robotaxi unveil delayed

Musk's promised robotaxi unveil delayed

-

On US coast, wind power foes embrace 'Save the Whales' argument

-

At least 10 dead in Florida after Hurricane Milton spawns tornadoes

At least 10 dead in Florida after Hurricane Milton spawns tornadoes

-

Internet Archive reels from 'catastrophic' cyberattack, data breach

-

Wall Street stocks retreat from records on US inflation data

Wall Street stocks retreat from records on US inflation data

-

Israel strikes central Beirut, killing 22

-

Solar storm could impact US hurricane recovery efforts: agency

Solar storm could impact US hurricane recovery efforts: agency

-

Delta eyes Election Day travel pullback as profits climb

-

Florida battered by hurricane, floods but spared 'worst-case scenario'

Florida battered by hurricane, floods but spared 'worst-case scenario'

-

UK's William and Kate in first joint public engagement since cancer treatment

-

Over 200 women in legal talks with Harrods over Fayed abuse claims

Over 200 women in legal talks with Harrods over Fayed abuse claims

-

A very stiff breeze: BBC says sorry for 20,000 kph wind forecast

-

Musk finally unveiling his long-promised robotaxi

Musk finally unveiling his long-promised robotaxi

-

London's Frieze art fair goes potty for ceramics

-

US, Europe stocks fall on US inflation data

US, Europe stocks fall on US inflation data

-

US consumer inflation eases to 2.4% in September

-

Hurricane Milton tornadoes kill four in Florida amid rescue efforts

Hurricane Milton tornadoes kill four in Florida amid rescue efforts

-

South Korea's Han Kang wins literature Nobel

-

Ikea posts fall in annual sales after lowering prices

Ikea posts fall in annual sales after lowering prices

-

Stock markets diverge, oil gains after China rebounds

-

World can't 'waste time' trading climate change blame: COP29 hosts

World can't 'waste time' trading climate change blame: COP29 hosts

-

South Korean same-sex couples make push for marriage equality

-

Mumbai declares day of mourning for Indian industrialist Ratan Tata

Mumbai declares day of mourning for Indian industrialist Ratan Tata

-

7-Eleven owner restructures to fight takeover

-

Sri Lanka recovering faster than expected: World Bank

Sri Lanka recovering faster than expected: World Bank

-

Hong Kong, Shanghai rally as most markets track Wall St record

-

Uniqlo owner reports record annual earnings

Uniqlo owner reports record annual earnings

-

Hong Kong, Shanghai rally as markets track Wall St record

-

Indonesia biomass drive threatens key forests: report

Indonesia biomass drive threatens key forests: report

-

Mumbai mourns Indian industrialist Ratan Tata

-

China opens $71 bn 'swap facility' to boost markets

China opens $71 bn 'swap facility' to boost markets

-

Asian markets track Wall St record as Hong Kong, Shanghai stabilise

-

'Denying my potential': women at Japan's top university call out gender imbalance

'Denying my potential': women at Japan's top university call out gender imbalance

-

China's central bank says opens up $70.6 bn in liquidity to boost market

-

Youth facing unprecedented wave of violence, UN envoy warns

Youth facing unprecedented wave of violence, UN envoy warns

-

'A casino in every kitchen': Brazil's online gambling craze

-

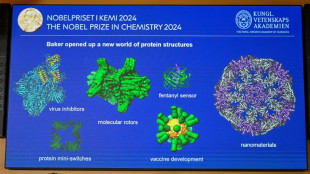

Nobel chemistry winner sees engineered proteins solving tough problems

Nobel chemistry winner sees engineered proteins solving tough problems

-

Discord seen as online home for renegades

-

US forecasts severe solar storm starting Thursday

US forecasts severe solar storm starting Thursday

-

Ratan Tata: Indian mogul who built a global powerhouse

-

One dead as storm Kirk tears through Spain, Portugal, France

One dead as storm Kirk tears through Spain, Portugal, France

-

Indian business titan Ratan Tata dead at 86

-

Fed minutes highlight divisions over rate cut decision

Fed minutes highlight divisions over rate cut decision

-

Steve McQueen debuts new WWII film at London festival

-

Nobel winners hope protein work will spur 'incredible' breakthroughs

Nobel winners hope protein work will spur 'incredible' breakthroughs

-

What are proteins again? Nobel-winning chemistry explained

Stocks wobble on China data and rate hike fears

Stock markets wobbled on Wednesday as investors were torn between data showing decade-high Chinese factory activity last month and worries about interest rate hikes due to grinding inflation.

The forecast-busting reading on China's manufacturing sector reinforced the view that the world's second-biggest economy would bounce back strongly from last year's period of sluggish growth as businesses start up and people travel again.

That helped Asian markets push higher and the positive sentiment carried over into early European trading. But those gains mostly disappeared after Wall Street opened lower.

"While European and US futures came into the day looking stronger thanks to Chinese factory data, they have found the going harder throughout the rest of the session," said Chris Beauchamp, chief market analyst at the IG online trading platform.

Frankfurt and Paris stocks ended the day lower, but London managed a gain as dovish comments by Bank of England governor Andrew Bailey dented a rally in the pound.

Wall Street stocks spent most of the day in the red, with both the S&P 500 and Nasdaq finishing decisively lower.

The yield on the 10-year US Treasury note, a proxy for expectations of Federal Reserve monetary policy, struck four percent for the first time since early November.

That came after the Institute for Supply Management's (ISM) manufacturing report showed a jump in the prices index, in a move that generated groans from investors who hope for an easing in Fed policy.

The ISM data, coupled with other recent inflation reports from Spain and Germany, do "not necessarily fit the narrative of the sharp move lower in inflation, which many were expecting," said Angelo Kourkafas, investment strategist at Edward Jones.

The US manufacturing figures came after European inflation data also dashed hopes of significant progress in containing inflation.

Germany's annual inflation rate held steady at 8.7 percent, the same level as in January, according to federal statistics agency Destatis.

Inflation in both France and Spain ticked higher.

The latest European pricing data "is not what the European Central Bank wants to see," said a note from Pantheon Macroeconomics.

It added that the figures raise the chances that the central bank will next lift rates by 50 basis points instead of 25 basis points.

Among other markets, oil prices pushed higher following the latest China data, as well as a US petroleum stockpile that showed higher demand for refined products.

- Key figures around 2140 GMT -

New York - Dow: FLAT at 32,661.84 (close)

New York - S&P 500: DOWN 0.5 percent at 3,951.39 (close)

New York - Nasdaq: DOWN 0.7 percent at 11,379.48 (close)

London - FTSE 100: UP 0.5 percent at 7,914.43 (close)

Frankfurt - DAX: DOWN 0.4 percent at 15,305.02 (close)

Paris - CAC 40: DOWN 0.5 percent at 7,234.25 (close)

EURO STOXX 50: UP 0.5 percent at 4,215.75 (close)

Tokyo - Nikkei 225: UP 0.3 percent at 27,516.53 (close)

Hong Kong - Hang Seng Index: UP 4.2 percent at 20,619.71 (close)

Shanghai - Composite: UP 1.0 percent at 3,312.35 (close)

Pound/dollar: UP at $1.2024 from $1.2022 on Tuesday

Euro/pound: UP at 88.71 pence from 87.97 pence

Euro/dollar: UP at $1.0672 from $1.0576

Dollar/yen: FLAT at 136.17 yen

West Texas Intermediate: UP 0.8 percent at $77.69 per barrel

Brent North Sea crude: UP 1.0 percent at $84.31 per barrel

burs-jmb/bys

A.Agostinelli--CPN