-

US writes off over $1 billion of Somalia debt

US writes off over $1 billion of Somalia debt

-

Stock markets climb, dollar dips as US votes

-

Boeing union approves contract, ending over 7-week strike

Boeing union approves contract, ending over 7-week strike

-

Stock markets rise, dollar falls as US votes

-

US September trade deficit widest in over two years

US September trade deficit widest in over two years

-

'Black day': French workers protest Michelin plans to close two plants

-

Saudi Aramco's quarterly profit drops 15% on low oil prices

Saudi Aramco's quarterly profit drops 15% on low oil prices

-

Spain unveils aid plan a week after catastrophic floods

-

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

-

Norway speeds ahead of EU in race for fossil-free roads

-

Most Asian markets rise as US heads to polls in toss-up vote

Most Asian markets rise as US heads to polls in toss-up vote

-

Nintendo lowers sales forecast as first-half profits plunge

-

Most Asian markets rise ahead of toss-up US election

Most Asian markets rise ahead of toss-up US election

-

Saudi Aramco says quarterly profit drops 15% on low oil prices

-

Boeing union says approves contract, ending over 7-week strike

Boeing union says approves contract, ending over 7-week strike

-

New Hampshire hamlet tied in first US Election day votes

-

China's premier 'fully confident' of hitting growth targets

China's premier 'fully confident' of hitting growth targets

-

Asian markets swing ahead of toss-up US election

-

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

-

Prince William plays rugby on S.Africa climate prize visit

-

Striking workers weigh latest Boeing contract offer

Striking workers weigh latest Boeing contract offer

-

Montreux Jazz Festival hails 'godfather' Quincy Jones

-

Stock markets hesitant before knife-edge US election

Stock markets hesitant before knife-edge US election

-

'War ruined me': Lebanon's farmers mourn lost season

-

Stock markets rise before knife-edge US election

Stock markets rise before knife-edge US election

-

Eight on trial over French teacher's 2020 beheading

-

Ryanair profit falls, growth hit by Boeing delays

Ryanair profit falls, growth hit by Boeing delays

-

Quincy Jones, entertainment titan and music mastermind

-

Most markets rise ahead of US vote, China stimulus meeting

Most markets rise ahead of US vote, China stimulus meeting

-

Most Asian markets rise ahead of US vote, China stimulus meeting

-

Climate finance billions at stake at COP29

Climate finance billions at stake at COP29

-

Nations gather for crunch climate talks in shadow of US vote

-

Asian markets rise ahead of US election, Chinese stimulus meeting

Asian markets rise ahead of US election, Chinese stimulus meeting

-

No need to tell your husband: Harris banks on women's votes

-

Striking Boeing workers set to vote on latest offer

Striking Boeing workers set to vote on latest offer

-

Pakistan shuts primary schools in Lahore over record pollution

-

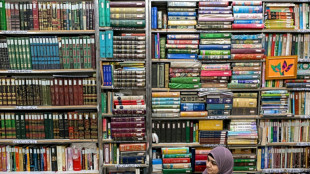

Fading literature: Delhi's famed Urdu Bazaar on last legs

Fading literature: Delhi's famed Urdu Bazaar on last legs

-

Green shoots spring from ashes in Brazil's fire-resistant savanna

-

Serbia to demolish 'German' bridge amid outcry

Serbia to demolish 'German' bridge amid outcry

-

War decimates harvest in famine-threatened Sudan

-

Nuts! NY authorities euthanize Instagram squirrel star

Nuts! NY authorities euthanize Instagram squirrel star

-

Nvidia to join Dow Jones Industrial Average, replacing Intel

-

US stocks rebound on Amazon results ahead of Fed, election finale

US stocks rebound on Amazon results ahead of Fed, election finale

-

Wall Street bounces while oil prices climb on Middle East worries

-

For a blind runner, the New York marathon is about 'vibrations'

For a blind runner, the New York marathon is about 'vibrations'

-

Wall Street bounces while oil prices gain on geopolitical fears

-

ExxonMobil profits dip as it gives back almost $10 bn to investors

ExxonMobil profits dip as it gives back almost $10 bn to investors

-

Global stocks diverge, oil prices gain on geopolitical fears

-

On Belgian coast, fishing on horseback -- and saving a tradition

On Belgian coast, fishing on horseback -- and saving a tradition

-

French brushmakers stage 'comeback' with pivot to luxury market

Tesla, airline shares take off

US and European stock markets rose on Thursday, with Tesla shares shooting higher after the electric carmaker reported record profits and airlines soaring as the travel outlook brightened.

At the start of trading, Tesla shares rose 10 percent after the company reported a new record in quarterly profits of $3.3 billion on Wednesday.

Elon Musk's high-flying firm said its 2022 output plan was on track despite ongoing supply chain problems and a hit from recent Covid-19 lockdown measures in China.

Tesla "reported much better-than-expected Q1 results and shared some encouraging growth guidance," said Briefing.com analyst Patrick O'Hare.

While many carmakers have been hobbled by a lack of semiconductors, Musk said it "seems likely" the company will produce more than 1.5 million vehicles in 2022, which would be above the company's long-term target of at least 50 percent output growth.

- Airlines soar -

A forecast by United Airlines for surging travel demand as the pandemic impact fades helped boost airline shares in Europe and the United States.

Shares in British Airways parent IAG soared 7.7 percent and those in low-cost rival EasyJet jumped 6.2 percent in afternoon trading in London.

France's Air France-KLM stock jumped over four percent and Germany's Lufthansa climbed 5.5 percent in Frankfurt.

"The aviation sector is flying higher on expectations of a bumper quarter, after United Airlines posted record guidance for the second quarter," City Index senior markets analyst Fiona Cincotta told AFP.

The aviation sector was ravaged by the Covid crisis that erupted in early 2020, decimating demand and grounding planes worldwide.

Surging oil prices amid the fallout from the Russian war have also acted as a headwind.

"But with demand set to soar over the coming months the likes of IAG and easyJet are being propelled" higher, she said.

United Airlines shares jumped 10.4 percent at the open of trading.

The carrier forecast "the strongest second-quarter revenue guidance in company history" despite logging another Covid-induced loss for the first quarter.

American Airlines, meanwhile, reported another quarterly loss Thursday, but said a recent sharp improvement in bookings should enable it to achieve profitability in the second quarter.

Shares in American airlines climbed 8.2 percent and those in Delta gained 3.8 percent.

"After what has been a very difficult few years for the aviation industry, as a result of lockdowns and alarming inflation, United Airlines' outlook certainly inspired some confidence," XTB analyst Walid Koudmani told AFP.

Wall Street opened higher thanks in part to the positive sentiment driven by Tesla and airlines.

Europe's main indices were also higher in afternoon trading.

Stock markets in Hong Kong and Shanghai fell sharply on heightened anxiety over China's renewed Covid lockdowns and curbs on tech companies.

Tokyo, however, rallied on optimism over a falling yen, which boosts exporters.

Meanwhile, world oil prices rebounded after diving the previous session on weaker demand concerns.

- Key figures around 1330 GMT -

Frankfurt - DAX: UP 1.5 percent at 14,573.38 points

Paris - CAC 40: UP 1.9 percent at 6,753.12

London - FTSE 100: UP 0.2 percent at 7,647.50

EURO STOXX 50: UP 0.6 percent at 3,794.24

New York - Dow: UP 0.8 percent at 35,435.80

Tokyo - Nikkei 225: UP 1.2 percent at 27,553.06 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 20,682.22 (close)

Shanghai - Composite: DOWN 2.3 percent at 3,079.81 (close)

Euro/dollar: UP at $1.0894 from $1.0853 late on Wednesday

Dollar/yen: UP at 128.27 yen from 127.86 yen

Pound/dollar: DOWN at $1.3064 from $1.3068

Euro/pound: UP at 83.29 pence from 83.05 pence

Brent North Sea crude: UP 1.8 percent at $108.75 per barrel

West Texas Intermediate: UP 1.9 percent at $104.09 per barrel

burs-rl/lth

A.Agostinelli--CPN