-

US writes off over $1 billion of Somalia debt

US writes off over $1 billion of Somalia debt

-

Stock markets climb, dollar dips as US votes

-

Boeing union approves contract, ending over 7-week strike

Boeing union approves contract, ending over 7-week strike

-

Stock markets rise, dollar falls as US votes

-

US September trade deficit widest in over two years

US September trade deficit widest in over two years

-

'Black day': French workers protest Michelin plans to close two plants

-

Saudi Aramco's quarterly profit drops 15% on low oil prices

Saudi Aramco's quarterly profit drops 15% on low oil prices

-

Spain unveils aid plan a week after catastrophic floods

-

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

-

Norway speeds ahead of EU in race for fossil-free roads

-

Most Asian markets rise as US heads to polls in toss-up vote

Most Asian markets rise as US heads to polls in toss-up vote

-

Nintendo lowers sales forecast as first-half profits plunge

-

Most Asian markets rise ahead of toss-up US election

Most Asian markets rise ahead of toss-up US election

-

Saudi Aramco says quarterly profit drops 15% on low oil prices

-

Boeing union says approves contract, ending over 7-week strike

Boeing union says approves contract, ending over 7-week strike

-

New Hampshire hamlet tied in first US Election day votes

-

China's premier 'fully confident' of hitting growth targets

China's premier 'fully confident' of hitting growth targets

-

Asian markets swing ahead of toss-up US election

-

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

-

Prince William plays rugby on S.Africa climate prize visit

-

Striking workers weigh latest Boeing contract offer

Striking workers weigh latest Boeing contract offer

-

Montreux Jazz Festival hails 'godfather' Quincy Jones

-

Stock markets hesitant before knife-edge US election

Stock markets hesitant before knife-edge US election

-

'War ruined me': Lebanon's farmers mourn lost season

-

Stock markets rise before knife-edge US election

Stock markets rise before knife-edge US election

-

Eight on trial over French teacher's 2020 beheading

-

Ryanair profit falls, growth hit by Boeing delays

Ryanair profit falls, growth hit by Boeing delays

-

Quincy Jones, entertainment titan and music mastermind

-

Most markets rise ahead of US vote, China stimulus meeting

Most markets rise ahead of US vote, China stimulus meeting

-

Most Asian markets rise ahead of US vote, China stimulus meeting

-

Climate finance billions at stake at COP29

Climate finance billions at stake at COP29

-

Nations gather for crunch climate talks in shadow of US vote

-

Asian markets rise ahead of US election, Chinese stimulus meeting

Asian markets rise ahead of US election, Chinese stimulus meeting

-

No need to tell your husband: Harris banks on women's votes

-

Striking Boeing workers set to vote on latest offer

Striking Boeing workers set to vote on latest offer

-

Pakistan shuts primary schools in Lahore over record pollution

-

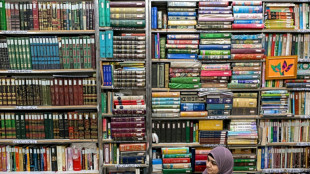

Fading literature: Delhi's famed Urdu Bazaar on last legs

Fading literature: Delhi's famed Urdu Bazaar on last legs

-

Green shoots spring from ashes in Brazil's fire-resistant savanna

-

Serbia to demolish 'German' bridge amid outcry

Serbia to demolish 'German' bridge amid outcry

-

War decimates harvest in famine-threatened Sudan

-

Nuts! NY authorities euthanize Instagram squirrel star

Nuts! NY authorities euthanize Instagram squirrel star

-

Nvidia to join Dow Jones Industrial Average, replacing Intel

-

US stocks rebound on Amazon results ahead of Fed, election finale

US stocks rebound on Amazon results ahead of Fed, election finale

-

Wall Street bounces while oil prices climb on Middle East worries

-

For a blind runner, the New York marathon is about 'vibrations'

For a blind runner, the New York marathon is about 'vibrations'

-

Wall Street bounces while oil prices gain on geopolitical fears

-

ExxonMobil profits dip as it gives back almost $10 bn to investors

ExxonMobil profits dip as it gives back almost $10 bn to investors

-

Global stocks diverge, oil prices gain on geopolitical fears

-

On Belgian coast, fishing on horseback -- and saving a tradition

On Belgian coast, fishing on horseback -- and saving a tradition

-

French brushmakers stage 'comeback' with pivot to luxury market

Asian markets tumble after Federal Reserve chief's comments

Asian markets fell sharply at the open on Friday, trailing losses on Wall Street after the US Federal Reserve boss said an interest-rate hike was likely forthcoming.

Hong Kong and Tokyo both opened deep in the red even as inflation data from Japan was in line with market expectations and better than elsewhere in the world.

A falling yen, due mainly to the interest rate gap between Japan and the United States, had boosted trade on the Nikkei 225 all of this week.

But the prospect of rate hikes in the United States and ongoing pandemic disruptions in China, where millions are still under a harsh Covid-19 precipitated lockdown, weighed on Asian bourses.

Shanghai, Seoul, Sydney, and Taipei were all down.

Fed Chair Jerome Powell's comments reversed fortunes on Wall Street mid-session.

Equities had opened higher following good results from Tesla and upbeat comments from leading airlines as well as solid gains in Paris and Frankfurt.

But US stocks tumbled after Powell, who has signalled the US central bank will have to move more aggressively to counter record US inflation, explicitly said a half-point interest rate increase is "on the table" for next month's policy meeting.

"Red flags are going up today," said Stephen Innes at SPI Asset Management.

"While one day certainly does not make a trend, when the market decides to focus on a super hawkish inflation-fighting Fed narrative stoking recession fears, it typically triggers significant shifts in investor behaviours and conversations, and markets then turn a lot more caution."

Major US indices all finished down more than one percent, while the dollar pushed higher against the euro and other currencies.

Oil prices also took a hit over the Fed's potential monetary policy tightening and dwindling energy demand in China.

Supply concerns linked to the war in Ukraine and protest-related disruptions in Libya were also impacting crude.

"Russian Production decreased, pointing to self and official sanctions starting to bite oil prices bullishly," Innes said.

"It is Friday, and typically, no one wants to go short oil into the weekend for fear of dreadful Ukraine weekend headline risk. So that suggests to me that oil holds a bid barring awful news out of China on the Covid front, where there seems to be some light at the end of the lockdown tunnel."

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.92 percent at 27,023.88

Hong Kong - Hang Seng Index: DOWN 0.93 percent at 20,490.48

Shanghai - Composite: DOWN 0.10 percent at 3,076.69

Euro/dollar: FLAT at $1.0840 from $1.0840

Dollar/yen: UP at 128.59 yen from 128.35 yen

Pound/dollar: DOWN at $1.3023 from $1.3029

Euro/pound: UP at 83.23 pence from 83.14 pence

Brent North Sea crude: DOWN 0.66 percent at $107.62 per barrel

West Texas Intermediate: DOWN 0.73 percent at $103.03 per barrel

New York - Dow: DOWN 1.1 percent at 34,792.76 (close)

London - FTSE 100: FLAT at 7,627.95 (close)

Frankfurt - DAX: UP 1.0 percent at 14,502.41 (close)

Paris - CAC 40: UP 1.4 percent at 6,715.10 (close)

burs-ssy/reb

Y.Tengku--CPN