-

US writes off over $1 billion of Somalia debt

US writes off over $1 billion of Somalia debt

-

Stock markets climb, dollar dips as US votes

-

Boeing union approves contract, ending over 7-week strike

Boeing union approves contract, ending over 7-week strike

-

Stock markets rise, dollar falls as US votes

-

US September trade deficit widest in over two years

US September trade deficit widest in over two years

-

'Black day': French workers protest Michelin plans to close two plants

-

Saudi Aramco's quarterly profit drops 15% on low oil prices

Saudi Aramco's quarterly profit drops 15% on low oil prices

-

Spain unveils aid plan a week after catastrophic floods

-

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

-

Norway speeds ahead of EU in race for fossil-free roads

-

Most Asian markets rise as US heads to polls in toss-up vote

Most Asian markets rise as US heads to polls in toss-up vote

-

Nintendo lowers sales forecast as first-half profits plunge

-

Most Asian markets rise ahead of toss-up US election

Most Asian markets rise ahead of toss-up US election

-

Saudi Aramco says quarterly profit drops 15% on low oil prices

-

Boeing union says approves contract, ending over 7-week strike

Boeing union says approves contract, ending over 7-week strike

-

New Hampshire hamlet tied in first US Election day votes

-

China's premier 'fully confident' of hitting growth targets

China's premier 'fully confident' of hitting growth targets

-

Asian markets swing ahead of toss-up US election

-

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

-

Prince William plays rugby on S.Africa climate prize visit

-

Striking workers weigh latest Boeing contract offer

Striking workers weigh latest Boeing contract offer

-

Montreux Jazz Festival hails 'godfather' Quincy Jones

-

Stock markets hesitant before knife-edge US election

Stock markets hesitant before knife-edge US election

-

'War ruined me': Lebanon's farmers mourn lost season

-

Stock markets rise before knife-edge US election

Stock markets rise before knife-edge US election

-

Eight on trial over French teacher's 2020 beheading

-

Ryanair profit falls, growth hit by Boeing delays

Ryanair profit falls, growth hit by Boeing delays

-

Quincy Jones, entertainment titan and music mastermind

-

Most markets rise ahead of US vote, China stimulus meeting

Most markets rise ahead of US vote, China stimulus meeting

-

Most Asian markets rise ahead of US vote, China stimulus meeting

-

Climate finance billions at stake at COP29

Climate finance billions at stake at COP29

-

Nations gather for crunch climate talks in shadow of US vote

-

Asian markets rise ahead of US election, Chinese stimulus meeting

Asian markets rise ahead of US election, Chinese stimulus meeting

-

No need to tell your husband: Harris banks on women's votes

-

Striking Boeing workers set to vote on latest offer

Striking Boeing workers set to vote on latest offer

-

Pakistan shuts primary schools in Lahore over record pollution

-

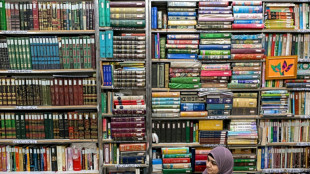

Fading literature: Delhi's famed Urdu Bazaar on last legs

Fading literature: Delhi's famed Urdu Bazaar on last legs

-

Green shoots spring from ashes in Brazil's fire-resistant savanna

-

Serbia to demolish 'German' bridge amid outcry

Serbia to demolish 'German' bridge amid outcry

-

War decimates harvest in famine-threatened Sudan

-

Nuts! NY authorities euthanize Instagram squirrel star

Nuts! NY authorities euthanize Instagram squirrel star

-

Nvidia to join Dow Jones Industrial Average, replacing Intel

-

US stocks rebound on Amazon results ahead of Fed, election finale

US stocks rebound on Amazon results ahead of Fed, election finale

-

Wall Street bounces while oil prices climb on Middle East worries

-

For a blind runner, the New York marathon is about 'vibrations'

For a blind runner, the New York marathon is about 'vibrations'

-

Wall Street bounces while oil prices gain on geopolitical fears

-

ExxonMobil profits dip as it gives back almost $10 bn to investors

ExxonMobil profits dip as it gives back almost $10 bn to investors

-

Global stocks diverge, oil prices gain on geopolitical fears

-

On Belgian coast, fishing on horseback -- and saving a tradition

On Belgian coast, fishing on horseback -- and saving a tradition

-

French brushmakers stage 'comeback' with pivot to luxury market

Eurozone growth speeds up in April despite Ukraine war

Economic growth in the eurozone accelerated and hit a seven-month high in April, a key survey showed on Friday, despite concerns about inflation and Russia's war in Ukraine.

The closely-watched monthly purchase managers' index (PMI) by S&P Global found that a rebounding services sector, benefiting from loosened Covid-19 restrictions, helped compensate for a near stagnation of manufacturing output.

Meanwhile goods and services prices rose at an unprecedented rate in April amid another near-record rise in firms' costs, hinting at further inflation rises to come, the survey said.

S&P Global's PMI rose from 54.9 in March to 55.8. A figure above 50 indicates growth.

"The eurozone has therefore started the second quarter on a stronger-than-anticipated footing, confounding consensus expectations of a slowdown," said S&P Global's chief business economist Chris Williamson.

"However, the weakness of the manufacturing sector is a major concern as it points to an economy that is not firing on all cylinders.

"Similarly, the ever-rising cost of living suggests that service sector growth could cool sharply once the initial rebound from the opening up of the economy fades."

The automotive sector took the hardest hit, with production levels falling sharply in April -- and at a faster rate than in March, the survey said.

Companies which suffered production cuts pinned their difficulties on severe supply chain problems, exacerbated by the war in Ukraine and fresh lockdowns in China aimed at combating the Covid-19 pandemic.

Growth evolved differently in countries across the eurozone.

In Germany, the largest economy in the bloc, the growth rate fell to the lowest level for three months, with a good performance in services failing to offset the first drop in manufacturing since June 2020.

But in France, growth accelerated and reached its highest level since January 2018, thanks to continued modest expansion in manufacturing and a strong increase in service sector activity.

P.Schmidt--CPN