-

US writes off over $1 billion of Somalia debt

US writes off over $1 billion of Somalia debt

-

Stock markets climb, dollar dips as US votes

-

Boeing union approves contract, ending over 7-week strike

Boeing union approves contract, ending over 7-week strike

-

Stock markets rise, dollar falls as US votes

-

US September trade deficit widest in over two years

US September trade deficit widest in over two years

-

'Black day': French workers protest Michelin plans to close two plants

-

Saudi Aramco's quarterly profit drops 15% on low oil prices

Saudi Aramco's quarterly profit drops 15% on low oil prices

-

Spain unveils aid plan a week after catastrophic floods

-

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

-

Norway speeds ahead of EU in race for fossil-free roads

-

Most Asian markets rise as US heads to polls in toss-up vote

Most Asian markets rise as US heads to polls in toss-up vote

-

Nintendo lowers sales forecast as first-half profits plunge

-

Most Asian markets rise ahead of toss-up US election

Most Asian markets rise ahead of toss-up US election

-

Saudi Aramco says quarterly profit drops 15% on low oil prices

-

Boeing union says approves contract, ending over 7-week strike

Boeing union says approves contract, ending over 7-week strike

-

New Hampshire hamlet tied in first US Election day votes

-

China's premier 'fully confident' of hitting growth targets

China's premier 'fully confident' of hitting growth targets

-

Asian markets swing ahead of toss-up US election

-

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

Turkey sacks 3 mayors on 'terror' charges, sparking fury in southeast

-

Prince William plays rugby on S.Africa climate prize visit

-

Striking workers weigh latest Boeing contract offer

Striking workers weigh latest Boeing contract offer

-

Montreux Jazz Festival hails 'godfather' Quincy Jones

-

Stock markets hesitant before knife-edge US election

Stock markets hesitant before knife-edge US election

-

'War ruined me': Lebanon's farmers mourn lost season

-

Stock markets rise before knife-edge US election

Stock markets rise before knife-edge US election

-

Eight on trial over French teacher's 2020 beheading

-

Ryanair profit falls, growth hit by Boeing delays

Ryanair profit falls, growth hit by Boeing delays

-

Quincy Jones, entertainment titan and music mastermind

-

Most markets rise ahead of US vote, China stimulus meeting

Most markets rise ahead of US vote, China stimulus meeting

-

Most Asian markets rise ahead of US vote, China stimulus meeting

-

Climate finance billions at stake at COP29

Climate finance billions at stake at COP29

-

Nations gather for crunch climate talks in shadow of US vote

-

Asian markets rise ahead of US election, Chinese stimulus meeting

Asian markets rise ahead of US election, Chinese stimulus meeting

-

No need to tell your husband: Harris banks on women's votes

-

Striking Boeing workers set to vote on latest offer

Striking Boeing workers set to vote on latest offer

-

Pakistan shuts primary schools in Lahore over record pollution

-

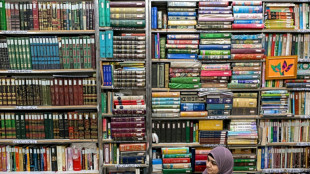

Fading literature: Delhi's famed Urdu Bazaar on last legs

Fading literature: Delhi's famed Urdu Bazaar on last legs

-

Green shoots spring from ashes in Brazil's fire-resistant savanna

-

Serbia to demolish 'German' bridge amid outcry

Serbia to demolish 'German' bridge amid outcry

-

War decimates harvest in famine-threatened Sudan

-

Nuts! NY authorities euthanize Instagram squirrel star

Nuts! NY authorities euthanize Instagram squirrel star

-

Nvidia to join Dow Jones Industrial Average, replacing Intel

-

US stocks rebound on Amazon results ahead of Fed, election finale

US stocks rebound on Amazon results ahead of Fed, election finale

-

Wall Street bounces while oil prices climb on Middle East worries

-

For a blind runner, the New York marathon is about 'vibrations'

For a blind runner, the New York marathon is about 'vibrations'

-

Wall Street bounces while oil prices gain on geopolitical fears

-

ExxonMobil profits dip as it gives back almost $10 bn to investors

ExxonMobil profits dip as it gives back almost $10 bn to investors

-

Global stocks diverge, oil prices gain on geopolitical fears

-

On Belgian coast, fishing on horseback -- and saving a tradition

On Belgian coast, fishing on horseback -- and saving a tradition

-

French brushmakers stage 'comeback' with pivot to luxury market

Global markets mostly sink on Fed chief's remarks

Asian and European stocks mostly sank Friday on hawkish comments from the Federal Reserve about its monetary tightening plans, sending the dollar sharply higher against the euro.

Frankfurt stocks dived 1.9 percent and Paris slid 1.7 percent in early afternoon eurozone deals, as investors shrugged off a survey showing that the bloc's economic activity accelerated in April.

London shed 0.7 percent around midday with losses capped by the slumping pound that boosts share prices of multinationals.

Sterling slumped against the dollar after data showed tumbling retail sales as Britons face a cost-of-living crisis.

The pound briefly hit an October 2020 low as British Prime Minister Boris Johnson comes under renewed political pressure.

Oil prices slumped on demand fears arising from rising interest rates in the United States and ongoing Covid restrictions in China.

- 'Cat among pigeons' -

Markets remain shaken after Fed Chairman Jerome Powell exacerbated worries over higher US interest rates late on Thursday.

Powell, who has signalled that the Fed will have to move more aggressively to counter decades-high US inflation, stated that a half-point interest rate increase was "on the table" for next month's meeting, sending Wall Street tanking.

"Further hawkish comments from the Federal Reserve Chair put another cat among the pigeons in a day of violent swings," said Richard Hunter, head of markets at Interactive Investor.

"Quite apart from the widely expected 0.5 percent rate hike in May, this could also imply similar rises in subsequent months."

That stoked worries that the Fed could send the US economy's pandemic recovery back into reverse.

"While the news should not have come as too much of a surprise, investors rushed for the exit as concerns of over-tightening and recession came back into focus," said Hunter.

Sharp price rises are forcing major global central banks to hike interest rates, in turn curbing recovery from the pandemic.

Higher lending rates tend to weigh on companies' share prices as they increase interest repayments on loans, while also further reducing consumers' incomes.

In Asia on Friday, Tokyo stocks slid more than 1.5 percent even as inflation data from Japan was in line with market expectations.

But Shanghai finished marginally higher as some Chinese Covid curbs were eased and the nation's securities regulator pushed banks and insurers to buy more stocks to lift ailing equities.

- Key figures around 1045 GMT -

London - FTSE 100: DOWN 0.8 percent at 7,568.34 points

Paris - CAC 40: DOWN 1.7 percent at 6,600.20

Frankfurt - DAX: DOWN 1.9 percent at 14,228.81

EURO STOXX 50: DOWN 1.9 percent at 3,854.39

Tokyo - Nikkei 225: DOWN 1.6 percent at 27,105.26 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 20,638.52 (close)

Shanghai - Composite: UP 0.2 percent at 3,086.92 (close)

New York - Dow: DOWN 1.1 percent at 34,792.76 (close)

Euro/dollar: DOWN at $1.0805 from $1.0834 late on Thursday

Dollar/yen: DOWN at 128.36 yen from 128.38 yen

Pound/dollar: DOWN at $1.2892 from $1.3030

Euro/pound: UP at 83.82 pence from 83.15 pence

Brent North Sea crude: DOWN 1.6 percent at $106.63 per barrel

West Texas Intermediate: DOWN 1.7 percent at $101.66 per barrel

burs-rfj/bcp/lth

A.Mykhailo--CPN