-

Vaccine misinformation: a lasting side effect from Covid

Vaccine misinformation: a lasting side effect from Covid

-

Indian court finds man guilty in notorious hospital rape case

-

TikTok's journey from fun app to US security concern

TikTok's journey from fun app to US security concern

-

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

-

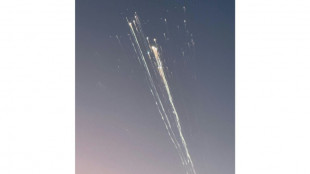

US grounds SpaceX's Starship after fiery mid-air explosion

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

Nintendo shares tumble as Switch 2 preview disappoints

-

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

7-Eleven owner's shares spike on report of new buyout offer

Shares in the Japanese owner of 7-Eleven surged Wednesday following reports that Canada's Alimentation Couche-Tard (ACT) had hiked its takeover offer by almost 20 percent.

Japan's biggest retailer Seven & i last month rejected ACT's initial offer, saying the $40 billion proposal undervalued its business and could face regulatory hurdles.

If realised, it would be the biggest-ever foreign buyout of a Japanese firm.

But Bloomberg News and Japan's Nikkei business daily reported Wednesday that ACT, which owns the Circle K brand, had upgraded its offer to $18.19 per share, or a total of around seven trillion yen ($47.2 billion).

Shares in Seven & i jumped nearly 12 percent in early trade, before settling at up 4.7 percent by mid-morning.

The new offer was sent to Seven & i on September 19, the reports said, adding that no substantive negotiations have taken place since then.

Seven & i declined to comment on the reported move when contacted by AFP.

While 7-Eleven began in the United States, the franchise has been wholly owned by Seven & i since 2005.

7-Eleven is the world's biggest convenience store chain and operates more than 85,000 outlets globally.

Around a quarter of those are in Japan, where it is a beloved institution, selling everything from concert tickets to pet food and fresh rice balls.

Seven & i will announce its quarterly earnings on Thursday, with the CEO scheduled to address the media.

Couche-Tard runs nearly 17,000 convenience store outlets, including Circle K, worldwide.

By purchasing 7-Eleven, it is seeking to become "truly global", said Kai Li, a professor and Canada Research Chair in Corporate Governance at UBC Sauder School of Business.

"Couche-Tard has done well with Circle K acquisitions, expanding its footprint in the United States," she told AFP.

But "such a purchase might raise antitrust concerns" given that the combined entity would have "more market power" and could drive smaller operators out of business, Li said.

Y.Uduike--CPN