-

Indian court finds man guilty in notorious hospital rape case

Indian court finds man guilty in notorious hospital rape case

-

TikTok's journey from fun app to US security concern

-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

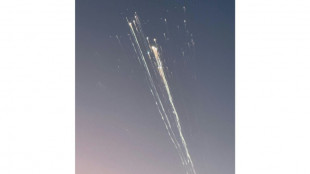

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

China's central bank says opens up $70.6 bn in liquidity to boost market

China's central bank boosted support for markets on Thursday as it launched a "swap facility" offering firms access to $70.6 billion in liquidity as Beijing seeks to raise confidence in the country's flagging economy.

The programme will allow "qualified... companies to exchange bonds, stock ETFs, CSI 300 constituent stocks and other assets with the People's Bank of China for high-grade liquid assets such as treasury bonds and central bank bills", the bank said.

"The scale of the first phase of the operation is 500 billion yuan and can be further expanded depending on the situation," it added.

"Starting today, applications from qualified securities, funds and insurance companies will be accepted."

Announcing the plans last month, People's Bank of China chief Pan Gongsheng said the move would "significantly enhance" firms' ability to access funds to buy stocks.

The world's second-largest economy has struggled to regain its footing since the lifting of pandemic measures at the end of 2022.

It faces multiple issues including a prolonged debt crisis in the property sector, chronically low consumption and high unemployment among young people.

In response, Beijing last month unveiled its most aggressive stimulus package in years.

The PBoC slashed interest on one-year loans to financial institutions, cut the amount of cash lenders must keep on hand and pushed to lower rates on existing mortgages.

Several major cities -- including Shanghai, Guangzhou and Shenzhen -- have also further eased restrictions on buying homes, and top officials including Premier Li Qiang have called for more effective implementation of the slate of measures.

The announcements triggered a blistering rally on stock markets on the mainland and in Hong Kong.

However, investor sentiment cooled after a news conference Tuesday by the country's top economic planning agency that failed to unveil any more stimulus or provide details on the measures already announced.

Zheng Shanjie, head of the National Development and Reform Commission, said only that Beijing was "fully confident in achieving the goals of economic and societal development for the year".

He added that "we are also fully confident in maintaining stable, healthy and sustainable development".

Analysts have warned that more direct state support is needed to boost consumption and achieve the government's official national growth target of about five percent for this year.

More may be in the offing on Saturday, when finance minister Lan Fo'an is set to hold a briefing on fiscal policy in Beijing.

Authorities said Wednesday that Lan will outline "countercyclical adjustment of fiscal policy to promote high-quality economic development".

H.Müller--CPN