-

Indian court finds man guilty in notorious hospital rape case

Indian court finds man guilty in notorious hospital rape case

-

TikTok's journey from fun app to US security concern

-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

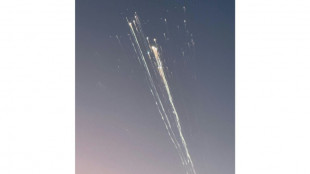

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

Hong Kong, Shanghai rally as markets track Wall St record

Chinese markets get back into winning ways Thursday after China's central bank unveiled a facility to boost liquidity for firms to buy stocks, while most other markets tracked another record day on Wall Street.

The yen sat around two-month lows after taking a hit in the wake of minutes showing Federal Reserve decision-makers were split on last month's bumper interest rate cut and a top official sparking questions about how many more could be in the pipeline.

Chinese investors were settling down after a volatile start to the week that saw mainland and Hong Kong markets whipsaw as the euphoria over last month's stimulus was dampened by a news conference that failed to unveil more measures or give details on those already announced.

Traders welcomed news that the People's Bank of China had released details of a "swap facility" that will allow "qualified securities, funds and insurance companies" to access more than $70 billion in liquidity to purchase equities.

The move, one of a number of measures announced last month, helped Shanghai rise more than one percent, having dived more than six percent Wednesday -- its worst day in more than four years.

Hong Kong briefly rose more than four percent, building on the previous day's advance that followed a more than nine percent plunge, its heftiest in 16 years.

Dealers are now keenly awaiting a Saturday finance ministry news conference on fiscal policy, though observers warned the bar would be high for Finance Minister Lan Fo'an if he is to get the recent market rally back on track.

Richard Tang, China strategist and head of research for Hong Kong at Julius Baer, said: "Market disappointment at (Tuesday's briefing) helps investors lower their elevated expectations for the policy measures."

"We believe the consensus is expecting around 2-3 trillion yuan... of fiscal stimulus measures," he added.

"The market had generally baked in expectations of some sorts of cash handouts to the underprivileged and/or consumption vouchers, policies to help relieve the funding challenges of local governments at least temporarily, and more policies to address the housing inventory problem."

The gains led a rally across Asia, which came after the Dow and S&P 500 chalked up fresh records on Wall Street thanks to a burst from tech giants including Amazon and Apple.

Among other markets in the Asia-Pacific, Sydney, Seoul, Mumbai and Bangkok advanced, while Singapore, Manila, Wellington and Jakarta edged down. London was up and Paris and Frankfurt were both down.

Tokyo was boosted by a drop in the yen fuelled by minutes from the Fed's September meeting, where it cut rates by 50 basis points but saw officials split on the decision.

They showed that while the move was ultimately supported by an 11-1 vote, some "noted that there had been a plausible case for a 25 basis point rate cut at the previous meeting".

"Some participants observed that they would have preferred a 25 basis point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision," the minutes said.

Meanwhile, San Francisco Fed President Mary Daly said she had backed the big cut in order to "recalibrate" monetary policy, adding that "two more cuts this year, or one more cut this year, really spans the range of what is likely in my mind, given my projection for the economy".

But she warned the bank would remain "data-dependent".

Focus now turns to the release of consumer price inflation later in the day and wholesale prices on Friday.

- Key figures around 0710 GMT -

Shanghai - Composite: UP 1.3 percent at 3,301.93 (close)

Hong Kong - Hang Seng Index: UP 2.8 percent at 21,215.00

Tokyo - Nikkei 225: UP 0.3 percent at 39,380.89 (close)

London - FTSE 100: UP 0.3 percent at 8,267.18

West Texas Intermediate: UP 0.7 percent at $73.72 per barrel

Brent North Sea Crude: UP 0.6 percent at $77.05 per barrel

Dollar/yen: DOWN at 149.14 yen from 149.35 yen on Wednesday

Euro/dollar: DOWN at 1.0935 from $1.0940

Pound/dollar: UP at $1.3076 from $1.3062

Euro/pound: DOWN at 83.66 pence from 83.72 pence

New York - Dow: UP 1.0 percent at 42,512.00 (close)

M.García--CPN