-

Indian court finds man guilty in notorious hospital rape case

Indian court finds man guilty in notorious hospital rape case

-

TikTok's journey from fun app to US security concern

-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

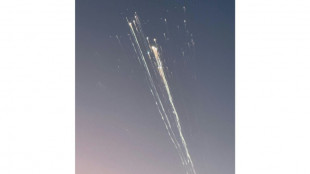

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

7-Eleven owner restructures to fight takeover

The owner of 7-Eleven announced a major restructuring on Thursday as it seeks to boost its share price and fend off what would be the biggest foreign takeover of a Japanese firm.

Seven & i Holdings rejected a $40-billion takeover offer last month from Alimentation Couche-Tard (ACT) but the Canadian group has since then reportedly sweetened its offer.

7-Eleven "konbini" are a ubiquitous lifeline for Japan's ageing population and a cherished one-stop shop for everything from rice balls to concert tickets to photocopies.

Second-quarter earnings published on Thursday, however, showed flagging sales with the company cutting its full-year operating profit outlook.

Seven & i announced plans to spin off non-core businesses into a new holding company comprising its supermarket food business, speciality stores and other businesses.

It said it would consider an initial public offering (IPO) of the new unit and bringing in strategic partners "to unlock value for the Company's shareholders and other stakeholders".

Creating the new unit allows Seven & i to focus solely on 7-Eleven -- the world's biggest convenience store chain with more than 85,000 outlets worldwide, a quarter of them in Japan.

An improved share price would also make a takeover attempt by ACT more expensive for the Canadian firm, while also easing pressure from shareholders pressing management to restructure.

7-Eleven began in the United States, but the franchise has been wholly owned by Seven & i since 2005.

Seven & i had said ACT's first proposal of $40 billion "grossly undervalues" its business and could face regulatory hurdles.

The Japanese company said on Wednesday it had received a revised offer but declined to give details.

Bloomberg News and other media outlets reported that ACT had improved its offer by around 20 percent to around seven trillion yen ($47 billion). ACT declined to comment.

Seven & i shares have climbed more than 30 percent since the takeover saga began but are still trading below the reported level of ACT's new offer.

Its shares closed up 4.7 percent on Wednesday, having initially surged nearly 12 percent on news of the new ACT offer. They edged down less than one percent on Thursday.

The new holding company will include 31 businesses, such as supermarket chains Ito-Yokado, York-Benimaru and baby goods shop Akachan Honpo.

Seven & i also said it plans to change its name, tentatively to 7-Eleven Corporation, which will be finalised at a shareholders' meeting.

Couche-Tard, which began with one store in the city of Laval in 1980, now runs nearly 17,000 convenience store outlets worldwide.

In 2021, Couche-Tard dropped a takeover bid worth 16 billion euros ($17 billion today) for French supermarket Carrefour after the French government said it would veto the deal over food security concerns.

It is unclear if Japan's new government under Prime Minister Shigeru Ishiba would do the same, but the finance ministry designated Seven & i a "core" industry last month.

A.Agostinelli--CPN