-

Indian court finds man guilty in notorious hospital rape case

Indian court finds man guilty in notorious hospital rape case

-

TikTok's journey from fun app to US security concern

-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

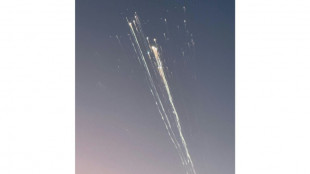

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

JPMorgan Chase profits top estimates, bank sees 'resilient' US economy

JPMorgan Chase reported a dip in profits on higher costs Friday while still topping expectations as executives described US consumers as healthy and the economy as poised to avoid recession.

But while the bank sees the US economy as "resilient," CEO Jamie Dimon offered a bracing geopolitical outlook, calling conditions "treacherous and getting worse."

The US banking giant enjoyed increases in revenues for equity trading as well as higher fees for asset management and investment banking.

However, costs tied to credit losses more than doubled from the year-ago period to $3.1 billion due to in part to $1 billion in reserves in case of bad loans.

But executives said the uptick in charge-offs was consistent with what it describes as "normalization" in credit quality rather than a sign of significant weakening in consumer health.

"We see the spending patterns as being sort of solid, consistent with the narrative that the consumers are on solid footing and consistent with a strong labor market," said Chief Financial Officer Jeremy Barnum, describing the dynamic as in line with a "soft landing" or "no landing" scenario.

A soft landing is one in which a period of fast growth gives way to slow growth rather than a recession.

JPMorgan's profits for the third quarter came in at $12.9 billion, down two percent from the same period a year ago.

Revenues were $42.7 billion, up seven percent.

- Navigating Fed policy shift -

Heading into the quarter, markets had been focused on how banks would navigate a pivot in US monetary policy to one in which interest rates are being lowered.

The shift is broadly expected to lead to lower net interest income (NII), which accounts for the difference banks make on loans minus what they pay in interest to depositors.

But JPMorgan's forecast was benign on this front, at least in the short run, as the bank lifted its estimate for 2024.

Barnum reiterated on a conference call that JPMorgan still sees NII trending lower in 2025, but emphasized that the benchmark can be choppy from quarter to quarter.

Barnum acknowledged that there had been a shift among US consumers away from some of the heavy spending on travel and entertainment of the last few years.

Some economists have expressed concerns about a possible US recession after a period of rising prices that has strained low-income households.

"You would normally think that rotation out of discretionary into non-discretionary would be a sign of consumers battening down the hatches and getting ready for a much worse environment," Barnum said. "But given the levels that it started from, what we see it as is actually like normalization."

- 'Prevailing uncertainty' -

But while JPMorgan was more upbeat on the US economy than in recent quarters, Dimon raised worries about geopolitics.

"We have been closely monitoring the geopolitical situation for some time, and recent events show that conditions are treacherous and getting worse," Dimon said in a press release.

"While we hope for the best, these events and the prevailing uncertainty demonstrate why we must be prepared for any environment."

Dimon, who speaks out frequently on public policy, again declined to endorse either of the two US presidential candidates.

But Dimon, who has sometimes been mentioned as a possible US Treasury secretary in a new administration, described the chances of such an appointment as "almost nil" in response to a question from an analyst.

"I probably am not going to do it, but I've always reserved the right," Dimon said. "I love what I do."

JPMorgan was joined in reporting results by Wells Fargo, which saw profits fall 11 percent to $5.1 billion, due in part to a drop in NII.

However, earnings per share topped analyst estimates, with the bank pointing to gains in venture capital investments and higher investment banking and asset management fees.

Shares of JPMorgan jumped 4.5 percent in mid-morning trading, while Wells Fargo surged 6.4 percent.

H.Cho--CPN