-

Indian court finds man guilty in notorious hospital rape case

Indian court finds man guilty in notorious hospital rape case

-

TikTok's journey from fun app to US security concern

-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

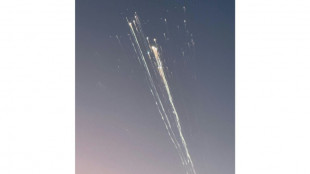

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

US, European markets rise as investors weigh rates, earnings

US and European stock markets rose Friday as traders weighed the outlook for interest rates and solid earnings from banking giant JPMorgan Chase.

Expectations of another bumper rate cut by the Federal Reserve were dampened by data Thursday showing US consumer inflation slowed to 2.4 percent in September, which was slightly above analyst expectations.

"Somewhat higher-than-expected inflation in September has eliminated market expectations of anything more than a 25 basis point interest rate reduction at the Fed's November meeting," said market strategist Patrick Munnelly at traders Tickmill Group.

Fresh data on Friday showed US wholesale prices were unchanged in September.

Insurance company Nationwide said the latest inflation report "won't spoil the Fed's plans" to further reduce interest rates in 2024.

The central bank's next policy meeting is in November.

Shares in JPMorgan Chase jumped more than five percent after the bank reported lower profits but topped estimates, with executives saying the economy was poised to avoid a recession.

Tesla shares fell almost eight percent as investors were apparently disappointed by Elon Musk's presentation of a much-hyped electric Robotaxi without steering wheels or pedals.

Critics said the presentation was short on details of financial steps and timelines to make the product a reality.

Wall Street's three main indexes were up in midday deals, with the tech-heavy Nasdaq reversing morning losses.

The Paris and Frankfurt stock markets closed higher as the European Central Bank is expected to make its third interest rate cut of the year next week.

Fawad Razaqzada, market analyst at City Index and Forex.com, said the ECB is expected to reduce rates by 25 basis points, half the size of the Fed's first rate cut in four years last month.

"Holding the ECB from being more aggressive in its rate-cutting is the still-strong wage growth in Eurozone, and the fact that the Fed has signalled it won't cut rates aggressively again following its initial 50 basis point rate cut," Razaqzada said.

"Middle East tensions add another layer of uncertainty for Eurozone given that its largest member states are all net energy importers," he said.

In London, the British capital's top-tier FTSE 100 index rose as data showed the UK economy rebounded in August after stagnating for two months, giving a boost to the new Labour government weeks before it presents its maiden budget.

In Asia, the Shanghai stock market closed more than two percent lower after a week dominated by concerns over a lack of detail on the scale of China's recent batch of stimulus measures.

Focus is now on a briefing Saturday at which Finance Minister Lan Fo'an is to set out fiscal policy.

"The stakes are high -- most observers agree that recent stimulus announcements won't amount to much unless backed up by fiscal support," said Julian Evans-Pritchard, head of China economics at Capital Economics, in a note.

"Three factors will be key in determining the impact of stimulus: its scale, where it's channelled, and how soon it's deployed," he said.

Elsewhere, oil steadied after having surged more than three percent Thursday following the Israeli defence minister's vow that his country would strike Iran in retaliation for last week's missile attack.

- Key figures around 1600 GMT -

New York - Dow: UP 0.8 percent at 42,796.92 points

New York - S&P 500: UP 0.6 percent at 5,814.33

New York - Nasdaq: UP 0.3 percent at 18,344.57

London - FTSE 100: UP 0.2 percent at 8,253.65 (close)

Paris - CAC 40: UP 0.5 percent at 7,577.89 (close)

Frankfurt - DAX: UP 0.9 percent at 19,373.83 (close)

Tokyo - Nikkei 225: UP 0.6 percent at 39,605.80 (close)

Shanghai - Composite: DOWN 2.6 percent at 3,217.74 (close)

Hong Kong - Hang Seng Index: Closed for holiday

Euro/dollar: UP at $1.0943 from $1.0935 on Thursday

Pound/dollar: UP at $1.3069 from $1.3058

Dollar/yen: UP at 149.11 yen from 148.58 yen

Euro/pound: DOWN at 83.72 pence from 83.73 pence

West Texas Intermediate: DOWN 0.7 percent at $75.33 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $78.94 per barrel

M.Mendoza--CPN