-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

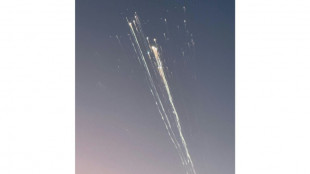

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

-

Indian Bollywood star Saif Ali Khan stabbed in burglary

Indian Bollywood star Saif Ali Khan stabbed in burglary

-

Taiwan's TSMC says net profit rose 57% in fourth quarter

United announces $1.5 bn share buyback as earnings top estimates

United Airlines announced a $1.5 billion share buyback on Tuesday as its earnings for the third quarter topped analyst estimates.

The US airline reported net income of $965 million, down more than 15 percent from the same period a year earlier. This translated to an adjusted diluted earnings per share of $3.33 -- above analyst estimates.

But operating revenues rose by 2.5 percent to around $14.8 billion due to an increase in both passenger and cargo revenues.

United's share price rose slightly in after-hours trading.

"I appreciate the entire United team coming together to take care of our customers by operating a safe and on-time airline this summer," United Airlines CEO Scott Kirby said in a statement.

"As predicted, unproductive capacity left the market in mid-August, and we saw a clear inflection point in our revenue trends that propelled United to exceed Q3 expectations," he continued.

Alongside its earnings, United also announced a new $1.5 billion share repurchase program -- its first since the onset of the Covid-19 pandemic.

The firm said the buyback program represents around seven percent of its market capitalization, based on Monday's closing stock price.

J.Bondarev--CPN