-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

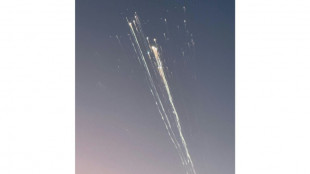

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

-

Indian Bollywood star Saif Ali Khan stabbed in burglary

Indian Bollywood star Saif Ali Khan stabbed in burglary

-

Taiwan's TSMC says net profit rose 57% in fourth quarter

UK inflation hits three-year low, fuelling rate-cut hopes

Britain's annual inflation rate fell to a three-year low in September, official data showed Wednesday, fuelling speculation that the Bank of England will resume cutting interest rates next month.

The Consumer Prices Index (CPI) reached 1.7 percent last month, well below the BoE's two-percent target, after hitting 2.2 percent in August, the Office for National Statistics (ONS) said in a statement.

The inflation rate was lower than the 1.9 percent rise that analysts forecast and has cemented expectations that the central bank would likely cut interest rates again in November.

"Lower airfares and petrol prices were the biggest driver of this month's fall," said Grant Fitzner, chief economist at the ONS.

He added that this was partially offset by a strengthening in food price inflation for the first time since early last year.

The inflation data "clears the path for another 25-basis point rate cut in November", said Richard Flax, chief investment officer at wealth management company Moneyfarm.

"The underlying conditions support this move -– energy prices have eased, the economy has cooled, and the labour market has stabilised," he said.

- 'Dramatic drop' -

It comes after official data on Tuesday showed an easing in Britain's unemployment rate and wage growth, which also bolstered analysts expectations of a rate cut.

"It is absolutely amazing to see such a dramatic drop in the UK's CPI number, and the news had brought nothing (but) good things for the Bank of England," said Naeem Aslam, chief investment officer at Zaye Capital Markets.

The inflation news will likely be a boost to the new Labour government ahead of its maiden budget later this month.

Prime Minister Keir Starmer has warned Britons that the budget announcement will be "painful", with tax rises and spending cuts expected.

"We are being repeatedly told tough decisions are to be announced, so any sliver of good economic news will likely be pounced upon," said Lindsay James, investment analyst at Quilter Investors.

Starmer's Labour government won power at the start of July, ending 14 years of Conservative rule.

In August, the BoE reduced it key rate for the first time since early 2020, from a 16-year high of 5.25 percent as inflation returned to normal levels.

But it decided against a second reduction in a row in September.

The BoE hiked borrowing costs 14 times between late 2021 -- when they stood at a record-low 0.1 percent -- and the second half of last year.

Supply-chain disruptions following Covid lockdowns, together with soaring food and energy prices caused by Russia's invasion of Ukraine, sent global inflation surging.

M.P.Jacobs--CPN