-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

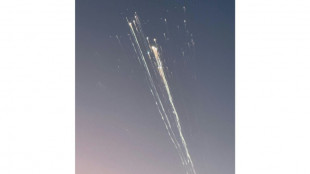

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

-

Indian Bollywood star Saif Ali Khan stabbed in burglary

Indian Bollywood star Saif Ali Khan stabbed in burglary

-

Taiwan's TSMC says net profit rose 57% in fourth quarter

Global stock markets fall as tech fears weigh

Major Asian and European stock markets mostly fell Wednesday after concerns about the red-hot semiconductor industry fuelled a tech sell-off.

Wall Street was shaken Tuesday after Dutch tech giant ASML, which supplies chip-making machines to the semiconductor industry, cut its 2025 guidance and forecast a slump in orders.

ASML shares were down around four percent in Amsterdam in early afternoon deals Wednesday after plunging about 16 percent following its update near the end of trading Tuesday.

All three main indices on Wall Street sank Tuesday as the profit-warnings revived concerns that the blockbuster surge in the tech sector, which has been fuelled by demand for artificial intelligence, may have gone too far.

"ASML's warning has spooked investors holding anything linked to the semiconductor space," said Russ Mould, investment director at traders AJ Bell.

The selling in New York filtered through to Asia on Wednesday, where chipmakers were well down.

Tokyo Electron led the retreat by slumping more than nine percent, while Taipei-listed TSMC shed more than two percent.

On Wall Street Tuesday, chip titan Nvidia sank more than four percent and rival company AMD dropped more than five percent. IT giant Intel lost more than three percent.

Losses were fuelled also by reports that President Joe Biden's administration was considering a cap on US exports of advanced AI chips to some countries, traders said.

In Europe on Wednesday, the Frankfurt and Paris stock markets dropped as weak luxury-sector earnings added to semiconductor woes.

Shares in Louis Vuitton-owner LVMH dropped around four percent after the luxury heavyweight reported disappointing third-quarter results amid a slowdown in demand from Asia.

The announcement heightened investor concerns over a luxury sector heavily-reliant on China, said market strategist Patrick Munnelly at traders Tickmill Group.

The news "tempered the recent surge in luxury stocks subsequent to the announcement of Chinese stimulus plans", he added.

Gucci-owner Kering and Cartier-owner Richemont both fell around two percent as the sector struggles with weaker demand from China.

In London, the FTSE 100 rose after data showed UK inflation hit a three-year low in September, fuelling speculation that the Bank of England would resume cutting interest rates next month.

Japan's stock market shed almost two percent, while Shanghai made small gains.

Hong Kong ended lower again even as developers were boosted after the city's chief executive unveiled some measures to help its struggling real estate industry.

This included an easing of mortgage rules, while there was also a tax cut on liquor to help the services sector.

Oil prices fell slightly, adding to the steep losses Monday and Tuesday caused by a report that Israel had pledged not to strike Iran's energy infrastructure in retaliation for a missile barrage this month.

Adding to pressure on the commodity were worries over demand from top importer China, a report from the International Energy Agency saying global markets remain "adequately" supplied and relatively modest output losses from hurricanes in the US Gulf Coast.

- Key figures around 1035 GMT -

London - FTSE 100: UP 0.5 percent at 8,293.22 points

Paris - CAC 40: DOWN 0.6 percent at 7,477.01

Frankfurt - DAX: DOWN 0.3 percent at 19,424.72

Tokyo - Nikkei 225: DOWN 1.8 percent at 39,180.30 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 20,286.85 (close)

Shanghai - Composite: UP 0.1 percent at 3,202.95 (close)

New York - Dow: DOWN 0.8 percent at 42,740.42 (close)

Euro/dollar: UP at $1.0895 from $1.0892 on Tuesday

Pound/dollar: DOWN at $1.3024 from $1.3066

Dollar/yen: UP at 149.32 yen from 149.22 yen

Euro/pound: UP at 83.67 pence from 83.33 pence

West Texas Intermediate: DOWN 0.2 percent at $70.41 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $74.06 per barrel

L.K.Baumgartner--CPN