-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

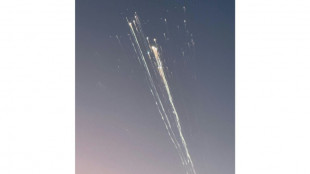

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

-

Indian Bollywood star Saif Ali Khan stabbed in burglary

Indian Bollywood star Saif Ali Khan stabbed in burglary

-

Taiwan's TSMC says net profit rose 57% in fourth quarter

Lower rates, surging stock market fail to ignite US IPO market

Public listings on Wall Street have seen a slow comeback in 2024 despite a resilient US economy, a long-awaited interest rate cut by the central bank and stock valuations hitting record highs.

Experts say the lackluster IPO activity is due to competition from venture capitalists and a rate cut that was slow to come.

While initial public offerings (IPOs) typically pick up in the fall, the market was "more muted than anticipated" this year, said research group Renaissance Capital.

The IPO market's "slow rebound" continued in the third quarter this year, the group added, as investors look towards 2025.

Even though IPOs jumped nearly 30 percent from a year ago during the first nine months of 2024, the surge came from a low base of comparison, said Mark Roberts, managing partner at The Blueshirt Group.

The fall of 2023 looked like a potential turning point for the market -- with British chip designer Arm, online marketing platform Klaviyo and German footwear brand Birkenstock all going public in a matter of weeks.

But the fledgling trend was short-lived.

- Unusual trend -

The lower level of activity has endured although the world's biggest economy has proven resilient and so far avoided slipping into a recession.

"Even more important than the state of the economy, with the stock market at record highs, you would expect a lot more IPO activity," said Jay Ritter, a finance professor at the University of Florida who focuses on public listings.

The beginning of a rate easing cycle by the Federal Reserve, which announced the first rate cut on September 18, was also expected to spur IPO activity.

But Matt Kennedy, senior strategist at Renaissance Capital, said the cut came too late and few were able to seize the opportunity.

Some deals did come through, the most notable of them being jet engine maintenance company StandardAero.

It raised over $1 billion in early October.

Others chose to stay on the sidelines or pull back, with aluminum recycler Novelis scrapping its IPO plans altogether, citing "current market conditions."

Roberts of The Blueshirt Group said the private sector is "significantly more upbeat" than a year ago and he expects more IPO activity in 2025.

- Upbeat about 2025 -

Experts say companies are not rushing to IPO because they can get funding elsewhere.

A public listing is an arduous and lengthy process which requires companies to disclose a lot of information on their financials, operations and strategy, whereas a funding round limits the sharing to a handful of investors.

"There's so much private equity and venture capital dry powder, so much money available for them to be investing that they're willing to pay high prices," said Ritter.

In early July, private equity companies and venture capital funds held a record $2.6 trillion of uncommitted capital, looking for investment opportunities in unlisted stocks.

Generative artificial intelligence powerhouse OpenAI had no trouble raising $6.6 billion in its latest funding round in early October, a tally that would have been the 12th biggest US IPO ever had they chosen to list on Wall Street.

"You can understand why they feel no desire to go public in that kind of environment," Ritter added. "It wouldn't necessarily make sense for them to file for an IPO."

In the past, existing shareholders might have pressured businesses to go public.

However, founders, employees or venture capitalists are now able to monetize shares more easily than a few years ago, thanks to startup platforms catered to unlisted companies.

Forge Global and Hiive are some of the options available -- as well as Nasdaq Private Market, run by Nasdaq, which also owns one of two main US stock exchanges.

D.Goldberg--CPN