-

The video games bedeviling Elon Musk

The video games bedeviling Elon Musk

-

Gamers tear into Musk for 'faking' video game prowess

-

Global equities rally, pushing London and Frankfurt to new records

Global equities rally, pushing London and Frankfurt to new records

-

US grounds SpaceX's Starship after fiery mid-air explosion

-

US to tighten trade rules to hit low-cost China shipments

US to tighten trade rules to hit low-cost China shipments

-

US grounds SpaceX's Starship rocket pending probe

-

IMF raises global growth outlook and flags rising economic divergence

IMF raises global growth outlook and flags rising economic divergence

-

London, Frankfurt hit record highs as global equities rally

-

Pompeii reveals 'impressive' bath complex

Pompeii reveals 'impressive' bath complex

-

EU deepens probe into X after Musk outbursts

-

London stock market hits record high as global equities rally

London stock market hits record high as global equities rally

-

2024 saw fastest-ever annual rise in CO2 levels: UK weather service

-

'No money': gloom on Beijing streets as economic growth slows

'No money': gloom on Beijing streets as economic growth slows

-

Nintendo shares tumble as Switch 2 teaser disappoints

-

Apple sidelines AI news summaries due to errors

Apple sidelines AI news summaries due to errors

-

China says population fell for third year in a row in 2024

-

Asian traders give mixed reaction as China's economic growth slows

Asian traders give mixed reaction as China's economic growth slows

-

Chinese economic growth among slowest in decades

-

'Damaging' AI porn scandal at US school scars victims

'Damaging' AI porn scandal at US school scars victims

-

Nintendo shares tumble as Switch 2 preview disappoints

-

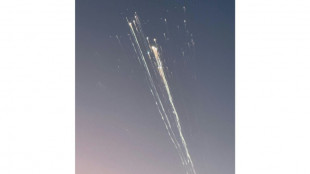

SpaceX catches Starship booster again, but upper stage explodes

SpaceX catches Starship booster again, but upper stage explodes

-

SpaceX catches Starship booster but upper stage explodes

-

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

Hypertec Cloud Partners With Potentia to Power Sustainable AI Cloud Expansion With Additional 480MW of Balanced Capacity Across North America

-

Insurance access for US homeowners with higher climate risks declines

-

Wall Street rally loses steam as European luxury shares advance

Wall Street rally loses steam as European luxury shares advance

-

China set to post sluggish growth as doldrums deepen

-

US braces for freezing weather fueled by polar vortex

US braces for freezing weather fueled by polar vortex

-

Musk's Starship set for launch after Bezos orbital triumph

-

Surf star Slater pays tribute as Quiksilver co-founder Green dies

Surf star Slater pays tribute as Quiksilver co-founder Green dies

-

Teen kills fellow student teacher at Slovak school

-

LIV Golf sign United States broadcast deal with Fox Sports

LIV Golf sign United States broadcast deal with Fox Sports

-

Slovak entrepreneur funding rescue of German flying taxi startup

-

French researchers aim to ease X refugees' path with 'HelloQuitX'

French researchers aim to ease X refugees' path with 'HelloQuitX'

-

China property giant Vanke's CEO 'taken away' by police: report

-

Oil giant BP cuts thousands of jobs to slash costs

Oil giant BP cuts thousands of jobs to slash costs

-

EU announces 120 mn euros in Gaza aid after ceasefire

-

Nepal's top court bars infrastructure in protected areas

Nepal's top court bars infrastructure in protected areas

-

Stock markets jump as inflation worries ease

-

China to probe US chips over dumping, subsidies

China to probe US chips over dumping, subsidies

-

India's outcast toilet cleaners keeping Hindu festival going

-

Apple loses top spot in China smartphone sales to local rivals

Apple loses top spot in China smartphone sales to local rivals

-

Sri Lanka signs landmark $3.7 bn deal with Chinese state oil giant

-

Blue Origin's New Glenn rocket blasts into orbit for first time

Blue Origin's New Glenn rocket blasts into orbit for first time

-

UK economy rebounds but headwinds remain for govt

-

Stocks follow Wall St higher on welcome US inflation data

Stocks follow Wall St higher on welcome US inflation data

-

Blue Origin's New Glenn rocket blasts off in first launch, reaches orbit

-

Chinese give guarded welcome to spending subsidies

Chinese give guarded welcome to spending subsidies

-

World Bank plans $20 bn payout for Pakistan over coming decade

-

Indian Bollywood star Saif Ali Khan stabbed in burglary

Indian Bollywood star Saif Ali Khan stabbed in burglary

-

Taiwan's TSMC says net profit rose 57% in fourth quarter

ECB set to cut rates again as inflation cools

European Central Bank policymakers meet on Thursday with fading price pressures and weaker economic activity in the eurozone nudging them towards making another cut to interest rates.

The 26 members of the governing council are gathering in Slovenia, as they make one of their regular tours away from the ECB's headquarters in Frankfurt.

ECB President Christine Lagarde arrived ahead of her colleagues, "checking on prices" at a market in the capital Ljubljana, she said in a video posted on social media on Tuesday.

What she heard from traders might well have reassured her -- recent data show that inflation in the eurozone has slowed considerably.

In Slovenia, the annual rate of consumer price rises was a mere 0.6 percent in September.

For the whole of the eurozone, the figure was 1.8 percent -- the first time it has been below the ECB's two-percent target in three years.

After cutting rates twice already this year, including at their last meeting in September, policymakers initially signalled a preference to wait until December to cut again.

But September's below-expectations reading has added to the sense that consumer prices are back under control after they soared in the wake of the coronavirus pandemic and the Russian invasion of Ukraine.

"Victory against inflation is in sight," French central bank governor and ECB rate-setter Francois Villeroy de Galhau said last week.

"A cut is very likely," he said of Thursday's meeting, adding that "it will not be the last".

- 'Significant' -

From its peak of four percent, the ECB has cut its key deposit rate in two increments of 25 basis points, once in June and another time in September.

Among ECB policymakers, there was "little apparent opposition" to another cut of the same size on Thursday, Deutsche Bank analysts said, describing the move as potentially "significant".

"As the first back-to-back cut of the cycle, it would signal a pivot into a faster easing cycle," they said.

Trends in both inflation and the real economy supported a case for a "straightforward" cut, Berenberg bank analyst Holger Schmieding said.

A surge in wages to make up for spikes in food and energy prices "seems to be petering out", Schmieding said, and the ECB would look through a small, anticipated rebound in inflation towards the end of this year.

The eurozone meanwhile has looked weak. The ECB's forecasts, published last month, already predicted that growth would slow to a meek 0.2 percent in the third quarter.

A slew of negative sentiment indicators in the weeks that followed have confirmed the impression that action is needed to bring relief to households and businesses.

- More cuts? -

Looking ahead, the ECB would continue to stress its actions were "data dependant" even as it increased the pace of its interest rate cuts, Schmieding said.

The oft-repeated phrase is likely to appear in Lagarde's planned statement at 2:45 pm in Slovenia (1245 GMT) after the ECB's decision has been announced.

Analysts will parse her remarks for any hints of the thinking among ECB policymakers and the future path of rates.

At the very least, Lagarde would not "correct market expectations for another 25 basis point move" at the ECB's next meeting in December, Schmieding said.

The fourth cut since the ECB started easing borrowing costs would put the key deposit rate at three percent, but the bank was unlikely to stop there, according to observers.

"The ECB is on a path to cut interest rates at each one of the next five policy meetings," including Thursday's gathering, HSBC bank analyst Chris Hare said.

A string of quarter-point cuts through to April would lower the deposit to 2.25 percent, a level which was having a neutral effect on the economy to being "slightly accommodative", Hare said.

A.Mykhailo--CPN