-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

-

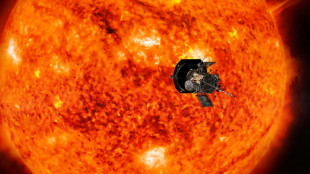

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Wall Street rebounds despite US inflation ticking higher

-

Serbia schools to shut amid new protests over station collapse

-

Argentina's dollar craze cools under greenback-loving Milei

Argentina's dollar craze cools under greenback-loving Milei

-

'Dark lull' in German energy transition sparks political debate

-

No longer Assad's mouthpiece, Syrian media face uncertainty

No longer Assad's mouthpiece, Syrian media face uncertainty

-

EU, Swiss hail 'historic' new deal resetting relations

-

Two dead after Lapland tourist bus crash in Finland

Two dead after Lapland tourist bus crash in Finland

-

Fed's favored inflation gauge edges higher in November

-

Spain orders 25 more Eurofighter jets from Airbus

Spain orders 25 more Eurofighter jets from Airbus

-

Fed's favored inflation gauge rises again in November

-

French PM rushes to name new government by Christmas

French PM rushes to name new government by Christmas

-

European stocks retreat further before US inflation data

Stock markets rise before knife-edge US election

Global stock markets rose and the dollar slid Monday as investors steel themselves for a coin-toss US presidential election, an interest rate decision and expected Chinese stimulus measures.

Oil prices rallied around 2.5 percent after eight members of the OPEC+ group of producers said Sunday they would extend supply cuts until the end of next month.

They had been delaying output hikes on worries about slowing demand in China and the United States.

All major European and Asian markets gained, tracking a positive lead from Wall Street ahead of the weekend.

"Traders are gearing up for perhaps the most important week of the year," said Joshua Mahony, chief market analyst at Scope Markets.

Investors are looking for any hint of an advantage between the US presidential candidates as Democratic Vice President Kamala Harris and her Republican rival Donald Trump remain neck and neck ahead of Tuesday's poll.

The dollar retreated against main rivals Monday as a fresh opinion poll in Iowa -- which Trump won in 2016 and 2020 -- showed Harris leading.

A victory for Trump is seen as being positive for the dollar and pushing up Treasury yields owing to his pledges to cut taxes and impose hefty tariffs on imports.

Elections for the Senate and House of Representatives are also being closely watched amid speculation the Republicans could take control of both.

"If the Republicans sweep all three, that will open the door to significant fiscal changes, which is negative for bondholders and could spell higher yields until the dust settles," said Peter Esho, founder of Esho Capital.

The election comes before the Federal Reserve is due to make its latest policy decision this week, with investors expecting 25-basis-point reduction after a bumper 50-point cut at its last gathering.

The vote is of particular interest to China, where Beijing is this week meeting to hammer out an economic stimulus.

"We believe the US election results will have some impact on the size of Beijing's stimulus package," Nomura's chief China economist, Ting Lu, said in a research note.

Both candidates in the race have pledged to get tougher on Beijing, with Trump promising tariffs of 60 percent on all Chinese goods coming into the country.

Economists expect lawmakers to approve around one trillion yuan ($140 billion) in extra budget, mostly for indebted local governments, and a one-off one trillion yuan payment for banks.

Hong Kong made gains and Shanghai was up more than one percent at the close. Tokyo was closed for a holiday.

In the eurozone, Paris and Frankfurt were higher in midday deals.

London gained 0.6 percent, with the Bank of England widely expected to cut its main interest rate on Thursday after inflation dropped below its target rate.

Oil prices won support also after Iran's supreme leader Ayatollah Ali Khamenei warned at the weekend that Israel and the United States "will definitely receive a tooth-breaking response" to Israeli attacks on October 26.

That strike was in response to an October 1 barrage of about 200 missiles against its rival.

- Key figures around 1100 GMT -

London - FTSE 100: UP 0.6 percent at 8,229.52 points

Paris - CAC 40: UP 0.4 percent at 7,434.89

Frankfurt - DAX: UP 0.1 percent at 19,271.49

Hong Kong - Hang Seng Index: UP 0.3 percent at 20,567.52 (close)

Shanghai - Composite: UP 1.2 percent at 3,310.21 (close)

Tokyo - Nikkei 225: Closed for a holiday

New York - Dow: UP 0.7 percent at 42,052.19 (close)

Euro/dollar: UP at $1.0902 from $1.0833 on Friday

Pound/dollar: UP at $1.2964 from $1.2917

Dollar/yen: DOWN at 151.82 yen from 153.01 yen

Euro/pound: UP at 84.15 from 83.86 pence

Brent North Sea Crude: UP 2.3 percent at $74.80 per barrel

West Texas Intermediate: UP 2.5 percent at $71.20 per barrel

Y.Jeong--CPN