-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

-

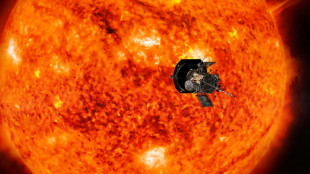

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Wall Street rebounds despite US inflation ticking higher

-

Serbia schools to shut amid new protests over station collapse

-

Argentina's dollar craze cools under greenback-loving Milei

Argentina's dollar craze cools under greenback-loving Milei

-

'Dark lull' in German energy transition sparks political debate

-

No longer Assad's mouthpiece, Syrian media face uncertainty

No longer Assad's mouthpiece, Syrian media face uncertainty

-

EU, Swiss hail 'historic' new deal resetting relations

-

Two dead after Lapland tourist bus crash in Finland

Two dead after Lapland tourist bus crash in Finland

-

Fed's favored inflation gauge edges higher in November

-

Spain orders 25 more Eurofighter jets from Airbus

Spain orders 25 more Eurofighter jets from Airbus

-

Fed's favored inflation gauge rises again in November

-

French PM rushes to name new government by Christmas

French PM rushes to name new government by Christmas

-

European stocks retreat further before US inflation data

Most Asian markets rise as US heads to polls in toss-up vote

Asian markets mostly rose Tuesday, a day before results from the US presidential election rolled in, with opinion polls showing a knife-edge vote, while Chinese equities were boosted by hopes over the country's economy.

Uncertainty about the outcome and worries that the winner might not be known for days has led to warnings that investors could be in for a period of volatility.

Eyes will also be on the Federal Reserve's policy decision on Thursday, with expectations for another cut, while the post-meeting statement from bank boss Jerome Powell will be pored over for an idea about its plans for 2025.

A win for Republican Donald Trump is expected to boost the dollar, restoke inflation, and send Treasury yields higher owing to his pledges to slash taxes and impose tariffs on imports.

Analysts see less upheaval from a win by Democratic Vice President Kamala Harris.

"Some view a second Trump term as a potential ticket to higher deficits and a dash of inflation, courtesy of his tax-and-tariff playbook," said Stephen Innes at STI Asset Management.

"A Trump victory with a Republican Congress would likely mean a green light for these pro-growth, deficit-stirring policies.

"With Harris and a divided Congress, radical Democratic policies would face a wall, keeping fiscal volatility in check compared to Trump's economic flamethrower."

He added that a Trump win and Republican sweep of both houses of Congress could cause headaches for Powell as he continues his battle to bring inflation to heel.

National Australia Bank's head of market economics, Tapas Strickland, said that after Thursday's decision: "Harder discussions come in December and beyond, especially on the pace of potential cuts, where rates are likely to go, and any policy impacts by the next president and Congress."

Wall Street's three main indexes ended in the red, and Asian traders mostly managed to build on Monday's performance with markets swinging in and out of positive territory.

Hong Kong and Shanghai each climbed more than two percent after data showed China's services sector expanded last month at its fastest pace since July.

The news came as traders await the end of a government meeting this week to hammer out an economic stimulus.

Officials are expected to give the go-ahead to about $140 billion in extra budget spending, mostly for indebted local governments, and a similar one-off payment for banks.

Adding to the risk-on mood were comments by Chinese Premier Li Qiang, who said he was "fully confident" the economy would hit its growth targets this year and indicated that there was room to do more.

Tokyo rallied more than one percent as investors returned from an extended weekend, while Singapore, Wellington, Taipei, Mumbai, Bangkok, Jakarta and Manila also advanced. Sydney and Seoul edged down.

London, Paris and Frankfurt all dipped at the open.

Oil prices inched up after surging almost three percent Monday after top producers agreed to extend output cuts through to the end of December and on worries about the Middle East crisis.

- Key figures around 0810 GMT -

Tokyo - Nikkei 225: UP 1.1 percent at 38,474.90 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 21,006.97 (close)

Shanghai - Composite: UP 2.3 percent at 3,386.99 (close)

London - FTSE 100: DOWN 0.1 percent at 8,179.18

Euro/dollar: UP at $1.0888 from $1.0878 on Monday

Pound/dollar: UP at $1.2976 from $1.2954

Dollar/yen: UP at 152.25 yen from 152.17 yen

Euro/pound: DOWN at 83.91 from 83.94 pence

West Texas Intermediate: UP 0.2 percent at $71.59 per barrel

Brent North Sea Crude: UP 0.1 percent at $75.18 per barrel

New York - Dow: DOWN 0.6 percent at 41,794.60 (close)

C.Peyronnet--CPN