-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

-

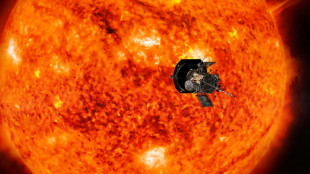

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Wall Street rebounds despite US inflation ticking higher

-

Serbia schools to shut amid new protests over station collapse

-

Argentina's dollar craze cools under greenback-loving Milei

Argentina's dollar craze cools under greenback-loving Milei

-

'Dark lull' in German energy transition sparks political debate

-

No longer Assad's mouthpiece, Syrian media face uncertainty

No longer Assad's mouthpiece, Syrian media face uncertainty

-

EU, Swiss hail 'historic' new deal resetting relations

-

Two dead after Lapland tourist bus crash in Finland

Two dead after Lapland tourist bus crash in Finland

-

Fed's favored inflation gauge edges higher in November

-

Spain orders 25 more Eurofighter jets from Airbus

Spain orders 25 more Eurofighter jets from Airbus

-

Fed's favored inflation gauge rises again in November

-

French PM rushes to name new government by Christmas

French PM rushes to name new government by Christmas

-

European stocks retreat further before US inflation data

Saudi Aramco's quarterly profit drops 15% on low oil prices

Energy giant Saudi Aramco reported a 15 percent year-on-year drop in third quarter profit on Tuesday, citing prices which have stayed low despite production cuts and war in the Middle East.

The fall in net income to $27.56 billion from $32.58 billion in 2023 is the seventh consecutive quarterly drop for Aramco, one of the world's biggest companies by market capitalisation.

Aramco is the chief source of revenue for Crown Prince Mohammed bin Salman's Vision 2030 reform agenda, which aims to remodel the Gulf kingdom's crude-reliant economy.

The lower third quarter profit "was mainly due to the impact of lower crude oil prices and weakening refining margins", Aramco said in a statement to the Saudi stock exchange.

Following a series of output cuts since October 2022, the world's biggest crude oil exporter is currently producing roughly nine million barrels per day (bpd), well below its capacity of 12 million bpd.

Yet despite lower production, as well as widening conflict in the Middle East, prices have remained low because of concerns about market oversupply.

Brent crude was priced at around $75 per barrel on Tuesday -- much cheaper than Saudi Arabia's estimated fiscal break-even mark.

"Aramco delivered robust net income and generated strong free cash flow during the third quarter, despite a lower oil price environment," chief executive Amin Nasser said in a statement.

The firm will maintain its $10.8 billion performance-based dividend for another quarter alongside its $20.3 billion base dividend, the statement said.

- 'No supply disruptions' -

Soaring energy prices following Russia's invasion of Ukraine allowed Aramco to post record profits in 2022, before they dipped by 25 percent last year.

Profits were down 14.5 percent in the first quarter of 2024 and 3.4 percent in the second quarter.

Israel's war against Hamas has drawn in Iran-backed groups from across the region and led to direct strikes between Israel and Iran, spurring fears about oil supply.

Yet while Brent rose above $80 per barrel in early October, it has not approached $96.2 -- the mark the International Monetary Fund has identified as break-even for the Saudi budget at current production levels.

"The markets appear to be dismissing geopolitical risk in the Middle East, so anything short of an actual supply disruption" will be unlikely to exert upward pressure on prices, said Amena Bakr, senior research analyst at Energy Intelligence.

"So far there have been no supply disruptions."

The year-on-year drop in profits "isn't coming as a surprise to the government which has already revised down revenue expectations for this year based on weakening oil markets", said Jamie Ingram, senior editor at the Middle East Economic Survey.

- 'Maximising prices' -

On Sunday, Saudi Arabia and seven other members of the OPEC+ group of oil-producing nations said they were extending a 2.2 million-barrel reduction announced in November 2023 by another month, until the end of December.

"When it comes to oil production policy, they'll be trying to assess what will ultimately bring in the most revenue," Ingram said.

"Is it maximising volumes or maximising prices? For now, the strategy remains the latter."

The government's stake in Aramco is around 81.5 percent, while the Saudi sovereign wealth fund, the Public Investment Fund, holds 16 percent.

Aramco is pushing to diversify from its core business, "investing big-time in renewable and hydrogen and carbon capture and storage" while also "making sure that we are growing our oil and gas activities and petrochemicals", Nasser told an investor forum in Riyadh last week.

The company's initial public offering in 2019, the biggest flotation in history, raised $29.4 billion, and a secondary offering this year of nearly 1.7 billion shares fetched $12.35 billion.

Aramco's profits help finance flagship projects including NEOM, the planned futuristic mega-city being built in the desert, a giant airport in Riyadh and major tourism and leisure developments.

The Saudi finance ministry has acknowledged that spending will outstrip revenue in the short term, and in September it projected a budget deficit of 2.3 percent of GDP in 2025 and for deficits to continue through 2027.

U.Ndiaye--CPN