-

Turkey's pro-Kurd party meets jailed PKK leader

Turkey's pro-Kurd party meets jailed PKK leader

-

EU universal charger rules come into force

-

Trump asks US Supreme Court to pause law threatening TikTok ban

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

Weak yen lifts Japan stocks higher, Wall Street slides

Weak yen lifts Japan stocks higher, Wall Street slides

-

Tourists return to post-Olympic Paris for holiday magic

-

Global stocks rise as Japan led Asia gains on a weaker yen

Global stocks rise as Japan led Asia gains on a weaker yen

-

Asian markets mostly rise but political turmoil holds Seoul back

-

Move over Mercedes: Chinese cars grab Mexican market share

Move over Mercedes: Chinese cars grab Mexican market share

-

Japanese shares gain on weaker yen after Christmas break

-

Fleeing Myanmar, Rohingya refugees recall horror of war

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Peru ex-official denies running Congress prostitution ring

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

-

US stocks take a breather, Asian bourses rise in post-Christmas trade

-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

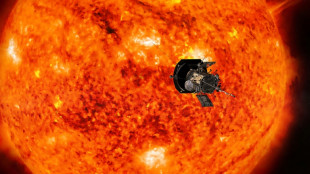

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

| RBGPF | 100% | 59.84 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| RYCEF | 0.14% | 7.27 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| JRI | -0.41% | 12.15 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| BP | 0.38% | 28.96 | $ |

Asian markets mostly rise on China hope, euro hit by France woes

Most markets rose in Asia on Tuesday on hopes China will unveil fresh measures to boost the world's number two economy following reports that authorities will hold a key meeting next week.

The gains, which followed another record day on Wall Street, came as traders were also left assessing Washington's decision to impose fresh tech export restrictions on Beijing in the latest volley in a long-running standoff between the rival powers.

Meanwhile, the euro extended losses on concerns of political and economic upheaval in France, with the country's government facing collapse.

Investors are also looking ahead to the release of US jobs data at the end of the week which could play a key role in the Federal Reserve's decision on whether to cut interest rates again.

The positive performance in Asia followed a recent run-up that was helped Monday by manufacturing activity data suggesting China's economic struggles may be coming to an end.

Bloomberg said Tuesday that China's top leaders, including President Xi Jinping, would hold a two-day economic work conference next week to outline their targets and stimulus plans for next year.

The gathering comes after figures Monday suggested the country's economy could be turning around after almost two years of malaise, and following a raft of support measures unveiled at the end of September.

Hong Kong and Shanghai rose in the afternoon, having retreated in the morning after Washington announced new export restrictions taking aim at Beijing's ability to make advanced semiconductors.

The moves step up existing US efforts to tighten curbs on exports of state-of-the-art AI chips to China.

Beijing hit back, saying the United States "abuses export control measures" and has "hindered normal economic and trade exchanges".

There were also healthy gains in Tokyo, Sydney, Seoul, Singapore, Mumbai, Bangkok and Jakarta, though Wellington and Manila retreated.

Still, investors remain wary about the prospect of a second term for Donald Trump as US president, particularly after he warned last month that he would hit China, Canada and Mexico with heavy tariffs.

"Although recent (manufacturing) data revealed that November saw the fastest expansion in factory activity in months -- likely boosted by exporters rushing to get ahead of Trump's anticipated tariff storm -- the broader economic outlook remains fraught with uncertainty," said Stephen Innes at SPI Asset Management.

"This complex tapestry of market dynamics -- China's manufacturing uptick, the deepening economic concerns, and the dollar's assertive rally -- are all intricately linked to Trump's aggressive trade posturing.

"His vows of imposing hefty tariffs as soon as he enters the Oval Office next month cast long shadows over the Asian markets, making investors both wary and watchful."

The euro weakened against the dollar and was sitting at lows not seen since October last year, owing to a brewing political crisis in France, the eurozone's second-largest economy.

Prime Minister Michel Barnier faces the risk of being deposed in a no-confidence vote, expected on Wednesday, after he used executive powers to force through controversial social security legislation without a vote.

The left wing as well as the far-right National Rally of Marine Le Pen both said they would back a motion bringing down the minority government, which has been in power for just three months.

The yield on French government debt rose in another sign of investor concern. France must now pay as much as Greece to borrow for 10 years.

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: UP 1.9 percent at 39,248.86 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 19,674.67

Shanghai - Composite: UP 0.4 percent at 3,378.81 (close)

Euro/dollar: DOWN at $1.0488 from $1.0499 on Monday

Pound/dollar: DOWN at $1.2650 from $1.2654

Dollar/yen: UP at 150.00 yen from 149.54 yen

Euro/pound: DOWN at 82.91 from 82.97 pence

West Texas Intermediate: UP 0.4 percent at $68.35 per barrel

Brent North Sea Crude: UP 0.5 percent at $72.15 per barrel

New York - Dow: DOWN 0.3 percent at 44,782.00 (close)

London - FTSE 100: UP 0.3 percent at 8,312.89 (close)

M.Anderson--CPN