-

Turkey's pro-Kurd party meets jailed PKK leader

Turkey's pro-Kurd party meets jailed PKK leader

-

EU universal charger rules come into force

-

Trump asks US Supreme Court to pause law threatening TikTok ban

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

Weak yen lifts Japan stocks higher, Wall Street slides

Weak yen lifts Japan stocks higher, Wall Street slides

-

Tourists return to post-Olympic Paris for holiday magic

-

Global stocks rise as Japan led Asia gains on a weaker yen

Global stocks rise as Japan led Asia gains on a weaker yen

-

Asian markets mostly rise but political turmoil holds Seoul back

-

Move over Mercedes: Chinese cars grab Mexican market share

Move over Mercedes: Chinese cars grab Mexican market share

-

Japanese shares gain on weaker yen after Christmas break

-

Fleeing Myanmar, Rohingya refugees recall horror of war

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Peru ex-official denies running Congress prostitution ring

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

-

US stocks take a breather, Asian bourses rise in post-Christmas trade

-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

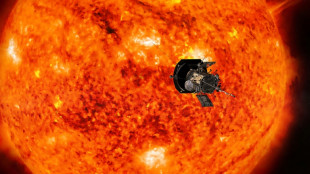

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

| RBGPF | 100% | 59.84 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| RYCEF | 0.14% | 7.27 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| JRI | -0.41% | 12.15 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| BP | 0.38% | 28.96 | $ |

China curbs exports of key chipmaking components to US

Beijing said Tuesday it would restrict exports to the United States of some key components in making semiconductors, after Washington announced curbs targeting China's ability to make advanced chips.

Among the materials banned from export are metals gallium, antimony and germanium, Beijing's commerce ministry said in a statement that cited "national security" concerns.

Exports of graphite, another key component, will also be subject to "stricter reviews of end-users and end-uses", the ministry said.

"To safeguard national security interests and fulfil international obligations such as non-proliferation, China has decided to strengthen export controls on relevant dual-use items to the United States," Beijing said.

"Any organisation or individual in any country or region violating the relevant regulations will be held accountable according to the law," it added.

In its own latest curbs, Washington on Monday announced restrictions on sales to 140 companies, including Chinese chip firms Piotech and SiCarrier, without additional permission.

They also impact Naura Technology Group, which makes chip production equipment, according to the US Commerce Department.

The move expands Washington's efforts to curb exports of state-of-the-art chips to China, which can be used in advanced weapons systems and artificial intelligence.

The new US rules also include controls on two dozen types of chip-making equipment and three kinds of software tools for developing or producing semiconductors.

Beijing swiftly vowed to defend its interests, saying the United States "abuses export control measures" and has "hindered normal economic and trade exchanges".

- 'Weaponised' trade -

And on Tuesday, China said Washington had "politicised and weaponised economic, trade and technological issues" as it unveiled its own export curbs.

The moves also restrict the exports of "dual-use items to United States military users or for military purposes", Beijing said.

China accounts for 94 percent of the world's production of gallium -- used in integrated circuits, LEDs and photovoltaic panels -- according to a report by the European Union published this year.

For germanium, essential for fibre optics and infrared, China makes up 83 percent of production.

Beijing last year had already tightened restrictions on exporters of the metals, requiring them to provide information on the final recipient and give details about their end use.

But the curbs unveiled Tuesday now ban them outright.

It had also previously restricted curbs on exports of certain types of graphite --also key to making batteries for electric vehicles.

"The move is clearly a retaliatory strike at the US," Chong Ja Ian, an associate professor of political science at the National University of Singapore, told AFP.

"Should these back and forth curbs affect trade for third parties, this can create some trade and supply chain disruption—as well as associated inflationary pressures," he said.

J.Bondarev--CPN