-

Turkey's pro-Kurd party meets jailed PKK leader

Turkey's pro-Kurd party meets jailed PKK leader

-

EU universal charger rules come into force

-

Trump asks US Supreme Court to pause law threatening TikTok ban

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

Weak yen lifts Japan stocks higher, Wall Street slides

Weak yen lifts Japan stocks higher, Wall Street slides

-

Tourists return to post-Olympic Paris for holiday magic

-

Global stocks rise as Japan led Asia gains on a weaker yen

Global stocks rise as Japan led Asia gains on a weaker yen

-

Asian markets mostly rise but political turmoil holds Seoul back

-

Move over Mercedes: Chinese cars grab Mexican market share

Move over Mercedes: Chinese cars grab Mexican market share

-

Japanese shares gain on weaker yen after Christmas break

-

Fleeing Myanmar, Rohingya refugees recall horror of war

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Peru ex-official denies running Congress prostitution ring

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

-

US stocks take a breather, Asian bourses rise in post-Christmas trade

-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

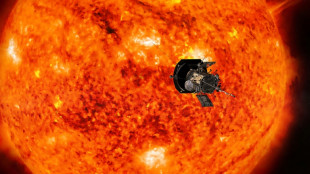

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

| RBGPF | 100% | 59.84 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| BP | 0.38% | 28.96 | $ | |

| RYCEF | 0.14% | 7.27 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| JRI | -0.41% | 12.15 | $ |

Defying headwinds, Germany stocks hit milestone

Germany's blue-chip DAX stock index jumped above 20,000 points for the first time Tuesday following gains on US and Asian markets, defying multiple headwinds battering Europe's biggest economy.

The index, which groups the 40 largest publicly-traded companies on the Frankfurt Stock Exchange, reached 20,022 points at around 0900 GMT before slightly paring its gains.

The German economy, hit hard by a manufacturing slowdown and weak demand for its exports, has been struggling in 2024 and is on course to contract for a second straight year.

Adding to the challenges are heightened political uncertainty as the country heads for new elections in February following the collapse of the government, and the threat of new US tariffs under US President-elect Donald Trump.

But the DAX has nevertheless surged ahead, rising more than 19 percent since the start of the year.

This is in part because the groups in the index are not domestically focused, with "84 percent of the turnover of DAX companies generated abroad," Ulrich Stephan, head of investment strategy at Deutsche Bank, said recently.

Recent falls in the euro have also boosted Germany's export-oriented companies, analysts have noted.

Some key examples of German firms with big overseas footprints are Deutsche Telekom, whose US subsidiary T-Mobile operates the largest 5G network in the United States, insurer Allianz and software giant SAP.

German markets have thus been boosted by the same forces that have seen Wall Street stocks hitting fresh records since Trump's election win, with investors cheering his promised tax cuts and deregulation.

- Betting on a better 2025 -

German stocks have also been lifted by hopes that China will unveil fresh stimulus to kickstart its beleaguered economy -- which would support Germany's crucial exporters.

Markets may also be betting that the German economy will start recovering in 2025 after a torrid two years marked by surging energy prices following Russia's invasion of Ukraine and post-pandemic supply chain woes.

Investors are "looking at least nine to 12 months ahead", said independent stock market analyst Andreas Lipkow.

Some stocks on the DAX have performed strongly due to specific factors.

Weapons manufacturer Rheinmetall is up 119 percent since the start of the year, boosted by healthy demand for its products as countries rush to re-arm following the outbreak of the Ukraine war.

Siemens Energy is up more than 320 percent as it rebounds strongly after receiving a state-backed bailout last year to resolve a crisis in its wind power unit.

It is a different story for the country's auto titans -- Volkswagen, BMW and Mercedes-Benz -- whose shares are down between 15 and 30 percent since January as they battle high costs, weak demand and fierce competition in China.

A key challenge for next year could come if Trump imposes hefty tariffs on all imports to the United States, with the German central bank warning the move could knock one percent off the country's growth.

But at home, investors are hopeful the resolution of ongoing political problems will have a positive effect, said Jochen Stanzl, chief market analyst for Germany with CMC Markets.

"There is hope that new elections in Germany will produce a government that will stimulate growth," he said.

Ng.A.Adebayo--CPN