-

Trump asks US Supreme Court to pause law threatening TikTok ban

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

Weak yen lifts Japan stocks higher, Wall Street slides

Weak yen lifts Japan stocks higher, Wall Street slides

-

Tourists return to post-Olympic Paris for holiday magic

-

Global stocks rise as Japan led Asia gains on a weaker yen

Global stocks rise as Japan led Asia gains on a weaker yen

-

Asian markets mostly rise but political turmoil holds Seoul back

-

Move over Mercedes: Chinese cars grab Mexican market share

Move over Mercedes: Chinese cars grab Mexican market share

-

Japanese shares gain on weaker yen after Christmas break

-

Fleeing Myanmar, Rohingya refugees recall horror of war

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Peru ex-official denies running Congress prostitution ring

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

-

US stocks take a breather, Asian bourses rise in post-Christmas trade

-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

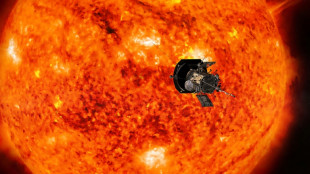

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

| RBGPF | -1.17% | 59.8 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| RYCEF | 0.14% | 7.26 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| BP | 0.38% | 28.96 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| JRI | -0.41% | 12.15 | $ |

Seoul stocks weaken, Paris edges up tracking political turmoil

South Korea's stock market fell less than feared Wednesday and the won rebounded from earlier losses after President Yoon Suk Yeol swiftly reversed a decision to impose martial law.

In Europe, Paris stocks managed to edge higher in midday deals as the euro dipped, with France's government facing no-confidence votes later in the day that could spell the end of the administration of Prime Minister Michel Barnier.

Oil prices extended gains after surging around 2.5 percent Tuesday mainly after the United States sanctioned 35 companies and ships it accused of involvement with Iran's "shadow fleet" illicitly selling Iranian oil to foreign markets.

Crude won additional support from reports that major producers at the OPEC+ grouping were close to a deal to extend output limits.

"Political turmoil in both France and South Korea provide a uncertain backdrop for global markets, with the likely removal of both Barnier and Yoon bringing the potential for both countries to find a fresh direction," said Joshua Mahony, chief market analyst at Scope Markets.

Yoon plunged South Korea into political chaos by imposing martial law and ordering troops and helicopters to parliament, before being forced into a U-turn.

Yoon's bombshell announcement in an emergency television address to the nation late Tuesday meant that for the first time in more than four decades martial law was in force in the country of 52 million people.

The suspension of civilian rule was to "safeguard a liberal South Korea from the threats posed by North Korea's communist forces and to eliminate anti-state elements plundering people's freedom and happiness", Yoon said.

Seoul's Kospi stocks index ended down more than one percent, having shed as much as 2.3 percent at the open.

South Koreans took to the streets in mass protest and the nation's largest umbrella labour union called an "indefinite general strike" until Yoon resigned.

The won tumbled more than three percent to a two-year low of 1,444 per dollar after the declaration, then bounced back to around 1,414 following the U-turn.

Thomas Mathews, head of Asia-Pacific markets at Capital Economics, said the losses could have been "much worse" had the president not aborted his plan.

"Rarely does a combined sell-off in a country's stocks, bonds and currency feel like a relief rally," he said.

"Investors now 'only' have to worry about a period of significant political uncertainty," said Mathews, as South Korea's finance ministry and central bank looked to provide stability and reassure markets.

"From a macro perspective, South Korea was already one of the more vulnerable countries to the impact of Trump's proposed tariffs," said analyst Michael Wan at financial group MUFG.

"This recent development could raise some further risk premium on the currency at least until we get clarity on political stability."

The losses in Seoul came on a mixed day for Asia stock markets.

In Europe, London fell while Frankfurt hit another record high after ending Tuesday above 20,000 points for the first time.

Wall Street provided a healthy lead, with the S&P 500 and Nasdaq hitting new highs Tuesday as investors assessed the chances of the Federal Reserve slashing interest rates again this month.

- Key figures around 1115 GMT -

London - FTSE 100: DOWN 0.3 percent at 8,332.41 points

Paris - CAC 40: UP 0.4 percent at 7,283.70

Frankfurt - DAX: UP 0.9 percent at 20,204.31

Seoul - Kospi Index: DOWN 1.4 percent at 2,464.00 (close)

Tokyo - Nikkei 225: UP 0.1 percent at 39,276.39 (close)

Hong Kong - Hang Seng Index: FLAT at 19,742.46 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,364.65 (close)

New York - Dow: DOWN 0.2 percent at 44,705.53 (close)

Euro/dollar: DOWN at $1.0499 from $1.0511 on Tuesday

Pound/dollar: DOWN at $1.2663 from $1.2673

Dollar/yen: UP at 150.99 yen from 149.53 yen

Euro/pound: DOWN at 82.90 from 82.94 pence

Brent North Sea Crude: UP 0.6 percent at $74.03 per barrel

West Texas Intermediate: UP 0.5 percent at $70.12 per barrel

H.Müller--CPN