-

Trump asks US Supreme Court to pause law threatening TikTok ban

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

Weak yen lifts Japan stocks higher, Wall Street slides

Weak yen lifts Japan stocks higher, Wall Street slides

-

Tourists return to post-Olympic Paris for holiday magic

-

Global stocks rise as Japan led Asia gains on a weaker yen

Global stocks rise as Japan led Asia gains on a weaker yen

-

Asian markets mostly rise but political turmoil holds Seoul back

-

Move over Mercedes: Chinese cars grab Mexican market share

Move over Mercedes: Chinese cars grab Mexican market share

-

Japanese shares gain on weaker yen after Christmas break

-

Fleeing Myanmar, Rohingya refugees recall horror of war

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Peru ex-official denies running Congress prostitution ring

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

-

US stocks take a breather, Asian bourses rise in post-Christmas trade

-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

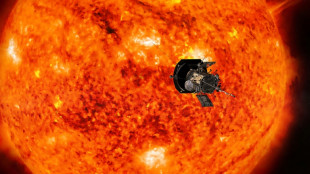

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

| RBGPF | -1.17% | 59.8 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| RYCEF | 0.14% | 7.26 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| BP | 0.38% | 28.96 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| JRI | -0.41% | 12.15 | $ |

GM announces more than $5 bn hit to earnings in China venture

General Motors announced Wednesday it will book more than $5 billion in losses and write-downs due to the restructuring of its China joint-venture.

Facing heavy competition in China that has forced automakers to cut retail prices, the SAIC General Motors Corporation is restructuring operations, resulting in non-cash impairment of between $2.6 and $2.9 billion and equity losses of around $2.7 billion, GM said in a securities filing.

GM and the Chinese state-owned company Shanghai Automotive Industry Corporation (SAIC) each own 50 percent of the company.

In October, GM reported a loss in equity income from China for the third straight quarter.

Chief Executive Mary Barra, who has divested several other GM overseas operations, emphasized at the time that the company saw a future for itself in the world's biggest automotive market.

"We believe we can turn around the losses," Barra said on an analyst conference call.

China has a "very challenging environment," she said. "But we do believe there's a place we can participate in a very different manner and do that profitably."

Foreign companies from the United States, Germany and other countries have been operating in China since the 1980s, with Beijing requiring them to partner with Chinese companies, which had lagged behind in the global auto sector.

But in recent years, Chinese car companies have progressed significantly, embracing artificial intelligence and other gadgetry and leapfrogging foreign players with efficient electric vehicle offerings that are priced aggressively.

Chinese company BYD has been symbolic of the rise, recently surpassing Tesla in quarterly revenue for the first time.

Wednesday's moves reflect a determination that the loss in value across the China venture is "other than temporary" in light of the actions "to address market challenges and competitive conditions," GM said in the filing.

The actions, which include plant closures, will mostly be recorded in the fourth quarter of 2024, GM said.

GM shares rose 0.2 percent in early trading.

O.Hansen--CPN