-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

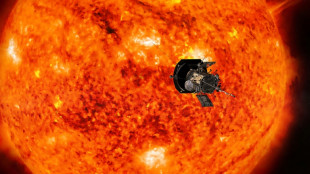

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Equity markets struggle after more weak China data

Most markets fell on Monday after an unexpected slowdown in retail sales reinforced worries about China's economy, with the latest batch of weak data compounding the disappointment of Beijing's latest stimulus pledges.

The tepid start came on the year's last full week of trading, with the focus on key monetary policy decisions by the US Federal Reserve and the Bank of Japan.

Observers are also tracking developments in Seoul after South Korean lawmakers impeached President Yoon Suk Yeol at the weekend in the wake of his short-lived declaration of martial law this month.

Hong Kong and Shanghai sank after figures showed that Chinese retail sales grew 3.0 percent last month, much slower than October and well off the five percent forecast.

The figures highlighted the work leaders had in store as they try to kickstart consumption and reignite the world's number two economy.

Officials unveiled new promises at the weekend to boost the battered property sector and tweak monitoring of equity markets.

That came after investors were left unimpressed last week with Beijing's pledge to introduce measures aimed at "lifting consumption vigorously" as part of a stimulus drive.

President Xi Jinping and other key players said at the annual Central Economic Work Conference they would implement a "moderately loose" monetary policy, increase social financing and reduce interest rates "at the right time".

Lynn Song, ING's chief economist for Greater China, said in a commentary: "Household confidence clearly remains soft, and it remains to be seen if the 'vigorous support' for consumption promised next year will be effective in stimulating a recovery.

"We expect the rollout of supportive policies could take some time, but overall retail sales growth should recover in 2025."

Elsewhere in Asia, there were also losses in Sydney, Mumbai, Bangkok, Manila and Jakarta, though Singapore, Wellington and Taipei rose. Tokyo was flat.

London and Frankfurt opened lower, while Paris also retreated after French President Emmanuel Macron named centrist Francois Bayrou as prime minister on Friday as he looks to end months of political crisis.

Seoul fluctuated after Saturday's impeachment of Yoon, with South Korea's Constitutional Court starting proceedings Monday to determine whether to uphold the vote.

While the martial law crisis shocked markets, observers said the economic impact would likely be limited, with some suggesting a stimulus package could be implemented in the new year.

The Fed is widely expected to cut interest rates again Wednesday but there are fears it will have to slow its pace of easing next year owing to sticky inflation and bets that president-elect Donald Trump's tax cuts and tariffs will reignite prices.

The gathering comes after figures last week showed the consumer price index ticked up and wholesale prices accelerated.

Investors are now pricing in a more than 75 percent chance the Fed holds rates steady in January, according to the CME FedWatch tool.

The Bank of Japan is due to deliver its own policy decision after that, with debate swirling on whether officials will announce a third hike of the year, having moved in March for the first time since 2007 as price pressures continue to build.

"The Bank of Japan will likely tighten monetary policy on Thursday," said economists at Moody's Analytics, pointing to a 25 basis-point lift.

"The central bank is worried that yen weakness might spur inflation, hurting real wages and consumer spending."

But Tony Sycamore, an analyst at the IG trading group, said expectations were for officials to hold rates at 0.25 percent.

However, he added that "the central bank's current inaction is unlikely to persist, with any rate hold expected to come with strong forward guidance signalling a potential January hike".

"Broadening underlying pricing pressures, such as service prices, continue to point towards a more persistent inflationary trend. This environment suggests conditions are ripe for another rate hike, reinforcing expectations for tighter policy down the line."

On currency markets, the dollar rose against the yen.

- Key figures around 0810 GMT -

Tokyo - Nikkei 225: FLAT at 39,457.49 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 19,795.49 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,386.33 (close)

London - FTSE 100: DOWN 0.1 percent at 8.296,17

Euro/dollar: UP at $1.0506 from $1.0504 on Friday

Pound/dollar: UP at $1.2634 from $1.2622

Dollar/yen: DOWN at 153.54 yen from 153.60 yen

Euro/pound: DOWN at 83.16 pence from 83.19 pence

West Texas Intermediate: DOWN 0.5 percent at $70.92 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $74.19 per barrel

New York - Dow: DOWN 0.2 percent at 43,828.06 (close)

A.Agostinelli--CPN