-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

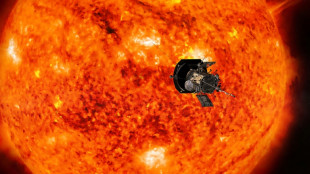

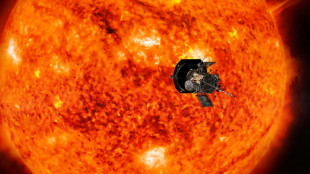

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Shares in Japan chipmaker Kioxia jump 10% on Tokyo debut

Shares in Japanese chipmaker Kioxia closed 10 percent higher in Tokyo on Wednesday after an initial public offering that valued the firm at more than $5 billion.

Formerly the semiconductor unit of Japanese engineering giant Toshiba, the firm is the world's third-largest producer of NAND flash memory chips.

It was acquired by US investment firm Bain Capital in 2018.

Memory chips are used in everyday devices such as smartphones and storage drives, as well as in industrial and medical equipment, but their prices are notoriously volatile.

Global demand for the chips has been driven by the growth of generative artificial intelligence technology, such as that used in OpenAI's popular chatbot ChatGPT.

Kioxia had been expected to go public in October, emboldened by soaring demand for AI, but a rout in tech shares forced the company to delay until this month.

The firm set its listing price at 1,455 yen per share, valuing it at 784 billion yen ($5.2 billion) and raising about 120 billion yen -- making it Japan's second biggest IPO this year.

Its shares closed 10 percent higher at 1,601 yen.

The company previously said it planned to issue around 21.5 million new shares, in addition to more than 63 million to be sold at home and abroad by existing shareholders Bain Capital and Toshiba.

Kioxia is among several Japanese semiconductor producers the government is subsidising as it seeks to triple the sales of domestically produced chips to more than 15 trillion yen by 2030.

Firms such as Toshiba and NEC helped Japan dominate in microchips during the 1980s, but competition from South Korea and Taiwan saw its global market share slump from more than 50 percent to around 10 percent now.

But as China ramps up military pressure on Taiwan, heralding volatility on the self-ruled island's ability to produce semiconductors, hopes are running high that Japan will re-emerge as a new chip hub.

C.Smith--CPN