-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

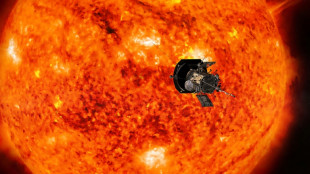

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

US Fed signals fewer cuts, sending stocks tumbling

The US Federal Reserve on Wednesday cut interest rates by a quarter point and signaled a slower pace of cuts ahead, triggering a sharp sell-off in the financial markets.

Policymakers voted 11-to-1 to lower the central bank's key lending rate to between 4.25 percent and 4.50 percent as expected, the Fed announced in a statement.

But they also halved the number of quarter-point cuts they expect next year, from an average of four back in September to just two on Wednesday, catching the markets by surprise.

All three major indices on Wall Street finished firmly lower, while the yields on US Treasurys surged as traders digested the prospect of higher interest rates over the next couple of years.

While inflation has "eased significantly," the level remains "somewhat elevated" compared to the Fed's long-term target of two percent, Chair Jerome Powell told reporters on Wednesday.

He said he remained "very optimistic" about the state of the US economy, adding that the Fed was now "significantly closer" to the end of its current easing cycle.

It was the final planned rate decision before outgoing Democratic President Joe Biden makes way for Republican Donald Trump, whose economic proposals include tariff hikes and the mass deportation of millions of undocumented workers.

The non-partisan Congressional Budget Office (CBO) estimates that imposing fresh tariffs would cut economic growth and push up inflation.

Following Trump's victory in November's election, some analysts had already pared back the number of rate cuts they expected in 2025, warning that the Fed may be forced to keep rates higher for longer.

- Inflation battle not over-

The Fed has made progress tackling inflation through interest rate hikes in the last two years without dealing a knockout blow to either growth or unemployment, and recently began cutting rates to boost demand in the economy and support the labor market.

But in past months, the Fed's favored inflation measure has ticked higher, moving away from the bank's target and raising concerns that the inflation fight is not over.

Members of the Fed's rate-setting Federal Open Market Committee (FOMC) now "need to see additional improvements in inflation to continue to cut rates -- full stop," KPMG chief economist Diane Swonk wrote in a note published after the decision.

- Higher growth, higher inflation -

In updated economic forecasts published alongside the rate decision, members of the 19-member FOMC penciled in just two quarter-point rate cuts in 2025, on average, halving the number of cuts they now expect.

They also hiked their outlook for headline US inflation next year to 2.5 percent, and do not see it returning to two percent before 2027.

In some good news for the world's largest economy, FOMC members raised their outlook for growth this year to 2.5 percent, and to 2.1 percent in 2025.

Policymakers expect the unemployment rate to be slightly lower this year than previously predicted at 4.2 percent, before ticking up slightly to 4.3 percent in 2025 and 2026 -- a figure at least one analyst said was overly optimistic.

"Rate cuts will come faster than the Fed expects, as unemployment tops the new forecast," Pantheon Macroeconomics chief US economist Samuel Tombs wrote in a note to clients published after the decision.

O.Ignatyev--CPN