-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

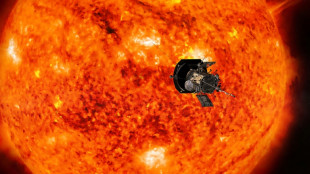

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Stock markets decline as Fed eyes fewer rate cuts

European and Asian stock markets slid Thursday following sharp losses on Wall Street as the Federal Reserve signalled fewer cuts to US interest rates next year.

In a busy week for rate decisions, the Fed on Wednesday trimmed borrowing costs by a quarter point but halved the number of similar cuts it expects to carry out in 2025.

The dollar initially rallied on the outlook, while the yen was pressured Thursday also after the Bank of Japan kept borrowing costs unchanged.

The Bank of England was widely expected to maintain its key interest rate in a decision due at 1200 GMT.

"Investors were blindsided as the Federal Reserve halved the expected pace of interest rate cuts for next year," noted Richard Hunter, head of markets at Interactive Investor.

All three main indices in New York were sent spinning Wednesday -- led by a rout in high-flying tech titans.

The Fed said it expected to cut just twice next year, down from a forecast of four quarter-point reductions signalled in September.

While inflation has "eased significantly", the level remains "somewhat elevated" compared to the Fed's long-term target of two percent, Fed chair Jerome Powell told reporters.

Powell said he remained "very optimistic" about the state of the US economy, adding that the Fed was now "significantly closer" to the end of its current easing cycle.

The Fed's revision came as a surprise even if investors had speculated about how the US central bank would position itself as president-elect Donald Trump prepares to take office.

Analysts said Trump's plans to cut taxes, slash regulations and impose tariffs on China risked reigniting inflation.

Jack McIntyre, a portfolio manager at Brandywine Global, said although the latest Fed rate-reduction had been priced in by markets, "when you include the forward guidance components, it was a hawkish cut".

"Stronger expected growth married with higher anticipated inflation -- it's no wonder the Fed reduced the number of expected rate cuts in 2025."

- Key figures around 1045 GMT -

London - FTSE 100: DOWN 1.4 percent at 8,086.92 points

Paris - CAC 40: DOWN 1.6 percent at 7,269.68

Frankfurt - DAX: DOWN 1.2 percent at 20,001.71

Tokyo - Nikkei 225: DOWN 0.7 percent at 38,813.58 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 19,752.51 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,370.03 (close)

New York - Dow: DOWN 2.6 percent at 42,326.87 (close)

Euro/dollar: UP at $1.0411 from $1.0365

Pound/dollar: UP at $1.2650 from $1.2581

Dollar/yen: UP at 156.91 yen from 154.73 yen

Euro/pound: DOWN at 82.33 pence from 82.38 pence

Brent North Sea Crude: UP 0.1 percent at $73.44 per barrel

West Texas Intermediate: FLAT at $70.04 per barrel

burs-bcp/ajb/cw

S.F.Lacroix--CPN