-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

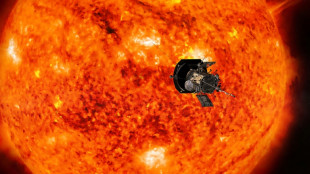

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

-

Serbia schools to shut amid new protests over station collapse

Serbia schools to shut amid new protests over station collapse

-

Argentina's dollar craze cools under greenback-loving Milei

-

'Dark lull' in German energy transition sparks political debate

'Dark lull' in German energy transition sparks political debate

-

No longer Assad's mouthpiece, Syrian media face uncertainty

| CMSC | -0.56% | 23.77 | $ | |

| RBGPF | -1.17% | 59.8 | $ | |

| RYCEF | -0.14% | 7.24 | $ | |

| RIO | -0.11% | 59.165 | $ | |

| VOD | 0.77% | 8.435 | $ | |

| SCS | 0.47% | 11.705 | $ | |

| GSK | -0.41% | 33.92 | $ | |

| CMSD | -0.34% | 23.47 | $ | |

| RELX | 0.52% | 45.828 | $ | |

| AZN | -0.62% | 66.22 | $ | |

| BTI | -0.01% | 36.215 | $ | |

| JRI | 0.37% | 12.145 | $ | |

| BP | 0.21% | 28.81 | $ | |

| BCE | 0.35% | 22.92 | $ | |

| BCC | 0.84% | 123.27 | $ | |

| NGG | -0.28% | 58.855 | $ |

Fed's favored inflation gauge edges higher in November

The Federal Reserve's preferred inflation measure rose for a second straight month in November, according to government data published Friday, although the increase came in a touch below expectations.

The personal consumption expenditures (PCE) price index rose 2.4 percent in the 12 months to November, up from 2.3 percent in October, the Commerce Department said in a statement.

"What we're seeing is encouraging news," New York Fed President John Williams told CNBC on Friday, adding that it had been "a bit of a bumpy kind of a journey" on inflation.

Goods prices fell 0.4 percent over the last 12 months, while services jumped 3.8 percent, the Commerce Department said.

Food prices rose 1.4 percent over this period, while energy prices dropped by 4.0 percent, underscoring some of the volatility seen in prices.

However, headline prices rose just 0.1 percent from October, pointing to a slight slowdown in what is sure to be welcome news for the US central bank.

Both the annual and monthly inflation figures came in slightly below the median forecasts from economists surveyed by Dow Jones Newswires and The Wall Street Journal.

"We can break for the holidays with the comfort that the economy's growth engine is humming along," Nationwide financial markets economist Oren Klachkin wrote in a note to clients.

- Still above two percent -

On Wednesday, the Fed cut interest rates by a quarter point to between 4.25 and 4.5 percent, and signaled a slower pace of cuts ahead, triggering a sharp sell-off in the financial markets.

The sole holdout voting against a cut, Cleveland Fed President Beth Hammack, said Friday that her decision had been "a close call."

"I prefer to hold policy steady until we see further evidence that inflation is resuming its path to our two percent objective," she said in a statement.

The independent US central bank is responsible for tackling inflation and unemployment, largely by hiking or lowering interest rates to affect demand.

This indirectly impacts the cost of borrowing for consumers and businesses, affecting everything from mortgages to car loans.

While headline inflation has come down slightly, it remains stuck above the Fed's long-term target of two percent.

At the same time, economic growth is still resilient, and the labor market has shown some signs of weakness while remaining relatively robust.

"The Fed would like to continue lowering interest rates, but it feels it can't do so amid what increasingly looks like an elevated inflation and resilient growth environment," said Klachkin of Nationwide.

Excluding the volatile food and energy segments, the core PCE price index was up 2.8 percent from a year earlier, and by 0.1 percent from a month earlier.

Both figures were slightly below expectations.

"The disinflation process is continuing and a little bit of good news this month," New York Fed President Williams said in his CNBC interview.

"We're still not to our two percent goal; we will make sure we get there," he added.

P.Kolisnyk--CPN