-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

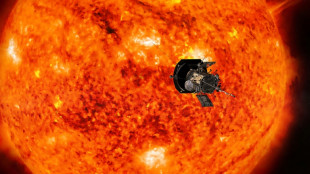

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

-

Serbia schools to shut amid new protests over station collapse

Serbia schools to shut amid new protests over station collapse

-

Argentina's dollar craze cools under greenback-loving Milei

-

'Dark lull' in German energy transition sparks political debate

'Dark lull' in German energy transition sparks political debate

-

No longer Assad's mouthpiece, Syrian media face uncertainty

| RBGPF | -1.17% | 59.8 | $ | |

| CMSC | -0.64% | 23.75 | $ | |

| SCS | 0.68% | 11.73 | $ | |

| JRI | 0.7% | 12.185 | $ | |

| NGG | -0.29% | 58.85 | $ | |

| BTI | 0.01% | 36.225 | $ | |

| BCC | 1.02% | 123.5 | $ | |

| GSK | -0.37% | 33.935 | $ | |

| CMSD | -0.63% | 23.402 | $ | |

| RIO | -0.07% | 59.186 | $ | |

| RYCEF | -0.14% | 7.24 | $ | |

| RELX | 0.55% | 45.84 | $ | |

| AZN | -0.57% | 66.25 | $ | |

| BCE | 0.28% | 22.905 | $ | |

| BP | 0.23% | 28.815 | $ | |

| VOD | 0.77% | 8.435 | $ |

Argentina's dollar craze cools under greenback-loving Milei

"Dollars, selling dollars!" a money changer shouts to people streaming past in Buenos Aires' financial district.

But there are no takers as Argentina's decades-long dollar craze finally shows signs of cooling.

Over years of high inflation and currency controls, Argentines lined up to trade their increasingly worthless pesos for dollars, propelling the US currency to a record 1,500 pesos on the black market on July 12.

But as the inflation rate slows under cost-cutting President Javier Milei -- from 25.5 percent in December 2023 to 2.4 percent in November 2024 -- the clamor for dollars has quieted, even after Milei pledged on the campaign trail last year to swap the peso for the greenback.

- Amnesty brings in billions -

Experts cite several reasons for the fall in demand for dollars. Milei's biting austerity measures have cratered Argentines' purchasing power, shattering their ability to save in hard American cash -- the preferred way to create a nest egg.

The experts also point to a tax amnesty launched by the government in July to encourage Argentines to deposit dollars that have been stashed under mattresses and floorboards, or tucked in safety-deposit boxes and offshore accounts.

The scheme has brought in $20 billion in deposits so far, helping ease a dollar shortage.

Meanwhile, the central bank has taken advantage of a stronger peso to build up its dollar reserves from $21 billion when Milei took power a year ago to $32 billion.

In a sign of how times have changed, the black market dollar rate, which at one point was double the official rate, is now nearly aligned with the official rate, at a little over 1,000 pesos to the greenback.

- Under the mattress -

Oscar, one of Buenos Aires' many black-market money changers -- they are dubbed "arbolitos,"or little trees, because they plant themselves in the street offering green notes -- told AFP that business has slowed dramatically.

"Up to a year ago I was conducting around 40 transactions in a six-hour period; now I have four, at most, in 10 hours," said Oscar, who works openly near the presidential palace but declined to give his full name due to the illegal nature of his work.

These days, his only customers for dollars are Bolivian and Peruvian migrant workers, who change small amounts to send home.

In scenes unthinkable just months ago, most of his Argentine customers are now offloading dollars -- because they need more pesos to pay bills that have soared since Milei took office and slashed energy and transport subsidies.

Retirees "walk the whole city center looking for the best deal" for pesos, Oscar said.

In the back room of her estate agency in the middle-class Caballito neighborhood, where she trades dollars on the black market, Fabiana is also struggling.

To compete, she offers home delivery service for well-off Argentines buying dollars to go on holiday abroad or for people cashing in savings in dollars, some of them "stained from having been kept under the mattress."

Money-changing is merely a source of "petty cash" these days, Fabiana said.

Most of her business comes from property sales, which are booming thanks to the amnesty, which also covers investments in real estate projects and certain property purchases.

- Impact on exports -

Experts warn the peso's strengthening against the dollar may be temporary if, as expected, the effects of the tax amnesty soon wear off or if Milei fails to secure a new cash injection from the International Monetary Fund.

The IMF said Thursday it was in talks with Argentina on a new program to replace a $44 billion loan agreement set to expire on December 31.

Economist Hernan Letcher credited the tax amnesty with helping stabilize demand for dollars, but said that program and any new IMF cash injection are one-off measures that do not resolve Argentina's currency woes.

"The amnesty dollars aren't yours (don't belong to the state) and you have to pay back the IMF dollars," he said.

Meanwhile, the strengthening of the peso risks hurting exports to Brazil, Argentina's biggest trading partner.

Brazil's currency, the real, fell to a record low against the dollar last week over concerns about its economy.

L.K.Baumgartner--CPN