-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

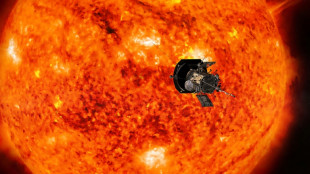

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

-

Serbia schools to shut amid new protests over station collapse

Serbia schools to shut amid new protests over station collapse

-

Argentina's dollar craze cools under greenback-loving Milei

-

'Dark lull' in German energy transition sparks political debate

'Dark lull' in German energy transition sparks political debate

-

No longer Assad's mouthpiece, Syrian media face uncertainty

| RBGPF | -1.17% | 59.8 | $ | |

| RYCEF | 0% | 7.25 | $ | |

| CMSC | -0.64% | 23.75 | $ | |

| SCS | 0.6% | 11.72 | $ | |

| RIO | -0.15% | 59.14 | $ | |

| NGG | -0.27% | 58.861 | $ | |

| CMSD | -0.51% | 23.43 | $ | |

| RELX | 0.57% | 45.85 | $ | |

| AZN | -0.58% | 66.245 | $ | |

| GSK | -0.41% | 33.92 | $ | |

| BCE | 0.28% | 22.905 | $ | |

| VOD | 0.72% | 8.431 | $ | |

| BP | 0.16% | 28.795 | $ | |

| JRI | 0.84% | 12.203 | $ | |

| BTI | 0.04% | 36.235 | $ | |

| BCC | 0.42% | 122.75 | $ |

Wall Street rebounds despite US inflation ticking higher

Wall Street stocks bounced higher Friday despite data showing an uptick in inflation and a looming US government shutdown.

Data showed the personal consumption expenditures (PCE) price index rose 2.4 percent in the 12 months to November, up from 2.3 percent in October, the Commerce Department said in a statement.

The core reading of PCE price index -- the Federal Reserve's preferred inflation measure -- that excludes highly volatile food and energy prices stayed steady at 2.8 percent.

Wall Street's main stock indices initially fell on the news, continuing a spiral lower after the Federal Reserve on Wednesday signalled fewer cuts than had been expected for 2025 as inflation remains sticky above its two percent target.

However they bounced higher during morning trading.

While the annual inflation measures ticked higher, they dropped month-on-month, providing some relief to investors.

Core prices rose just 0.1 percent from October, compared to monthly increases of 0.2 or 0.3 percent the previous five months, pointing to a slight slowdown in what is sure to be welcome news for the US central bank.

New York Fed President John Williams, a voting member of the Fed committee which sets rates, told CNBC that the data shows "the disinflation process is continuing" and that it offers "a little bit of good news this month".

Jochen Stanzl, Chief Market Analyst at CMC Markets, also called the data "good news," say it will lead to a moderation in the increase in the PCE price index over a longer term.

"Today's PCE data serves as quite a reprieve after this week's sell-off," he said.

Investors were keeping a watch also on developments in Washington.

The House of Representatives has rejected a Republican-led funding bill to avert a government shutdown, with federal agencies due to run out of cash Friday night and cease operations from this weekend.

The legislation would have kept the government open through March and suspended the borrowing limit for president-elect Donald Trump's first two years in office.

O'Hare noted US Treasury yields fell overnight, "driven by some safe-haven trading that stemmed from the ongoing weakness in the stock market and heightened political uncertainty" following the rejection of the government funding bill.

Friday's Wall Street rebound could also be driven by it being a so-called triple witching day when stock, index and index futures contracts expire. With more than $6 trillion in options estimated to expire, trading could prove volatile.

European stocks finished the day lower although they cut their losses as Wall Street rebounded, with data showing tepid retail sales in the UK in the runup to Christmas dampening sentiment.

Oil prices, which have also fallen since the Fed's Wednesday announcement, continued their slide lower.

- Key figures around 1630 GMT -

New York - Dow: UP 1.4 percent at 42,947.20 points

New York - S&P 500: UP 1.4 percent at 5,948.04

New York - Nasdaq Composite: UP 1.4 percent at 19,634.69

London - FTSE 100: DOWN 0.3 percent at 8,084.61 (close)

Paris - CAC 40: DOWN 0.3 percent at 7,274.48 (close)

Frankfurt - DAX: DOWN 0.3 percent at 19,916.56 (close)

Tokyo - Nikkei 225: DOWN 0.3 percent at 38,701.90 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 19,720.70 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,368.07 (close)

Euro/dollar: UP at $1.0414 from $1.0364 on Thursday

Pound/dollar: UP at $1.2576 from $1.2496

Dollar/yen: DOWN at 156.32 yen from 157.35 yen

Euro/pound: DOWN at 82.83 pence from 82.91 pence

West Texas Intermediate: DOWN 0.1 percent at $69.32 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $72.81 per barrel

burs-rl/gv

C.Peyronnet--CPN