-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

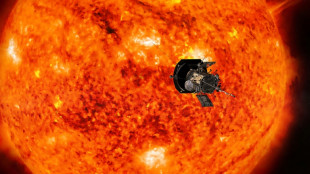

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

-

Serbia schools to shut amid new protests over station collapse

Serbia schools to shut amid new protests over station collapse

-

Argentina's dollar craze cools under greenback-loving Milei

-

'Dark lull' in German energy transition sparks political debate

'Dark lull' in German energy transition sparks political debate

-

No longer Assad's mouthpiece, Syrian media face uncertainty

| RIO | -0.11% | 59.165 | $ | |

| RBGPF | -1.17% | 59.8 | $ | |

| CMSC | -0.68% | 23.74 | $ | |

| SCS | 0.55% | 11.715 | $ | |

| NGG | -0.32% | 58.83 | $ | |

| RELX | 0.53% | 45.835 | $ | |

| RYCEF | 0% | 7.25 | $ | |

| GSK | -0.37% | 33.935 | $ | |

| BCE | 0.34% | 22.919 | $ | |

| VOD | 0.71% | 8.43 | $ | |

| AZN | -0.5% | 66.3 | $ | |

| BP | 0.18% | 28.801 | $ | |

| CMSD | -0.51% | 23.43 | $ | |

| JRI | 0.74% | 12.19 | $ | |

| BCC | 0.91% | 123.36 | $ | |

| BTI | -0.01% | 36.215 | $ |

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets rose Monday after big gains on Wall Street, with traders welcoming below-forecast US inflation data that tempered worries that the Federal Reserve will take a more hawkish tone with interest rates next year.

A holiday-thinned week got off to a healthy start after last week's sell-off sparked by the US central bank's outlook that suggested officials will not lower borrowing costs as much as previously hoped over the next 12 months.

Sharp losses in reaction to the forecasts were pared after data showed the personal consumption expenditures (PCE) index, the Fed's preferred gauge of inflation, came in at 2.4 percent on-year in November.

While the reading was up slightly from October, it was lower than expected, providing some optimism that policymakers were winning the battle against prices and would have room to keep cutting rates.

The figures led to a pullback in US Treasury bond yields that had jumped last week to their highest levels since May, helped by comments from Chicago Fed chief Austan Goolsbee, who expressed confidence that inflation was returning to the bank's two percent target.

Still, there remains some trepidation among investors as Donald Trump prepares to return to the White House, pledging to cut taxes, slash regulations and impose tariffs on imports, which some economists warn could reignite inflation.

Ronald Temple, chief market strategist at Lazard, said in a commentary: "The initial response to the US election was positive as investors focused on the obvious tailwinds to profitability: lower corporate tax rates and less regulation.

"However, I expect much more dispersion within the equity market when the reality of a much-less-friendly trade environment sets in."

All three main indexes in New York ended more than one percent higher.

Asia followed suit, with Tokyo, Hong Kong, Shanghai, Sydney, Singapore, Seoul, Taipei, Mumbai, Bangkok and Manila all in the green.

The dollar also held losses suffered in the wake of the PCE data, with the yen, pound and euro all stronger than Thursday.

Investors were also cheered by news that US lawmakers had reached a deal to avert a Christmastime government shutdown following marathon talks on Friday.

The last-minute scramble came after Trump and billionaire Elon Musk pressured Republicans to abandon an earlier bipartisan funding compromise.

Lawmakers then spent several days trying to hammer out another deal, with massive halts to government services hanging in the balance.

Non-essential operations would have ground to a halt if no deal had been struck, with up to 875,000 workers furloughed and 1.4 million more required to work without pay.

"This agreement represents a compromise, which means neither side got everything it wanted," President Joe Biden said on signing the bill on Saturday.

"But it rejects the accelerated pathway to a tax cut for billionaires that Republicans sought."

- Key figures around 0630 GMT -

Tokyo - Nikkei 225: UP 1.2 percent at 39,161.34 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 19,883.17

Shanghai - Composite: UP 0.2 percent at 3,373.24

Euro/dollar: UP at $1.0441 from $1.0431 on Friday

Pound/dollar: UP at $1.2580 from $1.2567

Dollar/yen: UP at 156.53 yen from 156.45 yen

Euro/pound: DOWN at 82.97 pence from 82.98 pence

West Texas Intermediate: UP 0.5 percent at $69.81 per barrel

Brent North Sea Crude: UP 0.4 percent at $73.25 per barrel

New York - Dow: UP 1.2 percent at 42,840.26 (close)

London - FTSE 100: DOWN 0.3 percent at 8,084.61 (close)

P.Schmidt--CPN