-

Liverpool-Man Utd Premier League clash to go ahead despite snowfall

Liverpool-Man Utd Premier League clash to go ahead despite snowfall

-

Bezos's Blue Origin poised for first orbital launch next week

-

Hollywood A-listers set to shine at Golden Globes

Hollywood A-listers set to shine at Golden Globes

-

Messi misses Presidential Medal ceremony with Biden

-

Bono, Messi, Soros awarded Presidential Medal of Freedom by Biden

Bono, Messi, Soros awarded Presidential Medal of Freedom by Biden

-

World's oldest person dies at 116 in Japan

-

Syria says international flights to and from Damascus to resume Tuesday

Syria says international flights to and from Damascus to resume Tuesday

-

Bono, Messi, Soros get Presidential Medal of Freedom from Biden

-

South Korea says fatal crash cockpit transcript nearly complete

South Korea says fatal crash cockpit transcript nearly complete

-

EV sales hit record in UK but still behind target

-

AI expected to star at CES gadget extravaganza

AI expected to star at CES gadget extravaganza

-

Brazil says 2024 was its hottest year on record

-

Soldier in Vegas Tesla blast suffered PTSD, no 'terror' link: FBI

Soldier in Vegas Tesla blast suffered PTSD, no 'terror' link: FBI

-

Microsoft expects to spend $80 bn on AI this fiscal year

-

Man arrested for supplying drugs to Liam Payne: Argentine police

Man arrested for supplying drugs to Liam Payne: Argentine police

-

Breeding success: London zoo counts its animals one-by-one

-

Biden blocks US Steel sale to Japan's Nippon Steel

Biden blocks US Steel sale to Japan's Nippon Steel

-

Wall Street stocks bounce higher, Europe retreats

-

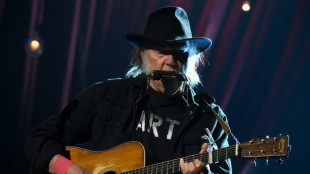

Neil Young says he will play Glastonbury after all

Neil Young says he will play Glastonbury after all

-

Biden blocks US-Japan steel deal

-

British novelist David Lodge dies aged 89

British novelist David Lodge dies aged 89

-

Indonesia says 2024 was hottest year on record

-

Indian duo self-immolate in Bhopal waste protest

Indian duo self-immolate in Bhopal waste protest

-

Indian food delivery app rolls out ambulance service

-

European stock markets retreat after positive start to year

European stock markets retreat after positive start to year

-

UK electricity cleanest on record in 2024: study

-

Biden to block US-Japan steel deal: US media

Biden to block US-Japan steel deal: US media

-

Thai PM declares millions in watches and bags among $400 mn assets

-

China says 'determined' to open up to world in 2025

China says 'determined' to open up to world in 2025

-

Asian shares rise defying slow Wall Street start to 2025

-

'Emilia Perez' heads into Golden Globes as strong favorite

'Emilia Perez' heads into Golden Globes as strong favorite

-

'You need to be happy': graffiti encourages Cuban self-reflection

-

Disaster-hit Chilean park sows seeds of fire resistance

Disaster-hit Chilean park sows seeds of fire resistance

-

Mixed day for global stocks as dollar pushes higher

-

Nick Clegg leaves Meta global policy team

Nick Clegg leaves Meta global policy team

-

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

Wall Street lifts spirits after Asia starts year in red

-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Most UK doctors suffer from 'compassion fatigue': poll

-

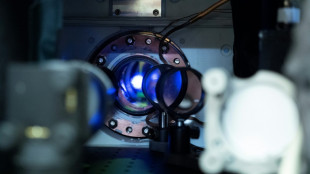

Secret lab developing UK's first quantum clock: defence ministry

Secret lab developing UK's first quantum clock: defence ministry

-

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

Wall Street dons early green after Asia starts year in red

-

Stock markets begin new year with losses

-

Sales surge in 2024 for Chinese EV giant BYD

Sales surge in 2024 for Chinese EV giant BYD

-

Asian stocks begin year on cautious note

-

Blooming hard: Taiwan's persimmon growers struggle

Blooming hard: Taiwan's persimmon growers struggle

-

Asia stocks begin year on cautious note

-

Cosmetic surgery aficionado Jocelyne Wildenstein dies aged 79: partner

Cosmetic surgery aficionado Jocelyne Wildenstein dies aged 79: partner

-

Power restored to most of Puerto Rico: utility

Wall Street lifts spirits after Asia starts year in red

Wall Street made a positive start to the year Monday, shrugging off falls in Asia as investors await planned tariffs from US president-elect Donald Trump, adding to China's economic struggles.

Midway through 2025's first session, while the Dow was just 0.2 percent in the green the tech-heavy Nasdaq Composite Index had added around 0.6 percent.

That was despite EV maker Tesla, facing rising electric vehicle competition in China and other major markets, slipping around five percent after posting its first annual drop in electric vehicle deliveries.

"The stock market ended 2024 with a whimper, but it is poised to begin 2025 with a bang," Briefing.com's Patrick O'Hare wrote in a note before markets opened on Wall Street.

Axel Rudolph, senior analyst with IG, saw European indices as "being dragged higher by their US counterparts", helping lift Paris, currently mired in political uncertainty, to a positive finnish.

London, bolstered by rising commodity shares to offset banks going in the opposite direction, closed with a one percent gain, while Frankfurt ended 0.6 up.

The euro fell to its lowest level against the dollar since November 2022 while sterling lost similar ground to an eight-month low on weak UK factory data.

Oil prices jumped on hopes of rebounding demand.

"January can be a testing time for markets and that's already proved the case as investors fret about the impact of Donald Trump's trade policies," said Russ Mould, investment director at AJ Bell.

"Technology and industrial stocks were among the areas worst hit, dragged down by weak Chinese manufacturing data and the fact Trump will be back in power in just over a fortnight.

"Tariffs are expected to be at the top of the new president's agenda and China is expected to be the biggest loser," Mould added.

The Hong Kong and Shanghai stock markets had set a negative tone earlier, slumping more than two percent by day end.

Tokyo was closed.

While the US Federal Reserve is seen cutting interest rates less than forecast this year, the European Central Bank is expected to keep reducing amid weakness for Europe's biggest economy Germany.

"Optimism about the strength of the mighty US economy remains buoyant for 2025," Susannah Streeter, head of money and markets at Hargreaves Lansdown, said Thursday.

"Already growth has kept outpacing forecasts as consumers and companies have shrugged off the impact of high interest rates."

Following a largely successful 2024 for equity markets, as inflation reduced further and investors scooped up technology stocks, sentiment soured towards the end of the year.

Nevertheless, Wall Street's Dow index ended the year up around 13 percent, while the S&P 500 and the Nasdaq -- which have more tech stocks -- climbed more than 23 percent and around 29 percent respectively on the artificial intelligence boom.

Frankfurt's DAX added almost 20 percent, as did Japan's Nikkei. The FTSE 100 gained nearly six percent, but France's CAC 40 was the outlier with a drop of 2.2 percent.

- Key figures around 1650 GMT -

New York - Dow: UP 0.2 percent at 42,617.28 points

New York - S&P 500: UP 0.4 percent at 5,902.14

New York - Nasdaq Composite: UP 0.6 percent at 19,406.76

London - FTSE 100: UP 1.0 percent at 8,260.09 (close)

Paris - CAC 40: UP 0.2 percent at 7,393.76 (close)

Frankfurt - DAX: UP 0.6 percent at 20,024.66 (close)

Tokyo - Nikkei 225: closed

Hong Kong - Hang Seng Index: DOWN 2.2 percent at 19,623.32 (close)

Shanghai - Composite: DOWN 2.7 percent at 3,262.56 (close)

Euro/dollar: DOWN at $1.0247 from $1.0360 on Tuesday

Pound/dollar: DOWN at $1.2368 from $1.2520

Dollar/yen: UP at 157.63 yen from 157.32 yen

Euro/pound: UP at 82.87 at 82.74 pence

Brent North Sea Crude: UP 2.4 percent at $76.40 per barrel

West Texas Intermediate: UP 2.6 percent at $73.58 per barrel

burs-bcp/cw/jj

Y.Tengku--CPN