-

Liverpool-Man Utd Premier League clash to go ahead despite snowfall

Liverpool-Man Utd Premier League clash to go ahead despite snowfall

-

Bezos's Blue Origin poised for first orbital launch next week

-

Hollywood A-listers set to shine at Golden Globes

Hollywood A-listers set to shine at Golden Globes

-

Messi misses Presidential Medal ceremony with Biden

-

Bono, Messi, Soros awarded Presidential Medal of Freedom by Biden

Bono, Messi, Soros awarded Presidential Medal of Freedom by Biden

-

World's oldest person dies at 116 in Japan

-

Syria says international flights to and from Damascus to resume Tuesday

Syria says international flights to and from Damascus to resume Tuesday

-

Bono, Messi, Soros get Presidential Medal of Freedom from Biden

-

South Korea says fatal crash cockpit transcript nearly complete

South Korea says fatal crash cockpit transcript nearly complete

-

EV sales hit record in UK but still behind target

-

AI expected to star at CES gadget extravaganza

AI expected to star at CES gadget extravaganza

-

Brazil says 2024 was its hottest year on record

-

Soldier in Vegas Tesla blast suffered PTSD, no 'terror' link: FBI

Soldier in Vegas Tesla blast suffered PTSD, no 'terror' link: FBI

-

Microsoft expects to spend $80 bn on AI this fiscal year

-

Man arrested for supplying drugs to Liam Payne: Argentine police

Man arrested for supplying drugs to Liam Payne: Argentine police

-

Breeding success: London zoo counts its animals one-by-one

-

Biden blocks US Steel sale to Japan's Nippon Steel

Biden blocks US Steel sale to Japan's Nippon Steel

-

Wall Street stocks bounce higher, Europe retreats

-

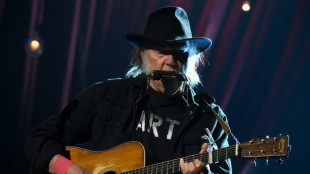

Neil Young says he will play Glastonbury after all

Neil Young says he will play Glastonbury after all

-

Biden blocks US-Japan steel deal

-

British novelist David Lodge dies aged 89

British novelist David Lodge dies aged 89

-

Indonesia says 2024 was hottest year on record

-

Indian duo self-immolate in Bhopal waste protest

Indian duo self-immolate in Bhopal waste protest

-

Indian food delivery app rolls out ambulance service

-

European stock markets retreat after positive start to year

European stock markets retreat after positive start to year

-

UK electricity cleanest on record in 2024: study

-

Biden to block US-Japan steel deal: US media

Biden to block US-Japan steel deal: US media

-

Thai PM declares millions in watches and bags among $400 mn assets

-

China says 'determined' to open up to world in 2025

China says 'determined' to open up to world in 2025

-

Asian shares rise defying slow Wall Street start to 2025

-

'Emilia Perez' heads into Golden Globes as strong favorite

'Emilia Perez' heads into Golden Globes as strong favorite

-

'You need to be happy': graffiti encourages Cuban self-reflection

-

Disaster-hit Chilean park sows seeds of fire resistance

Disaster-hit Chilean park sows seeds of fire resistance

-

Mixed day for global stocks as dollar pushes higher

-

Nick Clegg leaves Meta global policy team

Nick Clegg leaves Meta global policy team

-

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

Wall Street lifts spirits after Asia starts year in red

-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Most UK doctors suffer from 'compassion fatigue': poll

-

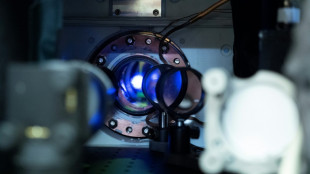

Secret lab developing UK's first quantum clock: defence ministry

Secret lab developing UK's first quantum clock: defence ministry

-

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

Wall Street dons early green after Asia starts year in red

-

Stock markets begin new year with losses

-

Sales surge in 2024 for Chinese EV giant BYD

Sales surge in 2024 for Chinese EV giant BYD

-

Asian stocks begin year on cautious note

-

Blooming hard: Taiwan's persimmon growers struggle

Blooming hard: Taiwan's persimmon growers struggle

-

Asia stocks begin year on cautious note

-

Cosmetic surgery aficionado Jocelyne Wildenstein dies aged 79: partner

Cosmetic surgery aficionado Jocelyne Wildenstein dies aged 79: partner

-

Power restored to most of Puerto Rico: utility

Wall Street stocks bounce higher, Europe retreats

Wall Street stocks bounced higher at the start of trading on Friday, but European stock markets retreated as traders booked profits from a positive start to 2025.

Asia's main equity indices closed mostly higher, Seoul jumping nearly two percent despite deepening political uncertainty in Asia's fourth-largest economy.

There were also gains for Hong Kong, Sydney and Taipei, although Shanghai slumped for a second session running.

Wall Street ended lower Thursday on the first US trading day of 2025 despite having started the day higher.

"The futures for the major indices are indicating a modestly higher open, but based on yesterday's trade, we're not sure that is bringing much comfort to market participants," said Briefing.com analyst Patrick O'Hare.

Instead of enjoying a so-called Santa Claus rally of rising prices during the year-end holiday period, Wall Street limped into 2025 as investors banked their healthy 2024 gains and worried about what the future holds.

"The post-Christmas malaise in US stocks continued as investors await the inauguration of president-elect Donald Trump who could prove a wildcard for markets this year," noted Russ Mould, investment director at AJ Bell, said of Thursday trading.

Departing President Joe Biden blocked early Friday the proposed $14.9-billion purchase of US Steel by Japan's Nippon Steel, saying it would "create risk for our national security and our critical supply chains".

Nippon Steel has described the transaction as a lifeline to Pennsylvania's much-diminished steel industry.

US Steel's share price slumped nearly seven percent at the start of trading. Nippon Steel shares had closed higher in Asian trading ahead of Biden's announcement.

The dollar dipped Friday against the euro, pound and yen.

The US currency had Thursday reached multi-year highs against some of its main rivals, reflecting expectations that the world's biggest economy would outpace others in 2025.

The yuan on Friday hit the lowest dollar level since late 2023.

"The very negative performance of China equities provides a better indication of the weakening sentiment around China assets at the start of 2025, and ahead of Trump's return to the White House," said Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

Investors are gearing up for Trump's inauguration on January 20, set to be followed by the formal announcement of deep tariffs, especially on Chinese goods, that could rattle international trade.

US jobless claims released Thursday fell more than expected, highlighting a robust labour market and leaving the Federal Reserve with less reason to support fresh rate cuts.

Other significant economic releases ahead include data on inflation and retail sales during the holiday shopping season.

- Key figures around 1430 GMT -

New York - Dow: UP 0.5 percent at 42,608.59 points

New York - S&P 500: UP 0.5 percent at 5,899.78

New York - Nasdaq Composite: UP 0.7 percent at 19,408.20

London - FTSE 100: DOWN less than 0.1 percent at 8,257.21

Paris - CAC 40: DOWN 1.0 percent at 7,317.29

Frankfurt - DAX: DOWN 0.4 percent at 19,937.11

Tokyo - Nikkei 225: closed

Hong Kong - Hang Seng Index: UP 0.7 percent at 19,760.27 (close)

Shanghai - Composite: DOWN 1.6 percent at 3,211.43 (close)

Euro/dollar: UP at $1.0293 from $1.0269 on Thursday

Pound/dollar: UP at $1.2400 from $1.2382

Dollar/yen: DOWN at 157.27 yen from 157.52 yen

Euro/pound: UP at 83.00 pence

West Texas Intermediate: UP 0.5 percent at $73.49 per barrel

Brent North Sea Crude: UP 0.3 percent at $76.14 per barrel

burs-rl/jj

A.Mykhailo--CPN