-

Meta mulling incorporation shift to Texas: report

Meta mulling incorporation shift to Texas: report

-

Scientists cast doubt on famous US groundhog's weather forecasts

-

World's longest cargo sail ship launched in Turkey

World's longest cargo sail ship launched in Turkey

-

TikTok king Khaby Lame joins UNICEF as goodwill ambassador

-

Stock markets mostly gain at end of turbulent week

Stock markets mostly gain at end of turbulent week

-

Stock markets gain at end of turbulent week

-

Calls for UK govt to allow bird flu vaccines for poultry

Calls for UK govt to allow bird flu vaccines for poultry

-

Offshore wind power giant Orsted changes CEO

-

South Korea, Ireland watchdogs to question DeepSeek on user data

South Korea, Ireland watchdogs to question DeepSeek on user data

-

Trio of rare tiger cubs spotted in Thai national park

-

Stock markets close out turbulent week with gains

Stock markets close out turbulent week with gains

-

South Korea watchdog to question DeepSeek over user data

-

Kenya's Ice Lions skate to win on East Africa's only rink

Kenya's Ice Lions skate to win on East Africa's only rink

-

World awaits Trump tariff deadline on Canada, Mexico and China

-

Samsung operating profit hit by R&D spending, fight to meet chip demand

Samsung operating profit hit by R&D spending, fight to meet chip demand

-

Japan records biggest jump in foreign workers

-

Asian markets mostly rise but worries over tariffs, AI linger,

Asian markets mostly rise but worries over tariffs, AI linger,

-

Investigators recover plane black boxes from Washington air collision

-

'No happiness': Misery for Myanmar exiles four years on from coup

'No happiness': Misery for Myanmar exiles four years on from coup

-

Ghosts of past spies haunt London underground tunnels

-

Chipmaker Intel beats revenue expectations amidst Q4 loss

Chipmaker Intel beats revenue expectations amidst Q4 loss

-

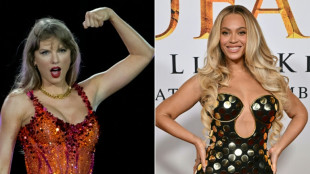

Key nominees for the Grammy Awards

-

Beyonce leads Grammys pack at gala backdropped by fires

Beyonce leads Grammys pack at gala backdropped by fires

-

Samsung Electronics posts 129.85% jump in Q4 operating profit

-

French luxury billionaire sparks tax debate with threat to leave

French luxury billionaire sparks tax debate with threat to leave

-

Apple profit climbs but sales miss expectations

-

Washington midair crash: What we know so far

Washington midair crash: What we know so far

-

Marianne Faithfull: from muse to master

-

Trump blames 'diversity' for deadly Washington airliner collision

Trump blames 'diversity' for deadly Washington airliner collision

-

Merkel slams successor over far-right support on immigration bill

-

Stock markets firm on ECB rate cut, corporate results

Stock markets firm on ECB rate cut, corporate results

-

Mexican economy shrinks for first time in three years

-

Nostalgia and escapism: highlights from Paris Couture Week

Nostalgia and escapism: highlights from Paris Couture Week

-

UK prosecutors defend jail terms of environmental activists

-

Qatari emir tells Syria leader 'urgent need' for inclusive government

Qatari emir tells Syria leader 'urgent need' for inclusive government

-

Dubai airport clocks record 92.3m passengers, extending hot streak

-

US economic growth steady in 2024 as Trump takes office

US economic growth steady in 2024 as Trump takes office

-

ECB cuts rate again as eurozone falters, with eye on Trump

-

No survivors from plane, helicopter collision in Washington

No survivors from plane, helicopter collision in Washington

-

Richard Gere to be honoured at Spain's top film awards

-

France, Germany stall eurozone growth in fourth quarter

France, Germany stall eurozone growth in fourth quarter

-

DR Congo leader vows 'vigorous' response as Rwanda-backed fighters advance

-

European stock markets rise before ECB rate call

European stock markets rise before ECB rate call

-

Dubai airport sees record 92.3 million passengers in 2024

-

Shell annual profit drops to $16 bn as oil prices fall

Shell annual profit drops to $16 bn as oil prices fall

-

UK car sector fears for Trump tariffs as output falls

-

French economy shrinks as political crisis eclipses Olympic boost

French economy shrinks as political crisis eclipses Olympic boost

-

Plane carrying 64 collides with helicopter, crashes in Washington

-

DR Congo leader says troops mounting 'vigorous' response to M23

DR Congo leader says troops mounting 'vigorous' response to M23

-

EU holds auto talks to revive embattled car sector

| RBGPF | 4.18% | 64.91 | $ | |

| CMSC | -0.89% | 23.47 | $ | |

| CMSD | -1.59% | 23.84 | $ | |

| SCS | -1.39% | 11.48 | $ | |

| NGG | -0.55% | 61.4 | $ | |

| RYCEF | 0.53% | 7.49 | $ | |

| RELX | -0.92% | 49.89 | $ | |

| BCC | -1.98% | 126.16 | $ | |

| RIO | -0.83% | 60.41 | $ | |

| GSK | -0.26% | 35.27 | $ | |

| BP | -1.77% | 31.06 | $ | |

| BTI | -0.1% | 39.64 | $ | |

| BCE | -0.46% | 23.79 | $ | |

| VOD | -0.82% | 8.54 | $ | |

| AZN | -0.68% | 70.76 | $ | |

| JRI | -0.32% | 12.53 | $ |

Stock markets mostly gain at end of turbulent week

Stock markets mostly rose Friday, led by New York after strong results from Apple reassured investors that the tech sector was still healthy after a volatile week, though European shares were hit by a late bout of profit taking.

AI-related stocks, particularly key chipmaker Nvidia, had plunged early in the week after China's DeepSeek unveiled an artificial intelligence model rivalling those of US tech giants but developed at a small fraction of the cost.

But markets have clawed back most of those losses thanks to encouraging earnings and company strategy updates, and as some investors re-evaluated the risks US firms face from Chinese competition.

"Monday's sell-off was likely an overreaction, as markets tend to 'shoot first and ask questions later'," said Daniela Sabin Hathorn, senior market analyst at Capital.com.

"Big US tech stocks still maintain significant competitive advantages that will make them difficult to disrupt overnight," she said.

Financial markets also digested the latest US inflation data, with the Federal Reserve's favourite inflation gauge, the Personal Consumption Expenditures index, accelerating for a third month in a row, reaching 2.6 percent in December as expected.

"While there's still further progress to be made on inflation, investors can breathe a sigh of relief and refocus on the market's more notable fundamentals, like earnings growth and the economy," said Bret Kenwell, US investment analyst at the eToro trading platform.

The Dow was little changed near midday Friday, while the wider S&P 500 and the tech-heavy Nasdaq were both higher.

Apple shares climbed about three percent at the opening and were last up about one percent after the tech titan reported that profit and revenue grew strongly, even if iPhone sales did not rise as fast as analysts' expectations.

London's benchmark FTSE 100 hit fresh highs, helped by an almost 12 percent surge in the share price of Smiths Group after the British engineering company said it planned to streamline its business and return substantial sums to shareholders.

But Paris and Frankfurt ended little changed as early rises fizzled. European stocks had one of their best months in two years in January with Europe-wide indexes rising six percent since the start of the year.

Data showed that German inflation unexpectedly slowed in January, the first decline in months, bolstering the case for further rate cuts by the European Central Bank.

The ECB cut rates on Thursday, its fifth reduction since June.

But investors are also bracing for tariffs that US President Donald Trump has vowed to impose on imports from Canada and Mexico this weekend.

Concerns over Trump's trade tactics pushed gold to new records above $2,800 an ounce.

"The gold price is proving its haven credentials, as investors choose it to hedge fears about Trump's tariff threats," said Kathleen Brooks, research director at XTB, even if the details of the potential tariffs are unclear.

The dollar held on to recent gains against the pound, euro and yen, supported by the Fed indicating this week that it did not see a need to cut interest rates further while the country's inflation remains elevated.

Next week, the Bank of England is widely forecast to trim its main interest rate as the British government struggles to grow its economy.

The greenback weighed even more on the Mexican peso and Canadian dollar as Trump said he would go ahead with the threatened 25 percent tariffs on the countries pencilled in for Saturday.

- Key figures around 1640 GMT -

New York - Dow: DOWN 0.1 percent at 44,861.74 points

New York - S&P 500: UP 0.7 percent at 6,110.56

New York - Nasdaq Composite: UP 1.2 percent at 19,918.00

London - FTSE 100: UP 0.3 percent at 8,673.96 (close)

Paris - CAC 40: UP 0.1 percent at 7,950.17 (close)

Frankfurt - DAX: UNCHANGED at 21,732.05 (close)

Tokyo - Nikkei 225: UP 0.2 percent at 39,572.49 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: UP at $1.0396 from $1.0392 on Thursday

Pound/dollar: DOWN at $1.2432 from $1.2420

Dollar/yen: UP at 154.91 yen from 154.38 yen

Euro/pound: DOWN at 83.63 pence from 83.67 pence

West Texas Intermediate: FLAT at $72.71 per barrel

Brent North Sea Crude: FLAT at $75.86 per barrel

A.Leibowitz--CPN