-

Pod of 157 dolphins stranded on remote Australian beach

Pod of 157 dolphins stranded on remote Australian beach

-

US lawmakers confirm Howard Lutnick as commerce secretary

-

China condemns US 'tariff shocks' at WTO

China condemns US 'tariff shocks' at WTO

-

Shakira medical record leak sparks Peru investigation

-

'City killer' asteroid now has 3.1% chance of hitting Earth: NASA

'City killer' asteroid now has 3.1% chance of hitting Earth: NASA

-

Global stocks unfazed as US and Russia hold talks

-

Global stocks steady as US and Russia hold talks

Global stocks steady as US and Russia hold talks

-

German auto supplier Continental to cut 3,000 more jobs

-

UK's disgraced Prince Andrew marks his 65th birthday

UK's disgraced Prince Andrew marks his 65th birthday

-

Global stocks mixed as US and Russia hold talks

-

UK court backs £3 bn loan for indebted Thames Water

UK court backs £3 bn loan for indebted Thames Water

-

Meta plans undersea cable to link five continents

-

Asian markets mixed as traders pare Hong Kong tech rally

Asian markets mixed as traders pare Hong Kong tech rally

-

Iran mulls moving capital to 'lost paradise' on southern coast

-

Tesla begins hiring in India after Musk and Modi meet

Tesla begins hiring in India after Musk and Modi meet

-

German 'bureaucracy monster' on everyone's election hit list

-

Why Brazil's Lula is bleeding support

Why Brazil's Lula is bleeding support

-

Japan sets new 2035 emissions cut goal

-

Musk launches 'scary smart' AI chatbot

Musk launches 'scary smart' AI chatbot

-

'They knew': Victims of paedophile French surgeon blame systemic failure

-

Tech rally helps Hong Kong lead Asian markets higher

Tech rally helps Hong Kong lead Asian markets higher

-

Japan targets 60% emissions cut by 2035 from 2013 levels

-

UN nuclear chief to view soil removed from Fukushima

UN nuclear chief to view soil removed from Fukushima

-

Rio swelters in heatwave amid run-up to Carnival

-

Delta plane flips upside down in Toronto crash, 15 wounded

Delta plane flips upside down in Toronto crash, 15 wounded

-

Shakira resumes world tour after Lima hospital stay

-

Mexico says to sue Google if it insists on using 'Gulf of America'

Mexico says to sue Google if it insists on using 'Gulf of America'

-

Rio swelters in heatwave in run-up to Carnival

-

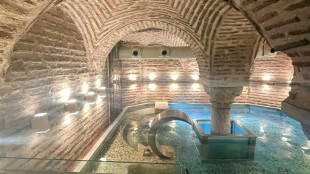

Turkey seals hotel spa illegally set up inside ancient cistern

Turkey seals hotel spa illegally set up inside ancient cistern

-

European markets rise ahead of Ukraine war talks

-

Stock markets start week on mixed note

Stock markets start week on mixed note

-

Chatbot vs national security? Why DeepSeek is raising concerns

-

S. Korea says DeepSeek removed from local app stores pending privacy review

S. Korea says DeepSeek removed from local app stores pending privacy review

-

Taiwan bounty hunters kill invading iguanas as numbers soar

-

Japan 2024 growth slows despite stronger fourth quarter

Japan 2024 growth slows despite stronger fourth quarter

-

Most Asian markets start week on positive note

-

General Atomics and EDGE Establish Partnership to Manufacture, Test and Repair Electromechanical Systems

General Atomics and EDGE Establish Partnership to Manufacture, Test and Repair Electromechanical Systems

-

Shakira cancels Lima concert after being hospitalized

-

Rivals eye BAFTA victory over scandal-hit 'Emilia Perez'

Rivals eye BAFTA victory over scandal-hit 'Emilia Perez'

-

New 'Captain America' crushes competition in N.American theaters

-

Claudel bronze sculpture goes for $3 mn at France auction

Claudel bronze sculpture goes for $3 mn at France auction

-

Bilbao v Espanyol match halted early after racist chanting

-

Musk says chatbot Grok 3 will be unveiled Monday

Musk says chatbot Grok 3 will be unveiled Monday

-

Cryptocurrency promoted by Argentina's Milei crashes

-

BAFTAs: Rival films eye victory over scandal-hit 'Emilia Perez'

BAFTAs: Rival films eye victory over scandal-hit 'Emilia Perez'

-

Trump tariffs fuel US auto anxiety

-

LIV Golf to stay in Adelaide till 2031 with Norman designing new course

LIV Golf to stay in Adelaide till 2031 with Norman designing new course

-

Late trains, old bridges, no signal: Germany's infrastructure woes

-

Trump tariffs loom large in South Korea's 'steel city'

Trump tariffs loom large in South Korea's 'steel city'

-

Jessica Chastain tackles US-Mexico politics in new film 'Dreams'

Stocks mostly up on Ukraine peace hopes, shrugging off latest US tariff talk

Major stock markets mostly rose Thursday on hopes for an end to the war in Ukraine and as US President Trump announced a trade policy shake-up but held off on specific new levies.

London was a rare faller owing to sharp losses to share prices of big companies, including Unilever, Barclays and British American Tobacco, on mixed earnings. That overshadowed news that the UK economy surprisingly grew in late 2024.

US President Donald Trump's talks with Russian leader Vladimir Putin to start negotiating an end to the war in Ukraine "has fostered a risk-on attitude among investors", said Naeem Aslam, chief investment officer at Zaye Capital Markets.

The positive showing "is a result of the potential reduction in geopolitical risks", he added.

Paris and Frankfurt won solid gains. Major US indices joined them, with the S&P 500 winning one percent.

Trump unveiled a "fair and reciprocal plan" for trade, ordering a review of tariffs on US goods and directing officials to propose remedies, a step towards potentially wide-ranging tariffs on allies and competitors.

But Wall Street was encouraged that the plan did not include immediate levies.

Investors are "taking comfort" in the "idea that it's negotiable and not coming into effect immediately," said Tom Cahill of Ventura Wealth Management.

US investors also shrugged off data showing a bigger than expected uptick in US wholesale prices in January, adding to concerns about worsening pricing pressure after Wednesday's consumer price data also exceeded estimates.

Some analysts also noted that the details of Thursday's US inflation report were less troubling than the headline figures.

But the dollar weakened after traders concluded the reciprocal tariffs will "either be tolerable for partners, negotiated away or never implemented," said Adam Button, currency analyst at ForexLive.

Among individual stocks, Nestle surged more than six percent in Zurich after the Swiss food giant posted better-than-expected annual sales.

But Deere & Company fell 2.2 percent as it navigates a tough agriculture market with the depressed state of farm income and higher interest rates that make equipment purchases difficult.

The company's revenues fell more than 30 percent last year, while it projected broad-based decline again in 2025.

- Key figures around 2150 GMT -

New York - Dow: UP 0.8 percent at 44,711.43 (close)

New York - S&P 500: UP 1.0 percent at 6,115.07 (close)

New York - Nasdaq Composite: UP 1.5 percent at 19,945.64 (close)

London - FTSE 100: DOWN 0.5 percent at 8,764.72 (close)

Paris - CAC 40: UP 1.5 percent at 8,164.11 (close)

Frankfurt - DAX: UP 2.1 percent at 22,612.02 (close)

Tokyo - Nikkei 225: UP 1.3 percent at 39,461.47 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 21,814.37 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,332.48 (close)

Euro/dollar: UP at $1.0467 from $1.0383 on Wednesday

Pound/dollar: UP at $1.2586 from $1.2446

Dollar/yen: DOWN at 152.76 yen from 154.42 yen

Euro/pound: DOWN at 83.28 pence from 83.42 pence

West Texas Intermediate: DOWN 0.1 percent at $71.29 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $75.02 per barrel

burs-jmb

D.Goldberg--CPN