-

'Assassin's Creed Shadows' leaked ahead of release

'Assassin's Creed Shadows' leaked ahead of release

-

Spain's Telefonica sells Argentina subsidiary for $1.2 bn

-

Anthropic releases its 'smartest' AI model

Anthropic releases its 'smartest' AI model

-

SpaceX targeting Friday for next test of Starship megarocket

-

Frankfurt stocks rise on German vote outcome

Frankfurt stocks rise on German vote outcome

-

Greenpeace trial begins in North Dakota in key free speech case

-

'Monster Hunter' on prowl for new audiences as latest game drops

'Monster Hunter' on prowl for new audiences as latest game drops

-

Apple says to invest $500 bn in US over four years, hire 20,000 staff

-

Frankfurt stocks, euro rise on German vote outcome

Frankfurt stocks, euro rise on German vote outcome

-

German business urges 'new beginning' after election

-

Asian markets track Wall St loss; Frankfurt lifted by German vote

Asian markets track Wall St loss; Frankfurt lifted by German vote

-

China's Alibaba to invest $50 bn in AI, cloud computing

-

Indonesia launches new multi-billion-dollar sovereign wealth fund

Indonesia launches new multi-billion-dollar sovereign wealth fund

-

Most Asian markets track Wall St loss; Hong Kong extends gains

-

Japan warns of avalanches, icy roads ahead of more snow

Japan warns of avalanches, icy roads ahead of more snow

-

Conservatives win German vote as far-right makes record gains

-

'Captain America' slips but clings to N. America box office lead

'Captain America' slips but clings to N. America box office lead

-

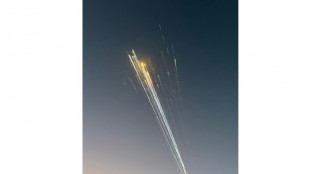

Tens of thousands vow support for Lebanon's Hezbollah at slain leader's funeral

-

Tens of thousands pour in for Beirut funeral of slain Hezbollah leader

Tens of thousands pour in for Beirut funeral of slain Hezbollah leader

-

Germans vote under shadow of far-right surge, Trump

-

Hong Kong and Singapore lead Asia's drive to cash in on crypto boom

Hong Kong and Singapore lead Asia's drive to cash in on crypto boom

-

Well-off Hong Kong daunted by record deficits

-

Trump tariffs shake up China's factory heartland

Trump tariffs shake up China's factory heartland

-

Top issues in Germany's election campaign

-

Friedrich Merz: conservative on verge of German chancellery

Friedrich Merz: conservative on verge of German chancellery

-

Germans go to vote under shadow of far-right surge, Trump

-

Oscars favorite Baker says indie film 'struggling' as 'Anora' tops Spirit Awards

Oscars favorite Baker says indie film 'struggling' as 'Anora' tops Spirit Awards

-

'Worst is over' as Chile's 'stolen' babies reunite with mothers

-

France's agriculture show, an outlet for angry farmers

France's agriculture show, an outlet for angry farmers

-

China's EV maker XPeng eyes doubling global presence by year's end

-

Germany on eve of elections under shadow of US-European rift

Germany on eve of elections under shadow of US-European rift

-

France still seeking to block EU-Mercosur trade deal: Macron

-

Ukraine's earth riches are rare and difficult to reach

Ukraine's earth riches are rare and difficult to reach

-

On $15 a month, Venezuela's teachers live hand to mouth

-

'See you in court': Trump, governor spar over trans rights

'See you in court': Trump, governor spar over trans rights

-

US stocks tumble on fears of slowdown

-

Cuba opens solar park hoping to stave off blackouts

Cuba opens solar park hoping to stave off blackouts

-

German flying taxi start-up's rescue deal collapses

-

Stock markets diverge, oil prices slide

Stock markets diverge, oil prices slide

-

'Queen of Pop' Madonna lambasts 'King' Trump

-

Apple says halting data protection tool for UK users

Apple says halting data protection tool for UK users

-

Female chefs condemn sexism in British kitchens

-

US, China economic leaders raise 'serious concerns' in first call

US, China economic leaders raise 'serious concerns' in first call

-

Russia sells famed imperial prison at auction

-

Stock markets rise as Alibaba fuels Hong Kong tech rally

Stock markets rise as Alibaba fuels Hong Kong tech rally

-

France full-back Jaminet returns to rugby after racist video ban

-

Chinese AI companies celebrate DeepSeek, shrug off global curbs

Chinese AI companies celebrate DeepSeek, shrug off global curbs

-

Asian markets advance as Alibaba fuels Hong Kong tech rally

-

Nissan shares jump 11% on reported plan to seek Tesla investment

Nissan shares jump 11% on reported plan to seek Tesla investment

-

Trump aid cut imperils water scheme in scorching Pakistan city

Frankfurt stocks rise on German vote outcome

Frankfurt equities squeezed out gains Monday after conservatives led by Friedrich Merz won Germany's national election, with investors hoping that Europe's largest economy can emerge from recession.

Elsewhere equities mostly slid with investors still concerned about the inflationary effect of US Donald Trump's plans to slap tariffs on various trading partners and their impact on interest rates and economic growth.

Frankfurt's DAX index jumped 0.8 percent at the start of trading but gave up part of its gains as the day wore on, closing 0.6 percent higher.

Merz urged a speedy formation of a new coalition government, warning that Trump was driving rapid and disruptive changes and that "the world isn't waiting for us".

"The hope that the conservatives' win might help pull Germany out of economic stupor and help bolster collective defence has lifted investor spirits," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

European defence stocks gained, with Germany's Rheinmetall up more than six percent and Britain's BAE Systems up nearly four percent.

With more than 28 percent of the vote, Merz's CDU/CSU bloc handily defeated Chancellor Olaf Scholz's Social Democrats (SPD) and the Greens, as the anti-immigration Alternative for Germany celebrated a record of over 20 percent.

Merz said he would reach out to the Social Democrats with hopes of forging a stable ruling alliance of the two traditional big-tent parties.

"Investors welcomed the outcome of Germany's election, which saw centrist parties positioned to form a coalition," said City Index and FOREX.com analyst Fawad Razaqzada.

But CMC Markets analyst Konstantin Oldenburger said the failure of the DAX to hold onto its gains "can likely be attributed to the understanding that the crucial negotiations between the (conservatives) and the SPD are yet to come".

The euro rose against the dollar and the pound.

Elsewhere Monday, shares in Amsterdam-listed Just Eat Takeaway soared almost 54 percent after it received a 4.1-billion-euro ($4.3-billion) takeover offer from investment giant Prosus.

Asian equity markets mostly fell following a dour end to last week for Wall Street fuelled by disappointing economic data, with a report on Friday showing that activity in the US key services sector hit a 25-month low in February and that consumer sentiment dived almost 10 percent from January.

The readings followed a recent run of figures pointing to a softening of the labour market and prices continuing to rise faster than the Federal Reserve's target rate.

This week sees the release of the January PCE price index, the Fed's preferred inflation gauge, which could further lower investor expectations about interest cuts this year.

Wall Street opened higher, but then gave up its gains only to see the Dow and S&P rebound in late morning trading.

Oil prices posted modest gains after dropping as much as three percent on Friday as the weak US data sparked demand fears, while there are also growing expectations that Trump will ease sanctions that have limited Russian oil exports.

- Key figures around 1630 GMT -

New York - Dow: UP 0.4 percent at 43,593.12 points

New York - S&P 500: UP less than 0.1 percent at 6,016.63

New York - Nasdaq: DOWN 0.4 percent at 19,439.84

Frankfurt - DAX: UP 0.6 percent at 22,425.93 (close)

Paris - CAC 40: DOWN 0.8 percent at 8,090.99 (close)

London - FTSE 100: FLAT at 8,658.98 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 23,341.61 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,373.03 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: UP at $1.0472 from $1.0462 on Friday

Pound/dollar: UP at $1.2636 from $1.2628

Dollar/yen: UP at 149.65 from 149.32 yen

Euro/pound: UP at 82.88 pence from 82.81 pence

Brent North Sea Crude: UP 0.4 percent at $74.33 per barrel

West Texas Intermediate: UP 0.5 percent at $70.73 per barrel

burs-rl/js

Y.Ponomarenko--CPN