-

Aston Martin cuts jobs as weak China demand weighs

Aston Martin cuts jobs as weak China demand weighs

-

Stellantis says 2024 profits fall 70% on N. America troubles

-

'Joyful' South Koreans hope rising births will continue

'Joyful' South Koreans hope rising births will continue

-

Indonesia agrees deal with Apple that could end iPhone sales ban: reports

-

US says Gaza ceasefire talks on track

US says Gaza ceasefire talks on track

-

Tech surge helps Hong Kong lead most Asian markets higher

-

Hong Kong to slash public spending, build AI institute

Hong Kong to slash public spending, build AI institute

-

Israelis mass for funeral of Bibas hostages killed in Gaza

-

Most Asian markets rebound as Hong Kong tech rally resumes

Most Asian markets rebound as Hong Kong tech rally resumes

-

Under pressure, EU to take axe to green rules

-

Shunned by US, Europe courts India over trade and security

Shunned by US, Europe courts India over trade and security

-

BP to unveil strategy shakeup amid energy transition

-

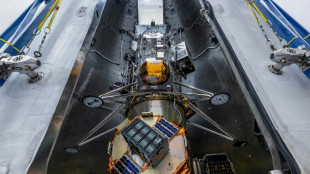

Private US company set for second Moon landing attempt

Private US company set for second Moon landing attempt

-

New cocktails shake up Oscar night

-

Leading rare earths miner sees profits fall as prices sag

Leading rare earths miner sees profits fall as prices sag

-

Tesla sinks below $1 tn market value as European auto sales slump

-

Paint them white: how Brazil is keeping trains on track

Paint them white: how Brazil is keeping trains on track

-

Japan's ANA to purchase mega-order of 77 new jets

-

US hardens visa sanctions over Cuba medical program

US hardens visa sanctions over Cuba medical program

-

'A normal family', says son of surgeon in French sex abuse trial

-

Stocks slide as US consumer confidence tumbles, tech slumps

Stocks slide as US consumer confidence tumbles, tech slumps

-

Germany's next leader grapples to boost defence spending

-

Stock markets shrug off Trump trade war fears but tech sags

Stock markets shrug off Trump trade war fears but tech sags

-

UK PM pledges to spend 2.5 percent of GDP on defence by 2027

-

'Matter of survival': Nations spar over nature funding at UN talks

'Matter of survival': Nations spar over nature funding at UN talks

-

German family-run machine maker issues SOS to future government

-

Stock markets struggle on fears over Trump's China tech curbs

Stock markets struggle on fears over Trump's China tech curbs

-

Indonesia agrees to terms with Apple to lift iPhone sales ban: source

-

Chance huge asteroid will hit Earth down to 0.001 percent

Chance huge asteroid will hit Earth down to 0.001 percent

-

Unilever boss to step down after less than two years at helm

-

Kate Bush leads UK musicians in 'silent album' AI fight

Kate Bush leads UK musicians in 'silent album' AI fight

-

Hein Schumacher to step down as Unilever CEO

-

Countries lock horns over cash for nature at rebooted UN talks

Countries lock horns over cash for nature at rebooted UN talks

-

Tesla rolls out advanced self-driving functions in China

-

Asian markets sink as Trump tariffs, China curbs stunt rally

Asian markets sink as Trump tariffs, China curbs stunt rally

-

Trump calls for revival of Keystone XL Pipeline project axed by Biden

-

Stuck in eternal drought, UAE turns to AI to make it rain

Stuck in eternal drought, UAE turns to AI to make it rain

-

Latin American classics get the streaming treatment

-

Fires, strikes, pandemic and AI: Hollywood workers can't catch a break

Fires, strikes, pandemic and AI: Hollywood workers can't catch a break

-

Bolivia inaugurates steel plant built with Chinese loan

-

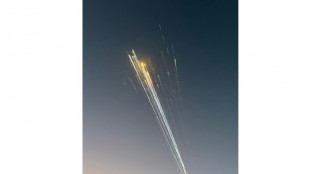

GA-ASI Advances Sub-Hunting With Test of New Air-Dropped Sensors

GA-ASI Advances Sub-Hunting With Test of New Air-Dropped Sensors

-

Bahrain EDB Attracts Over USD 380 Million in Investment Commitments from Singapore

-

'Assassin's Creed Shadows' leaked ahead of release

'Assassin's Creed Shadows' leaked ahead of release

-

Spain's Telefonica sells Argentina subsidiary for $1.2 bn

-

Anthropic releases its 'smartest' AI model

Anthropic releases its 'smartest' AI model

-

SpaceX targeting Friday for next test of Starship megarocket

-

Frankfurt stocks rise on German vote outcome

Frankfurt stocks rise on German vote outcome

-

Greenpeace trial begins in North Dakota in key free speech case

-

'Monster Hunter' on prowl for new audiences as latest game drops

'Monster Hunter' on prowl for new audiences as latest game drops

-

Apple says to invest $500 bn in US over four years, hire 20,000 staff

BP to unveil strategy shakeup amid energy transition

British energy giant BP is set Wednesday to announce a shakeup to its strategy after a difficult trading year and as countries transition to cleaner energy.

A much anticipated presentation to investors gathered in London comes after BP earlier this month pledged to "fundamentally reset" following a 97-percent slump to its net profit in 2024.

BP's profit after tax tumbled to $381 million last year from $15.2 billion in 2023 in the face of higher costs and weaker oil and gas prices.

Total revenue dropped nine percent to $195 billion.

"We now plan to fundamentally reset our strategy and drive further improvements in performance," chief executive Murray Auchincloss said following the earnings update, adding details would be revealed at the investor day.

He said it would be a "new direction for BP", a company born in 1908 and with a current worldwide workforce of nearly 88,000.

Auchincloss has put the emphasis on oil and gas to boost profits, scaling back on the group's key climate targets since taking the helm at the start of 2024.

Last year, BP announced it would "significantly reduce" investment in renewable energy through the end of the decade.

Ahead of the investor day, it has widely been reported that US activist investor Elliott Investment Management has built a significant stake in BP.

The fund is known for forcing through corporate changes within groups it invests in, signalling further upheaval ahead for BP, analysts said.

The energy group has already embarked on a plan to find $2 billion in cost savings and recently axed 4,700 staff jobs, or around five percent of its workforce.

- Production future -

Investors have speculated that BP could this week abandon its pledge to reduce oil production by 25 percent by 2030 compared to its 2019 levels.

It already scaled back its climate plans with a target of reducing carbon emissions by 20-30 percent by the end of this decade compared to 2019 levels.

This is down from a previous target of 35-40 percent.

British rival Shell and other oil majors have also cut back on clean energy objectives.

On the eve of BP's update, TotalEnergies chief executive Patrick Pouyanne said that while oil and gas would continue to be produced, "you need to produce it differently with much lower emissions".

The head of the French giant spoke Tuesday at International Energy Week, an annual gathering in London of major players from across the sector.

Shell the same day forecast global demand for liquefied natural gas to rise by about 60 percent by 2040.

It forecast that this would be "largely driven by economic growth in Asia, emissions reductions in heavy industry and transport as well as the impact of artificial intelligence".

A.Mykhailo--CPN