-

Indonesia agrees deal with Apple that could end iPhone sales ban

Indonesia agrees deal with Apple that could end iPhone sales ban

-

Global stability threatened by backslide in cooperation: S.Africa

-

'Sorry I couldn't protect you': Israel mourns Bibas mother, sons

'Sorry I couldn't protect you': Israel mourns Bibas mother, sons

-

BP ditches climate targets in pivot back to oil and gas

-

EU seeks to balance business needs, climate goals

EU seeks to balance business needs, climate goals

-

Stock markets rally with tech in focus

-

BP to up oil and gas output, slash clean energy spend in overhaul

BP to up oil and gas output, slash clean energy spend in overhaul

-

Los Angeles wildfires costliest in history: Munich Re

-

'Brat' icon Charli XCX picks up Brit award for best songwriter

'Brat' icon Charli XCX picks up Brit award for best songwriter

-

AB InBev posts record sales in 2024 despite beer volumes slipping

-

Aston Martin cuts jobs as weak China demand weighs

Aston Martin cuts jobs as weak China demand weighs

-

Stellantis says 2024 profits fall 70% on N. America troubles

-

'Joyful' South Koreans hope rising births will continue

'Joyful' South Koreans hope rising births will continue

-

Indonesia agrees deal with Apple that could end iPhone sales ban: reports

-

US says Gaza ceasefire talks on track

US says Gaza ceasefire talks on track

-

Tech surge helps Hong Kong lead most Asian markets higher

-

Hong Kong to slash public spending, build AI institute

Hong Kong to slash public spending, build AI institute

-

Israelis mass for funeral of Bibas hostages killed in Gaza

-

Most Asian markets rebound as Hong Kong tech rally resumes

Most Asian markets rebound as Hong Kong tech rally resumes

-

Under pressure, EU to take axe to green rules

-

Shunned by US, Europe courts India over trade and security

Shunned by US, Europe courts India over trade and security

-

BP to unveil strategy shakeup amid energy transition

-

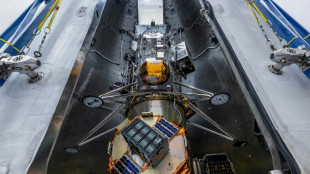

Private US company set for second Moon landing attempt

Private US company set for second Moon landing attempt

-

New cocktails shake up Oscar night

-

Leading rare earths miner sees profits fall as prices sag

Leading rare earths miner sees profits fall as prices sag

-

Tesla sinks below $1 tn market value as European auto sales slump

-

Paint them white: how Brazil is keeping trains on track

Paint them white: how Brazil is keeping trains on track

-

Japan's ANA to purchase mega-order of 77 new jets

-

US hardens visa sanctions over Cuba medical program

US hardens visa sanctions over Cuba medical program

-

'A normal family', says son of surgeon in French sex abuse trial

-

Stocks slide as US consumer confidence tumbles, tech slumps

Stocks slide as US consumer confidence tumbles, tech slumps

-

Germany's next leader grapples to boost defence spending

-

Stock markets shrug off Trump trade war fears but tech sags

Stock markets shrug off Trump trade war fears but tech sags

-

UK PM pledges to spend 2.5 percent of GDP on defence by 2027

-

'Matter of survival': Nations spar over nature funding at UN talks

'Matter of survival': Nations spar over nature funding at UN talks

-

German family-run machine maker issues SOS to future government

-

Stock markets struggle on fears over Trump's China tech curbs

Stock markets struggle on fears over Trump's China tech curbs

-

Indonesia agrees to terms with Apple to lift iPhone sales ban: source

-

Chance huge asteroid will hit Earth down to 0.001 percent

Chance huge asteroid will hit Earth down to 0.001 percent

-

Unilever boss to step down after less than two years at helm

-

Kate Bush leads UK musicians in 'silent album' AI fight

Kate Bush leads UK musicians in 'silent album' AI fight

-

Hein Schumacher to step down as Unilever CEO

-

Countries lock horns over cash for nature at rebooted UN talks

Countries lock horns over cash for nature at rebooted UN talks

-

Tesla rolls out advanced self-driving functions in China

-

Asian markets sink as Trump tariffs, China curbs stunt rally

Asian markets sink as Trump tariffs, China curbs stunt rally

-

Trump calls for revival of Keystone XL Pipeline project axed by Biden

-

Stuck in eternal drought, UAE turns to AI to make it rain

Stuck in eternal drought, UAE turns to AI to make it rain

-

Latin American classics get the streaming treatment

-

Fires, strikes, pandemic and AI: Hollywood workers can't catch a break

Fires, strikes, pandemic and AI: Hollywood workers can't catch a break

-

Bolivia inaugurates steel plant built with Chinese loan

Tech surge helps Hong Kong lead most Asian markets higher

Hong Kong stocks resumed their impressive start to the year on Wednesday as they rocketed more than three percent on the back of a surge in tech firms fuelled by fresh optimism over the sector in China.

The rally led gains across most Asian and European markets, with investors shifting back to buy mode following a poor start to the week sparked by fresh US tariff concerns.

Traders brushed off another disappointing day on Wall Street following more data showing consumers in the world's top economy were losing confidence.

The Hong Kong market climbed more than three percent and has enjoyed a blockbuster start to the year, rocketing by almost a fifth to hit its highest level since March 2022.

The rally has come as investors snap up long-neglected tech names after Chinese startup DeepSeek unveiled a chatbot last month that upended the AI universe.

It has also been helped by Beijing's moves to bring the firms in from the cold after years of government crackdowns on the industry.

E-commerce heavyweight Alibaba was again one of the major advancers, rallying 4.8 percent, with JD.com more than eight percent higher, Meituan up nearly 10 percent and Tencent up 3.4 percent.

Sentiment took a knock at the start of the week from news that US President Donald Trump had signed a memo over the weekend calling for curbs on Chinese investments in industries including technology, critical infrastructure, healthcare and energy.

The move is aimed at promoting foreign investment in the United States, while protecting national security interests "particularly from threats posed by foreign adversaries" like China, the White House said.

There were also gains in Shanghai, Seoul, Wellington, Taipei, Manila and Bangkok while London, Paris and Frankfurt rose at the open.

Sydney, Singapore and Jakarta fell.

Tokyo was down but pared earlier losses. It had been hit by a strengthening yen amid expectations that the Bank of Japan would continue hiking interest rates this year, while the currency also benefitted from a pickup in US rate cut bets.

Expectations for Federal Reserve reductions were boosted by a Conference Board survey showing US consumer confidence in February saw its largest monthly decline since August 2021.

The reading came on the heels of other lacklustre US reports including on service sector activity, jobs and inflation.

Rate-cut talk has grown as optimism over the US economy wanes and investors worry that Trump's tariffs drive and plans to slash taxes, regulations and immigration will reignite consumer prices.

Focus is now on the release of the core personal consumption expenditures price index, the Fed's preferred inflation metric, which could give a fresh idea about the outlook for US rates.

On Wall Street, the Dow rose but the S&P 500 and Nasdaq retreated as tech giants struggled amid concerns over their high valuations and their huge spending on AI development.

New York's main indexes have struggled this year as the long-running US tech surge has hit the buffers after Chinese startup DeepSeek unveiled its bombshell chatbot last month, upending the AI scramble.

Earnings from market heavyweight Nvidia will be closely watched for an insight into its AI chip sales.

"The main focus though is probably what CEO Jensen Huang says about the state of the chip sector, where AI is going, what the DeepSeek competition means and any impact from tariffs," said Neil Wilson, an analyst at TipRanks trading group.

- Key figures around 0815 GMT -

Tokyo - Nikkei 225: DOWN 0.3 percent at 38,142.37 (close)

Hong Kong - Hang Seng Index: UP 3.3 percent at 23,787.93 (close)

Shanghai - Composite: UP 1.0 percent at 3,380.21 (close)

London - FTSE 100: UP 0.6 percent at 8,722.16

Euro/dollar: DOWN at $1.0494 from $1.0517 on Tuesday

Pound/dollar: DOWN at $1.2649 from $1.2668

Dollar/yen: UP at 149.48 from 149.00 yen

Euro/pound: DOWN at 82.97 pence from 83.00 pence

West Texas Intermediate: UP 0.4 percent at $69.17 per barrel

Brent North Sea Crude: UP 0.3 percent at $73.27 per barrel

New York - Dow: UP 0.4 percent at 43,621.16 (close)

Y.Ponomarenko--CPN