-

EU was born to 'screw' US, Trump says

EU was born to 'screw' US, Trump says

-

Trump's trade envoy Jamieson Greer confirmed by lawmakers

-

Eyeing Trump trade policy shakeup, Eli Lilly to build 4 US factories

Eyeing Trump trade policy shakeup, Eli Lilly to build 4 US factories

-

Amazon's next-gen Alexa gets AI upgrade

-

G20 leaders say global stability threatened by declining cooperation

G20 leaders say global stability threatened by declining cooperation

-

US new home sales miss expectations in January on cold weather

-

EU vows to slash red tape but stick to climate goals

EU vows to slash red tape but stick to climate goals

-

France court orders retrial of Chilean over alleged murder of ex-girlfriend

-

Dreadlocks and downward dogs: Oslo's new bishop takes unorthodox approach

Dreadlocks and downward dogs: Oslo's new bishop takes unorthodox approach

-

Indonesia agrees deal with Apple that could end iPhone sales ban

-

Global stability threatened by backslide in cooperation: S.Africa

Global stability threatened by backslide in cooperation: S.Africa

-

'Sorry I couldn't protect you': Israel mourns Bibas mother, sons

-

BP ditches climate targets in pivot back to oil and gas

BP ditches climate targets in pivot back to oil and gas

-

EU seeks to balance business needs, climate goals

-

Stock markets rally with tech in focus

Stock markets rally with tech in focus

-

BP to up oil and gas output, slash clean energy spend in overhaul

-

Los Angeles wildfires costliest in history: Munich Re

Los Angeles wildfires costliest in history: Munich Re

-

'Brat' icon Charli XCX picks up Brit award for best songwriter

-

AB InBev posts record sales in 2024 despite beer volumes slipping

AB InBev posts record sales in 2024 despite beer volumes slipping

-

Aston Martin cuts jobs as weak China demand weighs

-

Stellantis says 2024 profits fall 70% on N. America troubles

Stellantis says 2024 profits fall 70% on N. America troubles

-

'Joyful' South Koreans hope rising births will continue

-

Indonesia agrees deal with Apple that could end iPhone sales ban: reports

Indonesia agrees deal with Apple that could end iPhone sales ban: reports

-

US says Gaza ceasefire talks on track

-

Tech surge helps Hong Kong lead most Asian markets higher

Tech surge helps Hong Kong lead most Asian markets higher

-

Hong Kong to slash public spending, build AI institute

-

Israelis mass for funeral of Bibas hostages killed in Gaza

Israelis mass for funeral of Bibas hostages killed in Gaza

-

Most Asian markets rebound as Hong Kong tech rally resumes

-

Under pressure, EU to take axe to green rules

Under pressure, EU to take axe to green rules

-

Shunned by US, Europe courts India over trade and security

-

BP to unveil strategy shakeup amid energy transition

BP to unveil strategy shakeup amid energy transition

-

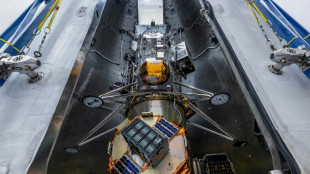

Private US company set for second Moon landing attempt

-

New cocktails shake up Oscar night

New cocktails shake up Oscar night

-

Leading rare earths miner sees profits fall as prices sag

-

Tesla sinks below $1 tn market value as European auto sales slump

Tesla sinks below $1 tn market value as European auto sales slump

-

Paint them white: how Brazil is keeping trains on track

-

Japan's ANA to purchase mega-order of 77 new jets

Japan's ANA to purchase mega-order of 77 new jets

-

US hardens visa sanctions over Cuba medical program

-

'A normal family', says son of surgeon in French sex abuse trial

'A normal family', says son of surgeon in French sex abuse trial

-

Stocks slide as US consumer confidence tumbles, tech slumps

-

Germany's next leader grapples to boost defence spending

Germany's next leader grapples to boost defence spending

-

Stock markets shrug off Trump trade war fears but tech sags

-

UK PM pledges to spend 2.5 percent of GDP on defence by 2027

UK PM pledges to spend 2.5 percent of GDP on defence by 2027

-

'Matter of survival': Nations spar over nature funding at UN talks

-

German family-run machine maker issues SOS to future government

German family-run machine maker issues SOS to future government

-

Stock markets struggle on fears over Trump's China tech curbs

-

Indonesia agrees to terms with Apple to lift iPhone sales ban: source

Indonesia agrees to terms with Apple to lift iPhone sales ban: source

-

Chance huge asteroid will hit Earth down to 0.001 percent

-

Unilever boss to step down after less than two years at helm

Unilever boss to step down after less than two years at helm

-

Kate Bush leads UK musicians in 'silent album' AI fight

| RBGPF | 3.4% | 67.13 | $ | |

| RYCEF | 2% | 8.02 | $ | |

| SCS | -0.68% | 12.445 | $ | |

| NGG | -0.03% | 62.71 | $ | |

| RIO | -0.84% | 61.59 | $ | |

| CMSC | -0.21% | 23.6 | $ | |

| RELX | -2.77% | 48.36 | $ | |

| GSK | -2.54% | 37.41 | $ | |

| AZN | -0.03% | 75.38 | $ | |

| VOD | -0.46% | 8.71 | $ | |

| JRI | -0.09% | 12.739 | $ | |

| CMSD | -0.08% | 23.65 | $ | |

| BCE | -2.07% | 23.425 | $ | |

| BTI | 0.9% | 38.91 | $ | |

| BP | -1.56% | 32.721 | $ | |

| BCC | -2.41% | 103.93 | $ |

Stock markets climb with tech in focus

Global stock markets climbed on Wednesday, helped by renewed interest in the tech sector.

Shares in Nvidia, the world's leading generative AI chipmaker, jumped around five percent in late morning trading with the company set to announce its results after the closing bell.

Hong Kong closed up more than three percent, with investors snapping up tech stocks following a poor start to the week sparked by fresh concerns over US President Donald Trump's tariff plans.

In Europe, Paris and Frankfurt led the way with gains of over one percent.

Wall Street pushed higher, with the tech-heavy Nasdaq Composite index rising 1.1 percent with traders looking keenly to Nvidia's results.

The company's guidance "could be pivotal, not just for the company, but in setting overall market direction, at least in the short term", said Trade Nation analyst David Morrison.

"This will be the first earnings update from the company since Chinese upstart DeepSeek managed to upset the US's generative AI industry by producing an assistant of equivalent quality but at a fraction of the cost," he said.

DeepSeek's unveiling of its chatbot threw US tech titans into a tailspin as it undermined their massive AI investments and their high stock valuations.

Nvidia's shares have taken a beating in recent sessions and overall US tech shares, which helped drive the market to record highs at the end of last year, have stumbled in 2025.

Hong Kong's stock market rally came as investors snapped up long-neglected tech names, after DeepSeek sparked renewed interest in the sector.

Beijing's moves to bring the firms in from the cold after years of government crackdowns on the industry also boosted sentiment.

E-commerce heavyweight Alibaba was again one of the major advancers, rallying 4.8 percent, with JD.com more than eight percent higher, Meituan up nearly 10 percent and Tencent up 3.4 percent.

Sentiment took a knock at the start of the week from news that Trump had signed a memo over the weekend calling for curbs on Chinese investments in industries including technology, critical infrastructure, healthcare and energy.

The move is aimed at promoting foreign investment in the United States, while protecting national security interests "particularly from threats posed by foreign adversaries" like China, the White House said.

Tokyo was a rare decliner among major stock markets Wednesday, hit by recent strengthening of the yen amid expectations that the Bank of Japan would continue hiking interest rates this year.

The yen has benefitted also from a pick-up in bets on cuts to US interest rates.

Expectations for Federal Reserve reductions were boosted by a Conference Board survey showing US consumer confidence in February saw its largest monthly decline since August 2021.

The reading came on the heels of other lacklustre US reports including on service sector activity, jobs and inflation.

- Key figures around 1630 GMT -

New York - Dow: UP 0.3 percent at 43,751.02 points

New York - S&P 500: UP 0.7 percent at 5,999.12

New York - Nasdaq Composite: UP 1.1 percent at 19,243.51

London - FTSE 100: UP 0.7 percent at 8,731.46 (close)

Paris - CAC 40: UP 1.2 at 8,143.92 (close)

Frankfurt - DAX: UP 1.7 percent at 22,794.11 (close)

Tokyo - Nikkei 225: DOWN 0.3 percent at 38,142.37 (close)

Hong Kong - Hang Seng Index: UP 3.3 percent at 23,787.93 (close)

Shanghai - Composite: UP 1.0 percent at 3,380.21 (close)

Euro/dollar: DOWN at $1.0509 from $1.0517 on Tuesday

Pound/dollar: UP at $1.2693 from $1.2668

Dollar/yen: UP at 149.30 from 149.00 yen

Euro/pound: DOWN at 82.79 pence from 83.00 pence

Brent North Sea Crude: DOWN 0.1 percent at $72.41 per barrel

West Texas Intermediate: FLAT at $68.91 per barrel

burs-rl/gv

A.Samuel--CPN