-

Two men publicly flogged in Indonesia for gay sex

Two men publicly flogged in Indonesia for gay sex

-

Thank you! Oscars speeches over the years

-

The women brewing change in India, one beer at a time

The women brewing change in India, one beer at a time

-

Asian markets mixed after latest Trump tariff threat

-

7-Eleven owner shares plunge as family buyout fails

7-Eleven owner shares plunge as family buyout fails

-

Oscar fave 'Anora,' a 'love letter' to eccentric beachside Brooklyn

-

Hamas hands over bodies of Israelis as more Palestinian prisoners freed

Hamas hands over bodies of Israelis as more Palestinian prisoners freed

-

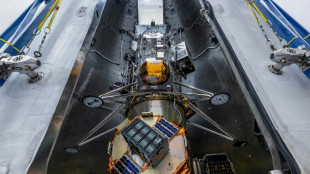

Private US company blasts off for second Moon landing attempt

-

US Fed will 'adapt' to any policy changes, Chicago's Goolsbee says

US Fed will 'adapt' to any policy changes, Chicago's Goolsbee says

-

AI chip giant Nvidia reports blockbuster revenue

-

EU was born to 'screw' US, Trump says

EU was born to 'screw' US, Trump says

-

Trump's trade envoy Jamieson Greer confirmed by lawmakers

-

Eyeing Trump trade policy shakeup, Eli Lilly to build 4 US factories

Eyeing Trump trade policy shakeup, Eli Lilly to build 4 US factories

-

Amazon's next-gen Alexa gets AI upgrade

-

G20 leaders say global stability threatened by declining cooperation

G20 leaders say global stability threatened by declining cooperation

-

US new home sales miss expectations in January on cold weather

-

EU vows to slash red tape but stick to climate goals

EU vows to slash red tape but stick to climate goals

-

France court orders retrial of Chilean over alleged murder of ex-girlfriend

-

Dreadlocks and downward dogs: Oslo's new bishop takes unorthodox approach

Dreadlocks and downward dogs: Oslo's new bishop takes unorthodox approach

-

Indonesia agrees deal with Apple that could end iPhone sales ban

-

Global stability threatened by backslide in cooperation: S.Africa

Global stability threatened by backslide in cooperation: S.Africa

-

'Sorry I couldn't protect you': Israel mourns Bibas mother, sons

-

BP ditches climate targets in pivot back to oil and gas

BP ditches climate targets in pivot back to oil and gas

-

EU seeks to balance business needs, climate goals

-

Stock markets rally with tech in focus

Stock markets rally with tech in focus

-

BP to up oil and gas output, slash clean energy spend in overhaul

-

Los Angeles wildfires costliest in history: Munich Re

Los Angeles wildfires costliest in history: Munich Re

-

'Brat' icon Charli XCX picks up Brit award for best songwriter

-

AB InBev posts record sales in 2024 despite beer volumes slipping

AB InBev posts record sales in 2024 despite beer volumes slipping

-

Aston Martin cuts jobs as weak China demand weighs

-

Stellantis says 2024 profits fall 70% on N. America troubles

Stellantis says 2024 profits fall 70% on N. America troubles

-

'Joyful' South Koreans hope rising births will continue

-

Indonesia agrees deal with Apple that could end iPhone sales ban: reports

Indonesia agrees deal with Apple that could end iPhone sales ban: reports

-

US says Gaza ceasefire talks on track

-

Tech surge helps Hong Kong lead most Asian markets higher

Tech surge helps Hong Kong lead most Asian markets higher

-

Hong Kong to slash public spending, build AI institute

-

Israelis mass for funeral of Bibas hostages killed in Gaza

Israelis mass for funeral of Bibas hostages killed in Gaza

-

Most Asian markets rebound as Hong Kong tech rally resumes

-

Under pressure, EU to take axe to green rules

Under pressure, EU to take axe to green rules

-

Shunned by US, Europe courts India over trade and security

-

BP to unveil strategy shakeup amid energy transition

BP to unveil strategy shakeup amid energy transition

-

Private US company set for second Moon landing attempt

-

New cocktails shake up Oscar night

New cocktails shake up Oscar night

-

Leading rare earths miner sees profits fall as prices sag

-

Tesla sinks below $1 tn market value as European auto sales slump

Tesla sinks below $1 tn market value as European auto sales slump

-

Paint them white: how Brazil is keeping trains on track

-

Japan's ANA to purchase mega-order of 77 new jets

Japan's ANA to purchase mega-order of 77 new jets

-

US hardens visa sanctions over Cuba medical program

-

'A normal family', says son of surgeon in French sex abuse trial

'A normal family', says son of surgeon in French sex abuse trial

-

Stocks slide as US consumer confidence tumbles, tech slumps

7-Eleven owner shares plunge as family buyout fails

Shares in the Japanese owner of 7-Eleven plunged as much as 12 percent on Thursday after the convenience store giant said its founding family failed to put together a white-knight buyout.

Last year Seven & i rejected an offer worth nearly $40 billion from Canadian rival Alimentation Couche-Tard (ACT) which would have been the biggest foreign buyout of a Japanese firm.

Even as ACT reportedly sweetened its bid, Seven & i said in November it was studying a counter-offer from its founding Ito family reportedly worth around eight trillion yen ($54 billion).

The family were reportedly negotiating financing from top Japanese banks as well as companies such as Itochu Corp, which owns the FamilyMart chain.

But Seven & i said Thursday it was "notified that it has become difficult to procure the necessary funds for an official proposal about the acquisition."

"We will continue to explore and scrutinise all strategic options including the proposal from ACT," it said in a statement.

Itochu said in its own statement it had "sincerely considered the matter" but that its "consideration on this matter has been terminated."

- 'Grossly undervalued' -

With around 85,000 outlets, 7-Eleven is the world's biggest convenience store brand.

The franchise began in the United States, but it has been wholly owned by Seven & i since 2005.

ACT, which began with one store in Quebec in 1980, now runs nearly 17,000 convenience store outlets worldwide including the Circle K chain.

In September, when Seven & i rejected the initial takeover offer from ACT, the company said it had "grossly" undervalued its business and could face regulatory hurdles.

Its 7-Eleven stores are a beloved institution in Japan, selling everything from concert tickets to pet food and fresh rice balls, although sales have been flagging.

Japan's minister for economic revitalisation said in January that the country would study the "economic security" aspects of any foreign acquisition of 7-Eleven.

Ryosei Akazawa highlighted the role Japan's convenience stores can play in times of crisis, such as after major earthquakes and other disasters, particularly in remote regions.

In 2021, ACT dropped a takeover bid worth 16 billion euros ($17 billion today) for French supermarket Carrefour after the French government said it would veto the deal over food security concerns.

Late morning in Tokyo, Seven & i shares were down 11.2 percent.

D.Goldberg--CPN