-

Greenland to get new govt to lead independence process

Greenland to get new govt to lead independence process

-

Meet 'Pink', the new face of human evolution in Europe

-

S.Africa revised budget gets booed despite smaller tax hike

S.Africa revised budget gets booed despite smaller tax hike

-

Stocks advance on US inflation slowing, Ukraine ceasefire plan

-

Shares in Zara owner Inditex sink despite record profit

Shares in Zara owner Inditex sink despite record profit

-

US consumer inflation cools slightly as tariff worries flare

-

Greenland to get new government to lead independence process

Greenland to get new government to lead independence process

-

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

-

Battery maker Northvolt files for bankruptcy in Sweden

Battery maker Northvolt files for bankruptcy in Sweden

-

Markets mixed as Trump trade policy sows uncertainty

-

'Stranded' astronauts closer to coming home after next ISS launch

'Stranded' astronauts closer to coming home after next ISS launch

-

Thailand sacks senior cop over illicit gambling, fraud

-

What to know about Manus, China's latest AI assistant

What to know about Manus, China's latest AI assistant

-

US tariffs of 25% on steel, aluminum imports take effect

-

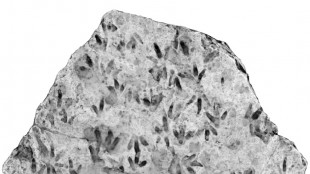

Trove of dinosaur footprints found at Australian school

Trove of dinosaur footprints found at Australian school

-

Rubio heads to Canada as Trump wages trade war

-

Most Asian stocks drop as Trump trade policy sows uncertainty

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

-

Trump talks up Tesla in White House show of support for Musk

Trump talks up Tesla in White House show of support for Musk

-

Oil companies greet Trump return, muted on tariffs

-

Trump burnishes Tesla at White House in show of support for Musk

Trump burnishes Tesla at White House in show of support for Musk

-

Italian defence firm Leonardo to focus on int'l alliances for growth

-

Stock markets extend losses over US tariffs, recession fears

Stock markets extend losses over US tariffs, recession fears

-

Trump doubles down on Canada trade war with major tariff hike

-

UK makes manslaughter arrest over North Sea ship crash

UK makes manslaughter arrest over North Sea ship crash

-

Ghana scraps IMF-linked 'nuisance' taxes

-

Trump doubles down on Canada trade war with massive new tariffs

Trump doubles down on Canada trade war with massive new tariffs

-

French right-wing media's Russia tilt irks Elysee

-

Stock markets waver after sell-off over US recession fears

Stock markets waver after sell-off over US recession fears

-

Volkswagen to navigate another tricky year after 2024 profit plunge

-

Ships blaze after North Sea crash, govt rules out foul play

Ships blaze after North Sea crash, govt rules out foul play

-

Chanel plays with proportions as Paris Fashion Week wraps up

-

Stock markets mixed as Trump-fuelled economy fears weigh

Stock markets mixed as Trump-fuelled economy fears weigh

-

Ships blaze, spill feared after North Sea crash

-

Volkswagen profits hit as high costs, China woes weigh

Volkswagen profits hit as high costs, China woes weigh

-

Struggling Japanese automaker Nissan replaces CEO

-

Ships still on fire after North Sea crash

Ships still on fire after North Sea crash

-

Lego posts record profit, CEO shrugs off US tariff threat

-

Most markets in retreat as Trump-fuelled economy fears build

Most markets in retreat as Trump-fuelled economy fears build

-

Asian markets track Wall St lower as Trump-fuelled economy fears build

-

From 'mob wives' to millennials: Faux fur is now a fashion staple

From 'mob wives' to millennials: Faux fur is now a fashion staple

-

South Korea's Kia denies responsibility for anti-Musk ad

-

Kung fu girl group puts fresh spin on ancient Chinese art

Kung fu girl group puts fresh spin on ancient Chinese art

-

Asian markets track Wall St selloff as Trump-fuelled economy fears build

-

Indian artisans keep traditional toymaking alive

Indian artisans keep traditional toymaking alive

-

Bear Robotics' Carti 100 Wins iF DESIGN AWARD 2025, Setting New Standards in Logistics Automation

-

Formerra Introduces Formerra+ Upgraded Ecommerce Site to Optimize Customer Experience

Formerra Introduces Formerra+ Upgraded Ecommerce Site to Optimize Customer Experience

-

Search ends for missing crew member after North Sea collision

-

One missing after cargo ship, tanker collide in North Sea

One missing after cargo ship, tanker collide in North Sea

-

Stock markets slump on US recession fears

| RBGPF | 2.81% | 68.35 | $ | |

| CMSD | -0.19% | 23.01 | $ | |

| CMSC | 0.09% | 22.94 | $ | |

| SCS | -1.99% | 11.08 | $ | |

| RELX | 1.5% | 47.92 | $ | |

| BCC | 1.27% | 99.265 | $ | |

| NGG | -0.44% | 61.975 | $ | |

| RIO | -1.62% | 60.865 | $ | |

| GSK | -1.18% | 39.04 | $ | |

| BCE | -1.47% | 24.42 | $ | |

| RYCEF | 3.98% | 10.05 | $ | |

| VOD | -1.29% | 9.112 | $ | |

| JRI | 0.12% | 12.915 | $ | |

| AZN | 1.77% | 75.575 | $ | |

| BP | 0.98% | 32.297 | $ | |

| BTI | 0.47% | 41.195 | $ |

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

European stock markets rose Wednesday but Asian equities sputtered as investors tracked President Donald Trump's latest tariffs and a potential ceasefire in Ukraine.

Analysts said support came from Ukraine endorsing an American proposal for a 30-day ceasefire, which was awaiting a response from Russia.

Chinese stock markets closed lower Wednesday, while Europe's main equity indices made solid gains nearing the half-way stage.

There had been a further equities selloff in New York on Tuesday that saw the Nasdaq extend Monday's four percent dive.

All eyes were also on US inflation data due Wednesday.

"Market volatility is rising as visibility (over tariffs) becomes cloudier by the day," noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

The on-off nature of the trade policies has fuelled uncertainty in markets, and has sent the VIX "fear index" of volatility to its highest level since August.

Global markets have endured severe swings this month as Trump looks to ramp up pressure on global partners by imposing or threatening hefty duties on their goods, citing huge trade imbalances.

In the latest move, sweeping 25 percent levies on all US aluminium and steel imports came into effect at midnight in Washington, hitting numerous nations from Brazil to South Korea, as well as the European Union.

Trump had threatened to double those on Canada after Ontario imposed an electricity surcharge on three US states, but he called that off after the province halted the charge.

China and the European Union on Wednesday vowed to strike back and defend their economic interests, moving Washington closer to an all-out trade war with two major partners.

Also in focus Wednesday is the release of key US consumer inflation data, which the Federal Reserve will keep a close eye on as it tries to determine monetary policy in light of the latest moves by Trump.

There is a fear that the tariffs, and plans to slash taxes, regulation and immigration will fan inflation again, forcing the bank to hold borrowing costs for longer or even hike them.

Analysts said high uncertainty in US stocks markets made other regions more attractive as investors seek out stability.

"For years, the US has been the undisputed leader of global markets, fuelled by aggressive fiscal spending, tech dominance, and a strong consumer," said Charu Chanana, chief investment strategist at Saxo.

"But cracks are starting to show. Investors are increasingly looking overseas as concerns mount over US stock valuations, monetary policy, and economic uncertainty."

- Key figures around 1030 GMT -

London - FTSE 100: UP 0.5 percent at 8,536.22 points

Paris - CAC 40: UP 1.1 percent at 8,027.20

Frankfurt - DAX: UP 1.5 percent at 22,652.33

Tokyo - Nikkei 225: UP 0.1 percent at 36,819.09 (close)

Hong Kong - Hang Seng Index: DOWN 0.8 percent at 23,600.31 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,371.92 (close)

New York - Dow: DOWN 1.1 percent at 41,433.48 points (close)

Euro/dollar: UP at $1.0918 from $1.0915 on Tuesday

Pound/dollar: DOWN at $1.2941 from $1.2954

Dollar/yen: UP at 148.69 yen from 147.70 yen

Euro/pound: UP at 84.36 pence from 84.26 pence

Brent North Sea Crude: UP 1.0 percent at $70.29 per barrel

West Texas Intermediate: UP 1.1 percent at $67.00 per barrel

A.Mykhailo--CPN