-

Monopoly Go game maker Scopely to buy Pokemon Go team

Monopoly Go game maker Scopely to buy Pokemon Go team

-

Detained pro-Palestinian activist denied legal calls, lawyer tells US court

-

Greenland to get new govt to lead independence process

Greenland to get new govt to lead independence process

-

Meet 'Pink', the new face of human evolution in Europe

-

S.Africa revised budget gets booed despite smaller tax hike

S.Africa revised budget gets booed despite smaller tax hike

-

Stocks advance on US inflation slowing, Ukraine ceasefire plan

-

Shares in Zara owner Inditex sink despite record profit

Shares in Zara owner Inditex sink despite record profit

-

US consumer inflation cools slightly as tariff worries flare

-

Greenland to get new government to lead independence process

Greenland to get new government to lead independence process

-

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

-

Battery maker Northvolt files for bankruptcy in Sweden

Battery maker Northvolt files for bankruptcy in Sweden

-

Markets mixed as Trump trade policy sows uncertainty

-

'Stranded' astronauts closer to coming home after next ISS launch

'Stranded' astronauts closer to coming home after next ISS launch

-

Thailand sacks senior cop over illicit gambling, fraud

-

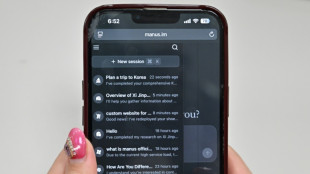

What to know about Manus, China's latest AI assistant

What to know about Manus, China's latest AI assistant

-

US tariffs of 25% on steel, aluminum imports take effect

-

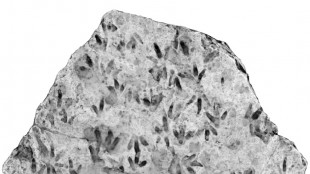

Trove of dinosaur footprints found at Australian school

Trove of dinosaur footprints found at Australian school

-

Rubio heads to Canada as Trump wages trade war

-

Most Asian stocks drop as Trump trade policy sows uncertainty

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

-

Trump talks up Tesla in White House show of support for Musk

Trump talks up Tesla in White House show of support for Musk

-

Oil companies greet Trump return, muted on tariffs

-

Trump burnishes Tesla at White House in show of support for Musk

Trump burnishes Tesla at White House in show of support for Musk

-

Italian defence firm Leonardo to focus on int'l alliances for growth

-

Stock markets extend losses over US tariffs, recession fears

Stock markets extend losses over US tariffs, recession fears

-

Trump doubles down on Canada trade war with major tariff hike

-

UK makes manslaughter arrest over North Sea ship crash

UK makes manslaughter arrest over North Sea ship crash

-

Ghana scraps IMF-linked 'nuisance' taxes

-

Trump doubles down on Canada trade war with massive new tariffs

Trump doubles down on Canada trade war with massive new tariffs

-

French right-wing media's Russia tilt irks Elysee

-

Stock markets waver after sell-off over US recession fears

Stock markets waver after sell-off over US recession fears

-

Volkswagen to navigate another tricky year after 2024 profit plunge

-

Ships blaze after North Sea crash, govt rules out foul play

Ships blaze after North Sea crash, govt rules out foul play

-

Chanel plays with proportions as Paris Fashion Week wraps up

-

Stock markets mixed as Trump-fuelled economy fears weigh

Stock markets mixed as Trump-fuelled economy fears weigh

-

Ships blaze, spill feared after North Sea crash

-

Volkswagen profits hit as high costs, China woes weigh

Volkswagen profits hit as high costs, China woes weigh

-

Struggling Japanese automaker Nissan replaces CEO

-

Ships still on fire after North Sea crash

Ships still on fire after North Sea crash

-

Lego posts record profit, CEO shrugs off US tariff threat

-

Most markets in retreat as Trump-fuelled economy fears build

Most markets in retreat as Trump-fuelled economy fears build

-

Asian markets track Wall St lower as Trump-fuelled economy fears build

-

From 'mob wives' to millennials: Faux fur is now a fashion staple

From 'mob wives' to millennials: Faux fur is now a fashion staple

-

South Korea's Kia denies responsibility for anti-Musk ad

-

Kung fu girl group puts fresh spin on ancient Chinese art

Kung fu girl group puts fresh spin on ancient Chinese art

-

Asian markets track Wall St selloff as Trump-fuelled economy fears build

-

Indian artisans keep traditional toymaking alive

Indian artisans keep traditional toymaking alive

-

Bear Robotics' Carti 100 Wins iF DESIGN AWARD 2025, Setting New Standards in Logistics Automation

-

Formerra Introduces Formerra+ Upgraded Ecommerce Site to Optimize Customer Experience

Formerra Introduces Formerra+ Upgraded Ecommerce Site to Optimize Customer Experience

-

Search ends for missing crew member after North Sea collision

| JRI | 0.28% | 12.936 | $ | |

| RBGPF | 2.81% | 68.35 | $ | |

| CMSC | 0.74% | 23.091 | $ | |

| BCC | 1.67% | 99.665 | $ | |

| CMSD | 0.64% | 23.2043 | $ | |

| RIO | -1.37% | 61.015 | $ | |

| NGG | 0.35% | 62.47 | $ | |

| SCS | -0.8% | 11.21 | $ | |

| BCE | -0.75% | 24.595 | $ | |

| RYCEF | 4.93% | 10.15 | $ | |

| GSK | -1.33% | 38.98 | $ | |

| VOD | -0.6% | 9.175 | $ | |

| BP | 1.4% | 32.435 | $ | |

| BTI | 0.68% | 41.28 | $ | |

| AZN | 1.75% | 75.56 | $ | |

| RELX | 1.54% | 47.94 | $ |

US consumer inflation cools slightly as tariff worries flare

US consumer inflation inched lower in February according to government data Wednesday, in the first full month of Donald Trump's White House return -- but concerns remain over stubborn price growth as jitters flare over the president's trade policies.

The consumer price index (CPI) came in at 2.8 percent last month from a year ago, down from 3.0 percent in January, said the Department of Labor.

While easing inflation would be a relief for policymakers, the latest reading is the lowest in just four months -- signaling a longer road ahead to bringing price increases back to officials' two percent target.

The world's biggest economy is also grappling with fears of a downturn -- and near-term inflation -- sparked by Trump's expanding slate of tariffs.

On Wednesday, Trump's latest salvo of 25 percent levies on steel and aluminum imports kicked in, sparking vows of firm responses from key US trading partners.

The European Commission said it would impose countermeasures from April 1 to counter Washington's "unjustified trade restrictions."

Between January and February, the CPI picked up 0.2 percent, Labor Department data showed, also a cooldown from January's 0.5 percent figure.

Excluding the volatile food and energy categories, the index was up 3.1 percent from a year prior, an improvement from before as well.

Last month, a pick-up in shelter costs was partially offset by declines for airline fares and gasoline prices. The index for food also picked up for the month.

The index for eggs jumped 10.4 percent, the report said.

Egg prices -- a hot political issue -- have surged recently as the country contended with an avian flu outbreak.

"I expect to see more risks going forward, particularly with the tariffs and the uncertainty around them," said economist Dan North of Allianz Trade North America.

"This level of uncertainty is, you might say, trailblazing," he told AFP.

Even though inflation came in a touch below a consensus forecast by analysts, North pointed out that downward progress remains sluggish.

The cooler reading on Wednesday might not be enough to nudge the Federal Reserve towards further rate cuts, given that the US economy is still holding up.

"We still have spending even though it's slowing down, we still have a strong labor market," North noted. "From the aspect of stimulating the economy, there's no need for a cut."

Fed policymakers will be gathering next Tuesday and Wednesday to mull further adjustments to the benchmark lending rate, after chair Jerome Powell maintained last week that the bank need not rush toward changes.

M.García--CPN